Everyone loves to hate the champ. The king must be dethroned, the leader replaced.

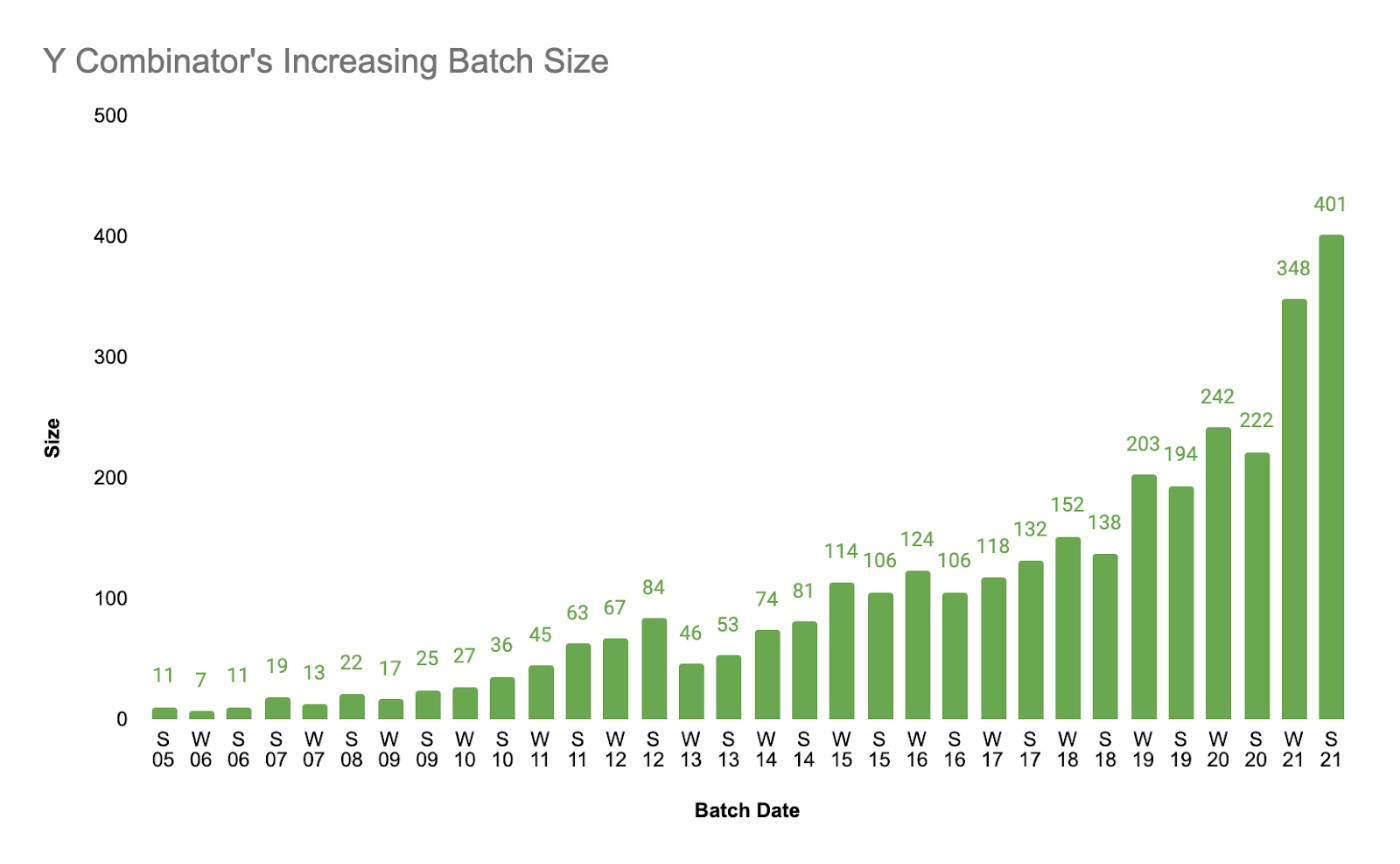

In Silicon Valley there is one institution that has resided at the top of the early-stage funding game for the last 10 years: Y Combinator. Their portfolio boasts over $400B in value, with 160+ companies valued at $150M+. What is even more impressive (at least to the strategy writer who runs this publication) is that they are the venture firm with the strongest network effects. A typical venture firm may compete on their ability to deploy capital quickly or on the clout of their partners. Y Combinator is different. By operating on an accelerator model, they make it such that the more companies that they fund, the stronger their network becomes. Each additional company means another potential customer and another expert that incoming CEOs can learn from. YC has leaned hard into that power, with an ever escalating number of startups running through their program.

They seem to be untouchable. They are so confident in their power that they have recently instituted new funding terms that crowd out seed investors (their partners of yesteryear). Previously, Y Combinator offered $125K for 7% of the company. Now, their new terms are still $125K for 7% and then another $375K at the next round of funding. This means that they’ll push out helpful angel investors and frustrate seed funds with ownership targets. You don’t have to trust me on this one for the Napkin Math—take a look at the NM done by a seed stage investor on Twitter:

Y Combinator would likely argue that seed stage funds can still be included! But for seed funds who have larger ownership targets, this new deal is a bitter pill.

To me, this seems like the clear move of a monopolist, a king, who can take what they want because they know they are indispensable.

The new funding terms alone would be an interesting story for Napkin Math, but what makes this truly fascinating is that they are making this move at the most competitive point in their history. There are numerous well-funded competitors (who also have network effects), all while the market for seed startups is, counter to popular narrative, shrinking in volume.

So the question is, is Y Combinator a despot blinded by hubris on the brink of losing its throne? Or is the company truly as powerful as it appears?

The Market Structure

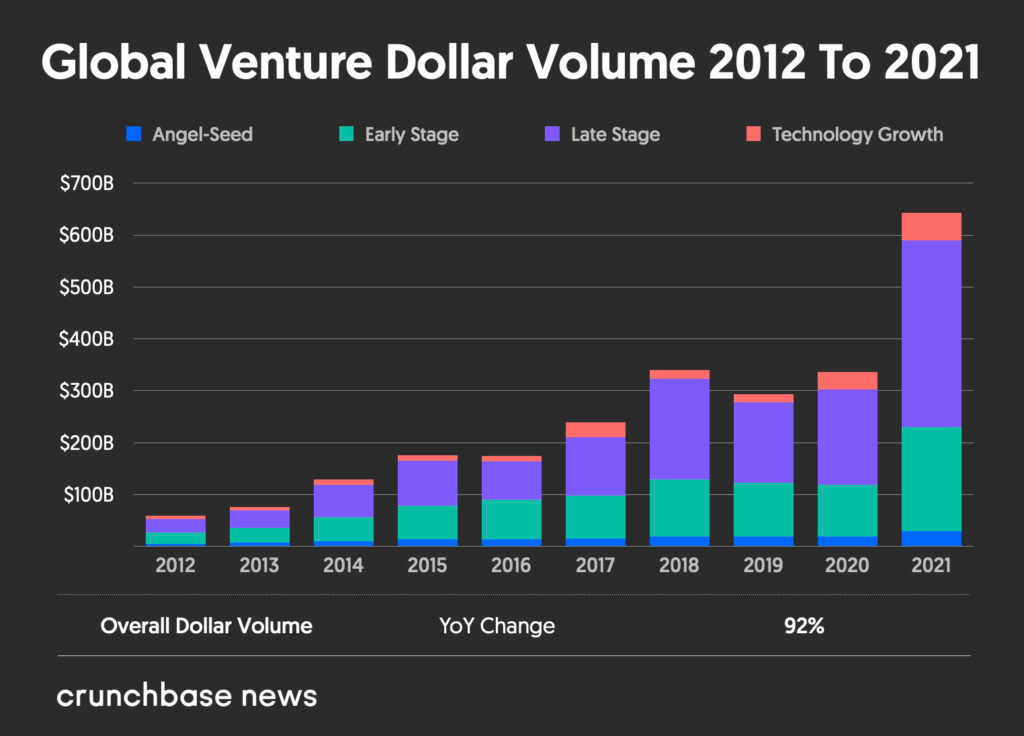

If you examine the headlines at the end of 2021, you’ll find almost universal astonishment over the amount of dollars flowing into private companies. Total dollars invested had doubled year-over-year, with mega-rounds in late-stage companies juicing the volumes. Seed capital trended upwards too.

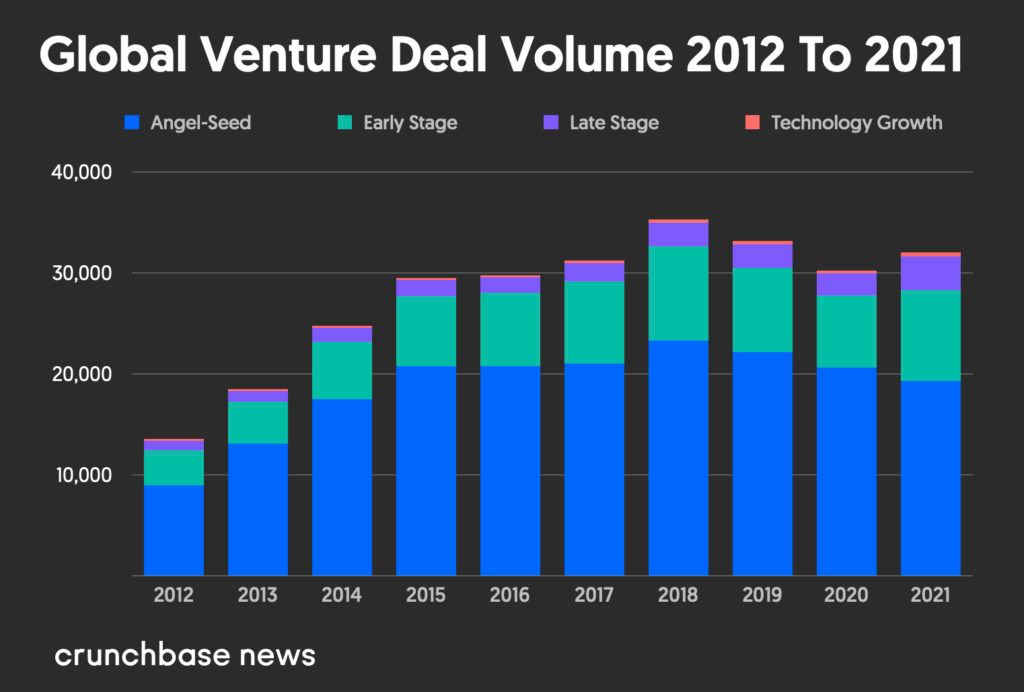

What is more interesting to me is the total deal volume in the “angel-seed” category actually has been shrinking:

If we assume that Y Combinator averages 500 startups per batch going forward, with 2 batches a year, that means that they would fund roughly 5% of all seed stage startups every year. Even crazier is that the Y Combinator President, Geoff Ralston, has publicly stated his ambition to increase the funding to 1,000 companies per batch, which would give them 10% of all venture-backed startups globally.

In many ways, this is the inverse strategy of late-stage juggernaut Tiger Global. Tiger recently raised $11B dollars and tries to get into the top 10% of late stage companies. Y Combinator appears to be going for 10% of the seed stage.

As even further evidence of the value of the startup index fund approach, research from AngelList found that “at the seed stage, investors would increase their expected return by broadly indexing into every credible deal.” The bet that Y Combinator is making is that they can be the filtering mechanism by which “every credible deal” is determined.

This dual pincer strategy of being squeezed from the bottom by Y Combinator and from the top by Tiger made every single investor I talked to for this piece incredibly nervous.

Despite this increasing lack of seed stage startup inventory, there has been an increase in accelerator competitors. A few recent standouts:

- South Park Commons: One part accelerator, one part technical talent community. $400K for 7%.

- On Deck: Remote accelerator with initial batch of 100 or so companies. $125K for 7%. Raised $20M from Founders Fund.

- Launchhouse: Raised $10M+ from a16z as a lead. Focuses on in-person cohorts meeting at houses in major U.S. cities. No equity fee. It does appear they have a fund to invest into companies based on their job postings for a VC associate.

- Hyper: Also raised money from a16z (wild to see a16z funding nearly direct competitors within a few months of each other). This one is a remote accelerator. Sister company to Product Hunt. Gives $300K for 5%.

- Z fellows: One-week hack week for early-stage fellows. $10K at a billion-dollar valuation cap.

- Seed Club: Web3-focused accelerator. Doesn’t provide capital but participants receive Seed Club’s native tokens. In return, Seed Club takes 3% of your tokens.

There are lots more, but the important thing is that they are here, they are well-funded, and they are going after Y Combinator’s turf.

Disclosure: Some of these organizations have sponsored NM in the past. I don’t care if this article affects my relationship with them, and I wrote what I wanted to write. Benefits of being a subscription-supported newsletter, baby.

So why do these upstarts think they have a chance?

Et Tu, On Deck?

In preparation for this piece I talked with multiple of these upstart accelerators and several seed fund investors who have previously invested in Y Combinator companies. Insider takes usually offer some interesting, unique insight. But what was more interesting here was what I couldn’t get anyone to say. I was unable to find anyone, literally anyone, who was willing to say something negative about Y Combinator on the record. To be clear, lots of people had lots of negative things to say—they were just unwilling to say it to you, my lovely readers. Y Combinator has enough power in the Valley that the fear of pissing them off is very, very real.

There are 4 strategies being attempted by which accelerators are trying to break Y Combinator’s stranglehold:

Go Early

As Y Combinator has grown in power and reputation, it has become increasingly difficult to get in. In the early days of YC, startups would join before they had a customer (and sometimes before they even had a product or fleshed-out idea). Now companies can show up with hundreds of thousands in revenue and may have already raised capital from outside investors. YC insists no team is too early, but still, many of the newest accelerators are focused on getting to highly talented people before they would even consider applying to Y Combinator. As an example, On Deck does this by having a founders fellowship where people can explore the next stages of their career. When those people are ready to start a company, On Deck is ready and waiting with their $125K for 7% terms in their own accelerator.

Go Sector-Specific

When a network gets overly large, it can start to crack under its own weight. It requires that the network build mechanisms/tools by which to surface the right value at the right time to the right participant. Think of how Airbnb can never quite deliver the perfect place for the occasion you are looking for without you using a bunch of filters. It takes a ton of work on your part to get what you want. Y Combinator is suffering from a similar burden: the larger it grows, the more opportunity exists for competitors to form sector-specific accelerators that have less filtering friction. A space startup going through the same program as a B2B software doesn’t make a ton of sense (to me at least). One example of this is SeedClub, an accelerator focused on Web3 companies.

Note: In an interesting wrinkle, the current Y Combinator president Geoff Ralston started his own vertical competitor ImagineK12, which was bought by YC.

Go Global

One of the O.G. competitors, 500 Startups ($2.3B assets under management), identified early Y Combinator’s bias toward SF companies. 500 Startups has built on-the-ground staff in dozens of countries that help local startups navigate their unique, geographical challenges. In contrast, Y Combinator pre-Covid just made everybody move to San Francisco for 3 months. Many of these accelerators concede that they will be unable to win top-tier SF-level talent, but they think they can find opportunities abroad.

Advanced Sourcing Mechanism

Because volume increases while total supply decreases, the average quality of a startup in Y Combinator’s cohort will decrease. Some accelerators are placing bets on their ability to filter for quality people early so they don’t suffer from a similar fate. South Park Commons ($200M+ AUM) has based their entire identity around this. Since starting in 2015, they have only let 450 people into their “community.” These people join before they even have an idea for a company or are even sure if they want to build a company. (See also point #1 above.) Despite this, or perhaps because of this, they have 10+ unicorns in their portfolio. Note: This is incredibly impressive.

To me this is the most compelling argument by which to beat YC. In its last summer batch the company had the following founder demographics:

- 37% of the batch identified as an underrepresented founder (women, Black and Latinx, Native American)

- Women founders: 22% of the companies have a woman founder, 12% of the founders are women

- 17% Asian founders

- 4% Black founders

- 15% Latinx

- 5% Middle Eastern or North African

- .33% Native American or Native Hawaiian

- 17% South Asian

- 43% White

It’s hard for me to believe that this represents the top 10% of founders globally. There are so many overlooked entrepreneurs that any accelerator that can do the extra work to find them is going to be successful. Skin color, race, and sexual orientation does not determine entrepreneurial destiny.

All of YC’s competitors use some combination of the four strategies above to try to win the market.

In this publication’s opinion, the outcome of all this chaos is likely a “yes, and” scenario. Y Combinator will continue to do YC things. Its network effects are going to chug along for a very, very long time. It is unlikely that any accelerator will truly seize the top spot from YC. However, Y Combinator has grown so large that there is certainly space for little kingdoms to be built in its periphery.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!