Does Sonos have a moat?

Sonos filled homes with silky smooth sound, but it’s questionable if their strategic decisions made them anything more than commodity hardware.

March 20, 2020

Want to listen to this post instead of reading it? Click here.

This was written by Adam Keesling, and edited by Nathan Baschez.

Do you remember how you listened to music twenty years ago?

Me neither, I was four years old. But let me paint you a picture based on second-hand accounts.

Start at your desktop computer.

Dial-up your internet and open Napster.

Search through the songs. Once you’ve found your jam, find the file that looks the most legit and click download.

Wait a few moments for it to download. Then wait a few more.

Alright now hop over to Windows Media Player, insert a CD into your tower, and burn the songs onto the disk.

Pop it out, then pop it into the CD drive of your home stereo system.

Hopefully you already spent a long weekend lugging around subwoofers, drilling holes in your walls, and untangling the mess of cords.

If not, now would be a good time to start.

Then — finally — plop down on your couch and enjoy the beautiful 5.1 surround sound piping through the air.

Safe to say things are a bit different in 2020.

…

There were several companies that were instrumental in building the audio ecosystem into what it is today, and Sonos was certainly one of them.

Lucky for us, Sonos is also an interesting case study in business strategy.

Their story can be told through the lens of The Conservation of Attractive Profits, an idea Clay Christensen introduced in his book The Innovator’s Solution.

The idea is simple: a business has a competitive advantage when it controls the thing that customers care about that isn’t good enough. When that happens, all adjacent businesses tend to adapt themselves to fit the standard defined by the company that controls the critical piece.

For example, in the 1990's, computer hardware manufacturers had to adapt to what Intel wanted, because Intel controlled the CPU, and the CPU determined speed, which was what customers cared about most.

From Christensen:

The companies that are positioned at a spot in a value chain where performance is not yet good enough will capture the profit.

In the 2000s, Sonos controlled the most important thing in the home audio market. At the time, the incumbents were traditional audio companies such as Sony and JBL. However, there were two things that made performance not good enough:

- In order to have high-quality audio in your house, you needed a wired setup. This was not only time-consuming to set up, but also was constrained to a single room.

- There was no easy way to play MP3's from your computer (let alone from a remote) to your home sound system, which was built for CDs.

These problems sparked Sonos to build the first high-quality wireless home speaker system. For the first time, it was easy to set up whole-home audio systems, and stream MP3s from iTunes. The plan worked and they rode this innovation to success.

But what's most interesting about Sonos is not how they got their initial traction. It's what happened next. Their true legacy is defined by how they responded to change as their market evolved. Or rather, how they didn't respond.

In this post, we’re going to examine Sonos’ strategic decisions, many of which were at the crossroads of major audio trends:

- Positioning as high quality (and high price)

- The proliferation of headphones

- Voice assistants and smart speakers

- Committing to a hardware business model

Which brings us to today. Does Sonos have a competitive advantage? Or are they like most consumer hardware products which devolve into modular commodities?

Let’s dive in to figure it out.

Sonos’ Founding Vision

From their experience building Software.com (a wireless internet company with an amusingly generic name), the four Sonos co-founders saw an opportunity at the intersection of three technology trends: wide-spread adoption of internet standards, cheaper internal computer components (circuits, CPUs, etc.) and faster wireless data transfer.

The group combined these technological trends with another trend at the time, the digitization of music, and came up with a simple idea: help music lovers play any song anywhere in their homes.

At the time, the only way to listen to music in your house was to wire together a stereo, amplifier and speakers. Then, if you wanted to listen to music you acquired digitally, you had to burn a CD and manually insert it into the stereo. Not the best situation.

Not to mention that the system was only useful for one room at a time — building a speaker system over multiple rooms required some serious DIY. And even if you spent energy building it, the music wasn’t easily coordinated between rooms.

The entire system was designed for a previous paradigm.

Sonos saw this and spent their first two years developing the product. They wanted to make the highest-quality audio product available, even if it meant taking longer or making their own parts. Everything was custom-built: the hardware, the operating system, the software. (Not unlike Apple.)

It wasn’t an easy engineering problem, but with several PhDs on staff and a belief in the product, Sonos became the point of integration in the new home audio value chain.

Problems with Sonos' Early Positioning

After they got the company rolling, the first major strategy decision Sonos made was deciding which speakers to add to their lineup, and at what price point.

Their first products were released in 2005: a wireless speaker, the ZP100, for $499 and a controller, the CR100, for $399.

This wasn't prohibitively expensive for their target market of wealthy homeowners, but there was a problem. Most people who downloaded MP3s online weren’t people who had high purchasing power or had a house to put multiple speakers in. They were college kids or young adults living in apartments.

Back then, you had to download MP3s from iTunes or an illegal peer-to-peer file-sharing website then load them onto a CD or iPod. The people who were willing and able to do this weren’t the same people with large, multi-room homes that Sonos speakers were designed for.

So while Sonos created a new technology that people wanted, their early products were a few years ahead of widespread adoption of digital music.

Over time, thanks to products like iTunes, Pandora, and Spotify, more and more people became comfortable with digital music. They also launched products like the Playbar to address the home theater market. This expanded the market for Sonos, and they continued to grow.

Sonos’ product positioning was focused on delivering the highest quality audio. But was this the right strategy? Would they have grown faster if they reduced prices and sacrificed audio fidelity, perhaps appealing to younger customers?

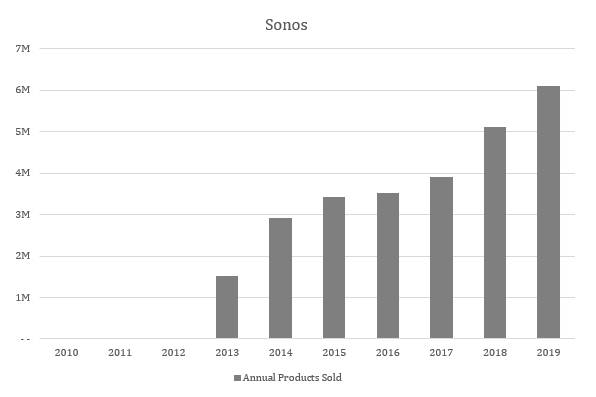

It wasn't until 2013 — eight years after the launch of their initial $499 product — that Sonos experimented with a more affordable option. They launched the Play:1, a speaker that retailed at $199. It ended up being quite popular and was a big contributor to their jump from 1.5 million products sold in 2013 to 3.4 million products sold in 2015.

(Source: company public filings.)

So this was a good decision, even if it was a bit late. In 2015 a survey from Strategy Analytics showed that 55% of consumers use built-in desktop or laptop speakers to listen to music, in contrast to the 41% that connect to a portable device. Clearly, lots of people value convenience and affordability. Sonos’ decision to go a bit downmarket helped them reach this broader market while still maintaining healthy unit economics.

But perhaps Sonos would be in a better position if they had acted sooner.

What about Headphones?

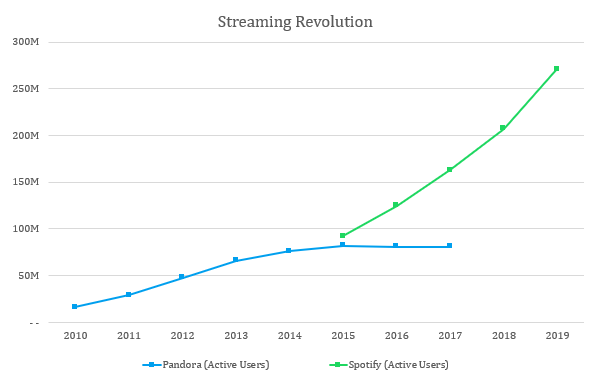

The next big wave that affected audio was the rise of streaming services like Pandora and Spotify in the early 2010s. It’s hard to point to a single year where streaming “took off”; instead, it happened gradually over the past decade.

(Source: company public filings. Note: active users includes both paid subscribers and free users that have used the product in the last month (MAUs).)

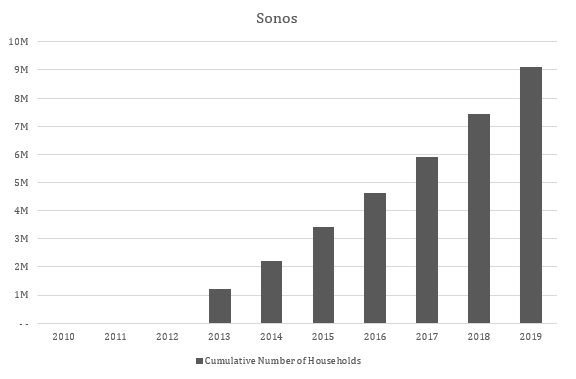

Sonos certainly benefited from the rise of streaming, and streaming benefited from the rise of Sonos. Their position as the premium home speaker helped them acquire a base of 9.1 million households by 2019.

(Source: company public filings.)

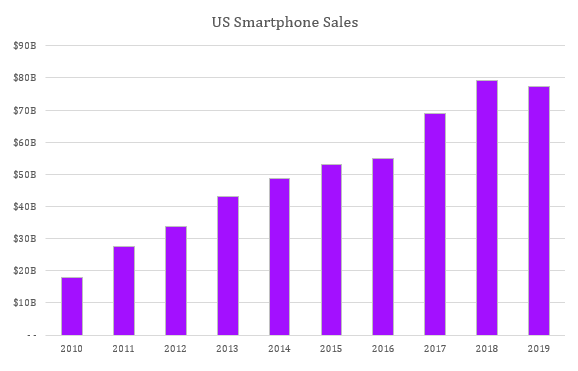

And while this led to billions in revenue and millions of happy customers, in-home speakers weren’t the only consumer hardware market booming from the resurgence in audio. Headphones grew from $670 million in 2010 to $2.3 billion in 2020), largely driven by rising smartphone sales.

(Source: Statistica.)

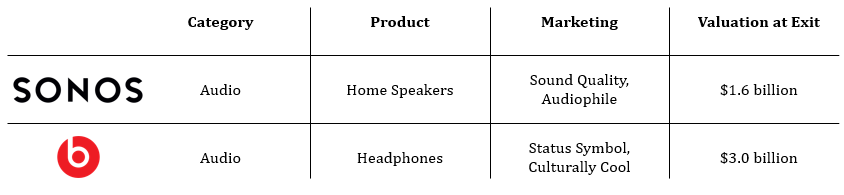

There was one headphone manufacturer in particular that saw this trend and took advantage of it. In a category-defining move, rapper Dr. Dre and music producer Jimmy Iovine founded Beats Electronics, a headphone company that not only chose a different product then Sonos, but also a different marketing strategy. And they succeeded.

Beats headphones was founded in 2006, but took two years to launch a product. Instead of rushing the process, they used their founders' cachet to get musicians and athletes to use the product and give feedback.

Beats headphones were designed for the younger generation to listen to hip-hop like how it sounded in a club. They weren’t the greatest from an audio quality perspective — a professional producer wouldn’t want to use them in the booth — but instead built them like a fashion accessory.

It was all part of Dre and Iovine’s thesis: music is about how you feel, so your headphones should be about how you feel too. From 3 Kings:

Dre’s stamp of approval helped Beats headphones get off the ground despite continued lukewarm reviews from audiophiles unenthused by the product’s sometimes-overwhelming bass and hefty price tag. But the audiophiles weren’t his target. Beats aimed to attract young music fans who’d never bought fancy headphones before, serving up the product with a side of sex appeal. [Emphasis mine]

When asked about the competition, they didn’t just name other headphone companies — they knew they were competing for their demographic’s discretionary spending.

Customers were deciding between Air Jordans and Beats. The job to be done wasn’t just listening to music — it was indulging in a status symbol.

They positioned their product as a celebrity-endorsed lifestyle good and it paid off. Their sales rocketed to $200 million by 2010 and reached $1.2 billion by 2013.

A year later they sold to Apple for $3 billion.

While Beats success is incredible, I’m not saying Sonos should’ve, or could’ve, replicated it. Beats’ unique advantage was that they were built by some of the sharpest (and coolest) music executives in the world, and Sonos would have a hard time replicating that.

But could Sonos have made a successful headphone without celebrity marketing? I think they could’ve. We even have an example of a high-end hardware company that launched a premium headphone: Apple, with their Airpods.

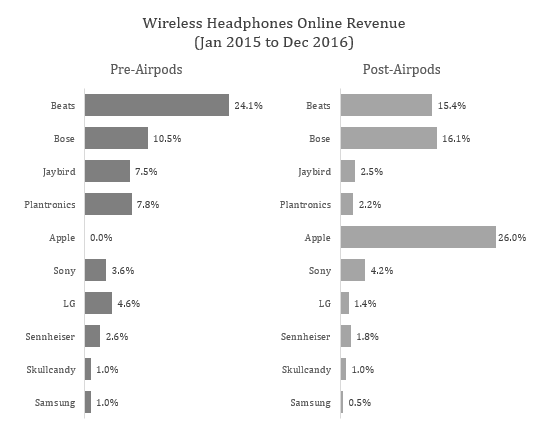

Before Airpods, the headphone market was dominated by Beats (high-end) and the default Apple headphones (low-end). Apple launched Airpods in 2016 and scooped up 26% of the wireless headphone market within a year.

(Source: Slice Intelligence, now operating as Rakuten.)

Now this isn’t quite an apples to apples comparison (heh). We can’t expect Sonos headphones to do as well as Apple headphones. Apple can create a uniquely great product experience by tying headphones together with the iPhone — and has a much larger global brand to boot.

But the Airpods did prove that you didn’t need Beats-style marketing to create a successful headphone. So why didn’t Sonos launch their own headphones?

In short, they didn’t want to lower their quality standard. In response to why the company had an anti-Bluetooth culture, CEO Patrick Spence said:

It would never pass the test of somebody leaving the party. We never wanted the music to stop so in a situation where somebody walks too far away and all of a sudden the music stops, that’s a really disappointing experiential thing.

Or sometimes [Blueooth] doesn’t connect properly to a particular product. How do you make sure you have that connection and that it’s going to be more reliable than people are used to?

From the very beginning, it’s been in Sonos’ DNA to give users the very best audio experience. They custom-built all their products and that was a major contributor to their initial rise.

Throughout their history, Sonos was relentless about not giving up that advantage. They used WiFi to connect their devices instead of Bluetooth because WiFi was faster, more secure, better suited to send large files, and had a longer connection range. However, it also limited the products they made.

Voice Assistants & Smart Speakers

The final audio trend important to Sonos — that they missed at first — was voice.

Apple announced Siri on the iPhone in April 2011 and Google launched voice search on desktop in June 2011. Amazon took it a step further in November 2014 by announcing the first voice assistant / smart speaker combo with Amazon Alexa and Echo.

This was a big deal for consumers, and an ever bigger deal for Sonos. The Echo not only had unique capabilities (being able to buy things using your voice) but also was cheaper than Sonos speakers. The Echo retailed at $99 for Prime members.

Sonos responded almost three years later — releasing the Sonos One in October 2017. The One was a smart speaker that had support for both Alexa and Google Assistant.

It’s unclear why it took Sonos that long to create a smart speaker. The engineering required is substantial, but they may not have even started working on it until after Alexa and the Echo were launched.

This delay likely had an impact on their market share: by the time Sonos released Sonos One, over 20 million Alexa devices had already been sold.

However once Sonos entered the smart speaker market, they were able to hold a unique position. While Amazon, Google and Apple all had their own voice assistants and smart speakers, Sonos just focused on the hardware.

This allowed them to be a neutral third-party (a middleman of sorts) by integrating all the voice assistants in one spot. So for consumers that wanted higher quality audio than Amazon or Google offered, Sonos was able to leverage their traditional strengths to offer a compelling alternative.

You might be wondering why the technology giants might integrate with Sonos at all. If Amazon, Google and Apple have the hardware and software, why do they bother integrating their assistants with companies like Sonos?

Let's take a step back and look at the the strategy of each smart speaker company:

- Amazon’s Alexa: Amazon’s business model is to sell you physical goods over the internet. They want to have the option to buy something from anywhere, so they were quick to integrate with third-parties like Sonos.

- Google’s Google Assistant: Google makes money from ads, and they can sell ads when people search for something. So everything Google does is to get people searching on Google more. They were also willing and eager to tap into the seven million homes that had Sonos speakers in them.

- Apple’s Siri. Apple makes money in a similar way to Sonos: through hardware. They want to do everything they can do to keep you in the Apple ecosystem. For them, Siri is a way to make the hardware more compelling to buy. As a result, Apple doesn’t integrate Siri into the Sonos speakers.

So Amazon and Google want to integrate with Sonos in order to gain market share (Sonos already had a base of 5.9 million households in 2017). But was it a good strategy for Sonos to integrate with them?

It certainly made for a better product experience: when a user talks to a voice assistant, they shouldn’t have to buy different hardware if they want to search for something on Google vs order something on Amazon. Plus, if Sonos fans want a smart speaker, they don’t have to leave the Sonos family (and risk enjoying another speaker a bit too much!).

Additionally, the direct costs of making a smart speaker are obviously cheaper than making a smart speaker and a voice assistant. So all things considered, this made sense for Sonos.

Why Hardware is Hard

Consumer durables is a tough business, and hardware is no exception. There are two issues.

First, in a hardware business model, the customer only pays once but extracts value over several years. For Sonos, a customer might buy a speaker for $399 and use it for 10 years without paying Sonos again. Contrast this with a company like Spotify — the customer receives value each month and also pays Spotify $10 each month.

Second, the value proposition doesn’t change much with each cycle upgrade. Cars are a great example of this — most of the value to the customer is having an independent transport that has plenty of storage, includes seating for the family, and is safe. Regardless of whether a car is built in 2010 or 2020, most of those things don’t improve so there’s less of a need to upgrade.

Sonos has these problems too. But their product has one advantage: when someone buys a Sonos speaker, they are highly likely to buy one for another room. As of 2019, 62% of households have more than one speaker. The “land and expand” strategy works well, which is great because the marketing cost for an incremental speaker is much lower than for the first speaker.

So should Sonos stick to their hardware business model? Or should they somehow attempt to switch to a subscription model?

GoPro — another consumer hardware business — has tried to change by providing cloud storage and video editing in a monthly subscription. However, they haven’t seen much success. While their subscription revenue is growing, it’s a very small part of their business (~$18 million vs over $1.2 billion for their core business). Until they begin to see more significant scale with subscriptions, expect their stock price to stay relatively flat.

Regardless of GoPro’s success or lack thereof, pivoting to subscriptions is not the direction Sonos has decided on.

In 2017, Patrick Spence took over the CEO reins from John MacFarlane and shortly thereafter mentioned that he likes the hardware business model and plans to stick with it.

Since taking the reins, the pace of product development has rapidly increased —- before Patrick took over as CEO, Sonus was releasing one product every 18-24 months. Now they release about two new products every year.

For example, in July 2019 they announced a licensing deal with IKEA. The partnership allows Sonos to have additional distribution, a lower price point, and an aesthetic that doesn’t scream gadget.

(Sonos x IKEA.)

They also started building products with Bluetooth. They launched the very first portable speaker called the Sonos MOVE in September 2019. It’s received positivereviews so far and serves a use case that they hadn’t addressed before. They also are rumored to finally be releasing headphones in 2020.

This shift to using Bluetooth wasn’t easy — Spence has said that it took some convincing to move engineering and product teams to build products with different technology. While WiFi may have made sense in 2005, Bluetooth has advanced to be more reliable and secure.

All of this product development — partnerships with IKEA, new bluetooth-powered products — is designed to maximize their hardware business model. Sonos is driving growth by trying to sell you a speaker to fill every moment of your day.

In addition to launching more hardware products, they also recently announced they will no longer be supporting software updates for old speakers. This is a big deal because from day one, Sonos has said that if you buy a speaker, they will update the software.

This announcement (rightfully) angered many customers and Sonos may lose customers after breaking their trust. However, this policy also definitively supports the hardware business model.

By making old speakers obsolete, it will encourage customers to update to new speakers. This lowers the refresh cycle and hopefully will lead to more sales. (It helps with costs too — paying developers to maintain old software isn’t cheap!)

But the real question is if it helps them build a moat.

What’s Next For Sonos?

At the beginning of this article I posed a question:

Does Sonos have a competitive advantage? Or are they like most consumer hardware products which turn into modular commodities?

Let’s begin by discussing Apple and the iPhone.

The iPhone was successful because it controlled the thing that “wasn’t good enough” for consumers. With smartphones, consumers cared most about photo and video quality, speed and ease of use, battery life, and access to a wide selection of apps.

By controlling the hardware (iPhone) and the operating system (iOS), Apple was perfectly positioned to solve for those concerns. They had engineers, designers and leadership that executed the strategy well, and made products that were irresistible to many.

As a result, other links in the value chain became commodities. Apple exerted market power over competitors both downstream (cellular networks, component suppliers) and upstream (application developers) in order to get everyone to conform to their standard. They gained the power to set this because they controlled the piece that proved to be most important to end users.

So, could Sonos become the Apple of smart speakers? To figure it out, Clay Christensen might ask: “which part of the smart speaker value chain is not good enough?” By controlling that part, a company can build a competitive advantage and earn higher profits.

Sonos is making the bet that consumers care most about improvements to:

- Audio quality — some may think the audio quality of a default speaker isn’t good enough for listening to music, especially throughout the whole home.

- Interoperability — if you buy a smart speaker from Apple, Amazon, or Google, you can only use one voice assistant. With Sonos, you can switch between Alexa and Google Assistant.

Compare this with the strategy of the other smart speaker manufacturers:

- Apple is betting that people care more about the integration with the iPhone and Apple services ecosystem.

- Google is betting that people care most about the quality of the voice assistant AI.

- Amazon is betting people will care most about a robust ecosystem of third-party apps, which they call “skills.”

Which company will succeed? If I had to guess, Google or Amazon has the best chance of becoming the dominant company in this value chain. A lot more people want a cheaper speaker with a single voice assistant and a lot less care about high-quality audio throughout their homes. Apple’s HomePod is relatively expensive, but not as good at sound quality as Sonos is, not as good at AI as Google is, and doesn’t have as many apps as Alexa does.

However, even if Sonos doesn’t control the critical choke point in the home audio value chain, they still may have a bright future. For every winner in a market, there are several successful companies that operate in a mutually-beneficial relationship with the dominant platform. You can think of their strategy as almost a corollary of the dominant player’s strategy. The degree and duration of success depends on a lot of factors, but you can see this “corollary company” pattern play out in industry after industry:

For example, Facebook created the most popular attention aggregator of all time, and for a time this enabled Buzzfeed to also build a good business ($100m revenue in 2014) as a leading content producer built on that platform. (It worked until Facebook changed their feed algorithm).

Microsoft and Intel dominated the PC value chain throughout the 1990s and 2000s, and Dell was able to maintain a healthy business by selling computers that ran Windows software and Intel hardware.

Google has control over much of the mobile operating system market thanks to Android, but this created space for Samsung to succeed by focusing on the premium hardware layer. This is the example that feels most similar to Sonos. Currently, Samsung has the highest market share in Asia and earned $2.5 billion in operating profit on their smartphones in 2019 (a 32% increase from the year prior).

This all goes to say that even if Sonos doesn’t become the dominant player in the home audio value chain, they can still build a great business. They’re essentially selling a premium complement to two large new platforms: Google Assistant and Alexa. For a certain (wealthy) subset of customers, audio quality and whole-home sound are important, and they’re willing to pay a premium. Because they’re a “corollary company” there are no guarantees, but it looks like they’re on more of a “Samsung” path than a “Buzzfeed” path.

Sonos has a premium brand in a growing category, and a CEO who is aggressively developing products. They are in a great spot to maintain their double-digit growth for years to come.

Enjoy this? You might also like:

- How Clay Christensen’s failure helped me process my own — My eulogy for a larger-than-life thinker. Few people know many details about his own experience as a founder, but I discovered a fascinating story that helped me cope with my own startup’s death.

- Your Actual Competition — Most people think of their competition too narrowly. You’re not just competing with other companies that do the same thing as you, you’re also competing in a way with customers, suppliers, substitutes, and potential new entrants. This post explains and updates a classic framework from Michael Porter, an iconic HBS strategy professor.

- Strategy Drunk — Why do companies filled with smart people do dumb things so often? Often, it’s because they’re “strategy drunk.”

Become a subscriber

Divinations is supported by readers. If you’d like access to everything we make, and to support our ability to keep making it, please consider a paid subscription. Right now the yearly plan costs $133. (If this is a financial burden for you please let me know, and we’ll work something out!)

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!