Sponsored By Axios HQ

Want to write like the pros? Try Axios HQ. It’s intuitive software that will help you and your team write in Axios’s smart brevity style designed to allow you to think more clearly, communicate more crisply, and send focused, effective updates.

Fortune 100s and startups alike use Axios HQ to craft smart updates that distill essential information in half the time. Writing is thinking, and Axios HQ can help you do both better:

Historically, whenever someone wanted to fund an ambitious technology project, they only had one choice—venture capital. You could try to convince a bank to give you a loan, but if you are doing a “billion or bust” type of startup, a bank will likely deem your venture too risky.

Enter 2022. A new option for fundraising is growing in popularity: crypto tokens. Some public intellectuals are proclaiming they are a 10x improvement over traditional equity. Visions of a decentralized, blockchained funding future dance like sugar plum fairies in the heads of technologists all over the globe. In this imagined utopia, greedy middlemen in Patagonia vests are entirely stripped out of the process, and community participants shower ETH into the treasuries of deserving founders.

A claim of 10x improvement is enough to qualify for a chance at monopoly status. Zero to One, Peter Thiel’s canonical book on startups, says:

“As a good rule of thumb, proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage. Anything less than an order of magnitude better will probably be perceived as a marginal improvement and will be hard to sell, especially in an already crowded market.” Emphasis Added

This essay is my best attempt to figure out the dimensions that could make crypto 10x better than equity for funding early-stage projects. It’s important because it is entirely possible that in a few years time we could be living in a world where traditional equity goes the way of the dinosaur (or, closer to home, the entrepreneurial bank loan). But it will only happen if tokens are, as some claim, a 10x improvement.

By my analysis, the differences between the two technologies come down to three important factors:

- Narrative Network Effects

- No Privacy, Total Anonymity

- Public and Liquid

Narrative Network Effects

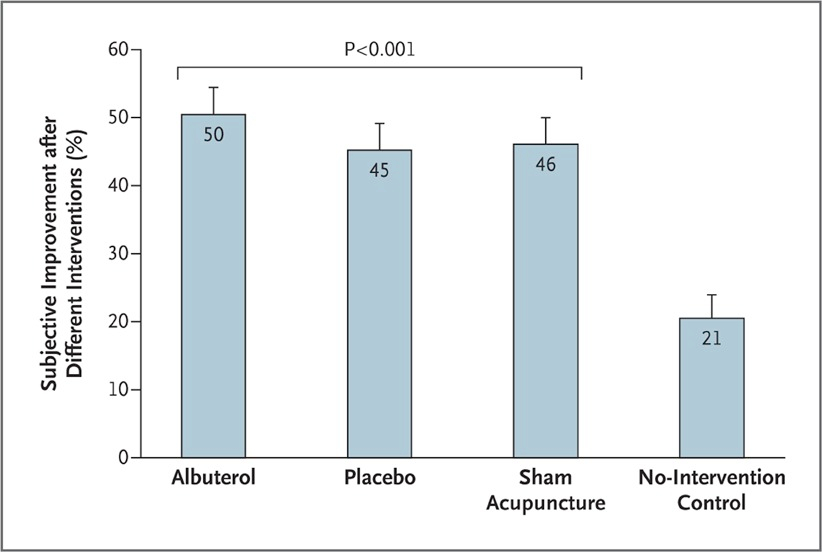

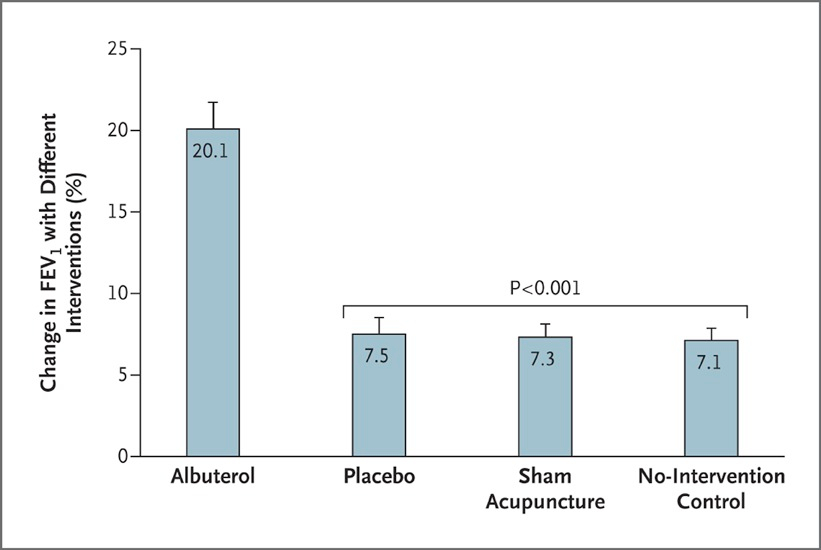

In a 2011 study of asthma patients, subjects were split into four test groups. One cohort received nothing, the second underwent a “sham” treatment of acupuncture where the needles didn’t break skin, the third received an inhaler with nothing inside, and the fourth received an inhaler with albuterol. All 3 groups that received any sort of treatment reported “substantial” improvement to their symptoms.

Allow me to say that again in non-science speak. People who received absolutely no medical intervention reported having the same feeling of health improvement as those who had been treated with actual medication. This, however, is not a case of the placebo effect curing asthma; it is a case of the body tricking the mind. Only the patients who received albuterol had an objective, measurable improvement to their airflow.

This individual study isn’t perfect with an n of only 36 completed participants, but the placebo effect is well-established and it acts as a fun illustration of my point.

Human beings have an incredible ability to deceive ourselves about the efficacy of interventions.

Even if the “active ingredient” in the crypto narrative is inert, it almost doesn't matter at this point. Crypto has become a religion, and Web2 companies like Facebook have become so reviled, that there is a sizable contingent that believes decentralization is the answer to everything. Many crypto diehards truly believe that a decentralized ledger of record is better in every way for every problem. Or as my granddaddy would put it, “To a hammer, everything is a nail.” By raising capital via token, entrepreneurs can tap into this narrative belief from an adoring crypto public.

This is not necessarily a bad thing! The ability to achieve instant buy-in to the story of a company utilizing crypto is a powerful distinction for tokens versus traditional equity. Think of the ICO boom of 2017. There were 800 ICOs that raised over $20B. The fascinating thing was that many of these companies were started by teams with absolutely no track record. People believed so strongly in the blockchain (or believed that their returns would be incredible whatever the underlying tech) that they ponied up vast sums of capital. Of course, most people lost everything, but hey, the founding teams did great!

This is not a crypto-unique phenomenon—the stock markets have examples of this collective belief mechanism too. ARK Capital, a notorious stock ETF, pulls on similar heartstrings. By screaming into the void words like AI, innovation, and electric vehicles, the company has somehow gotten over $12B+ AUM. This is despite losing 50% over the last year (it takes an incredible talent to lose this much money over the year tech stocks just had).

Do these narrative network effects make tokens 10x better than a traditional equity? Maybe.

They are certainly better for founders. It allows them to pull in foolish money to fund their enterprise, regardless of whether it deserves it.

For the market as a whole, it means lots of dumb ideas end up funded. In my opinion, that may be a good thing! I am of the perspective that we need 10x more big swings and startups. Crypto allows for wildly ambitious and weird projects to receive funding because the crypto narrative network effect allows the story to achieve escape velocity.

For investors, should you prefer to trade ETH for tokens, or USD for equity? This leads us to the next two sections…

No Privacy, Total Anonymity

In a regular stock sale, complex rules and scary 3-letter government agencies ensure that everybody involved is supposedly qualified to be on the cap table. There are entire multi-billion dollar companies devoted to tracking who owns what type of stock. Between the need for accreditation verification and the right signature at the right times, the whole process is an absolute mess.

In contrast, crypto token sales can occur and you don’t know the name of a single person involved. Any investor can buy in—all they need is a wallet. To make it even weirder, the system of record is on the blockchain, so every single movement of value is publicly viewable—despite participants being entirely anonymous. Meaning that anyone with sufficient technical knowledge can find out which wallets own what, including the entire history of what they owned.

The terms of the contract are totally public too, creating an additional wrinkle. This means that not only are the shareholders public, but so are the customers! If crypto is at the heart of your customer purchase or user experience, it means that any rival can come around to try to steal your customers.

Note: It is ironic that this total availability of transaction data stands in sharp contrast with blatantly illegal token sales. In the question of whether this is 10x better, for SEC prosecutors the answer is probably a resounding yes.

But the public/anonymous nature of blockchains isn’t the only major difference market participants should consider. There’s also one last huge difference, in my estimation.

Instantly Liquid

An investment in private companies is one of the most illiquid assets around. Sales before a company’s shares are on a public marketplace typically require board approval and are difficult transactions to execute. In contrast, crypto tokens can be sold pretty much instantly. No such thing as a public or private market in cryptoland—everything is public from day one.

The implications are exciting—and troubling. In the early stages of a startup, a company lives and dies on a daily basis. So much can go wrong, and if you don’t have a team that is long-term focused, it can be easy to get distracted. A company being liquid on day one is only good for those looking to sell.

However, there is an element of gamification and buy-in that comes from being instantly public. Early backers can watch their token tick upward on a daily basis. They’ll likely evangelize the value of the project to the nonbelievers, helping spread the good news of decentralization. It is a virtuous cycle of ever-increasing hype. There does come a point where this becomes overheated and the bubble pops, but some token designs are trying to overcome this problem.

Liquid token equity can also lead to liquid rewards. Companies will airdrop tokens to early supporters as reward for the community (or as a marketing stunt) to generate hype. Hype leads to attention which leads to price appreciation. Essentially, an airdrop is just a well-executed marketing campaign that can pay for itself very quickly.

However, it is important to note that both of the benefits of being liquid (reward early believers and reward current stakeholders to increase equity price) already exist in the real world.

When Marc Lore started Jet.com, it was with the audacious goal to destroy Amazon. To generate his initial buzz, he came up with a novel promotional idea: give away part of the company. He promised that whoever could get the most people to sign up for the waitlist would receive 100K shares in Jet. The competition was a wild success with over 250K people quickly joining the list. Jet was able to turn this list into a $3.3B business that they sold to Walmart within 2 years of its founding. (Not bad.) The contest winner, Eric Martin, likely netted north of $20M from the sale. (Not bad at all.)

Another example of using gifts to prop up equity prices is the Japanese practice of Yunti. 1037 of the 3865 publicly listed companies in Japan (latest data available from 2016) have a tradition of sending their shareholders presents. The gifts can range from hokey trinkets to much more expensive items like hotel vouchers. This practice is enormously popular among retail investors. Multiple surveys show that some holders keep the stocks just for the presents! In the United States, companies with similar levels of retail support like AMC offered shareholders perks. AMC’s was a free bucket of popcorn. It apparently made their investors a little salty if we are to judge based off of the stock’s yearly performance.

Is this 10x better than the near substitute? Again, probably not. It offers unique benefits! But whether those outweigh the other downsides is circumstance dependent.

Conclusion

Token Sales as a funding mechanism is sorta 10x better, sorta 10x worse. The ability to easily break stupid laws and take funding from non-accredited investors is a great example of the sorta/sorta dynamic of tokens. It is great that the layman can get involved. It is great that network participants can receive value for their early contributions. It is also bad to break the law! (Wild that this is a controversial take.) It is bad that there isn’t any auditing of financial statements! It is bad that token holders have no legal rights!

Perhaps rather than 10x better, the correct way to think of crypto is as 10x weirder. This is an entirely new financial paradigm with no historical precedent. We have no idea what all of this will do. Maybe, like the ICO boom, everything will be fraudulent garbage! Or maybe we will all get rich!

Whatever happens, Napkin Math will be watching and keeping you informed.

If you enjoyed this piece and would like to receive more technology and company breakdowns, please subscribe.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Thanks to our Sponsor: Axios HQ

Writing is thinking, and teams that do both well use Axios HQ. Click below to see a sample newsletter written using Axios HQ and learn how your team can start communicating more effectively.

Comments

Don't have an account? Sign up!

I love Napkin math, but this article fell short in a few areas due to a lack of depth.

Tokens are analogous to equity in terms of an instrument of value. However, there are a few key differentiating factors with equity. And also some relevant some similarities:

1. While I agree that having instant liquidity for an early-stage, highly volatile startup is nonsensical. Almost all high-quality Web3 projects sell tokens initially privately first to value-add angels and VCs, with tokens only launched at the Token Generation Event ("TGE) when the platform is fully built and operational. In other words, when the token has utility. Of course, there are exceptions to this, but that's the general rule. And the time from the first token sale to TGE is usually at least six months, if not 1-2 years+.

2. For tokens to have fundamental value, they must align with the core values of Web3 - shared ownership and participation, in particular.

Ownership of tokens tends to be less concentrated and more distributed than equity cap tables, with considerable portions - typically over 50% of the supply / cap table - reserved for the "community" of stakeholders, ie supply-side participants, demand-side users, casual contributors to the code base, early supporters, referrers etc etc.

And the token has value from coordinating and incentivising participation in the platform itself, typically as a supply-side coordination mechanism, with supply-side participants "staking" in the network to signal that they are willing to do work and enabling the protocol to send them work and reward them for work done, and conversely, burn some of that stake for actions not in line with the protocol's SLA so-to-speak. Check out the decentralised SLA for Pocket network, for example - https://docs.pokt.network/v1/specs/utility#4.2-castaway, and it's economics - https://docs.pokt.network/home/v0/economics

3. Regarding the total anonymity point, we're early in developing best practices for token offerings. My firm belief is that better conflicts of interests rules, disclosure and transparency will solve 99% of the problems with token issuances. I think Cryptography and smart contracts combined with higher levels of accountability and scrutiny for "insiders" - team members and early investors - can solve a lot of this.

4. Lastly re regulation, hopefully I've made it clear that startup financing is predominantly not about regulatory arbitrage. Saying that, good laws are helpful to ward off the bad actors. And decentralisation is an important frame for a lot of this. All token projects should only benefit from protection from global securities laws if they become "sufficiently decentralised" within a period - of say 12 to 24 months - from the date of their token sale.