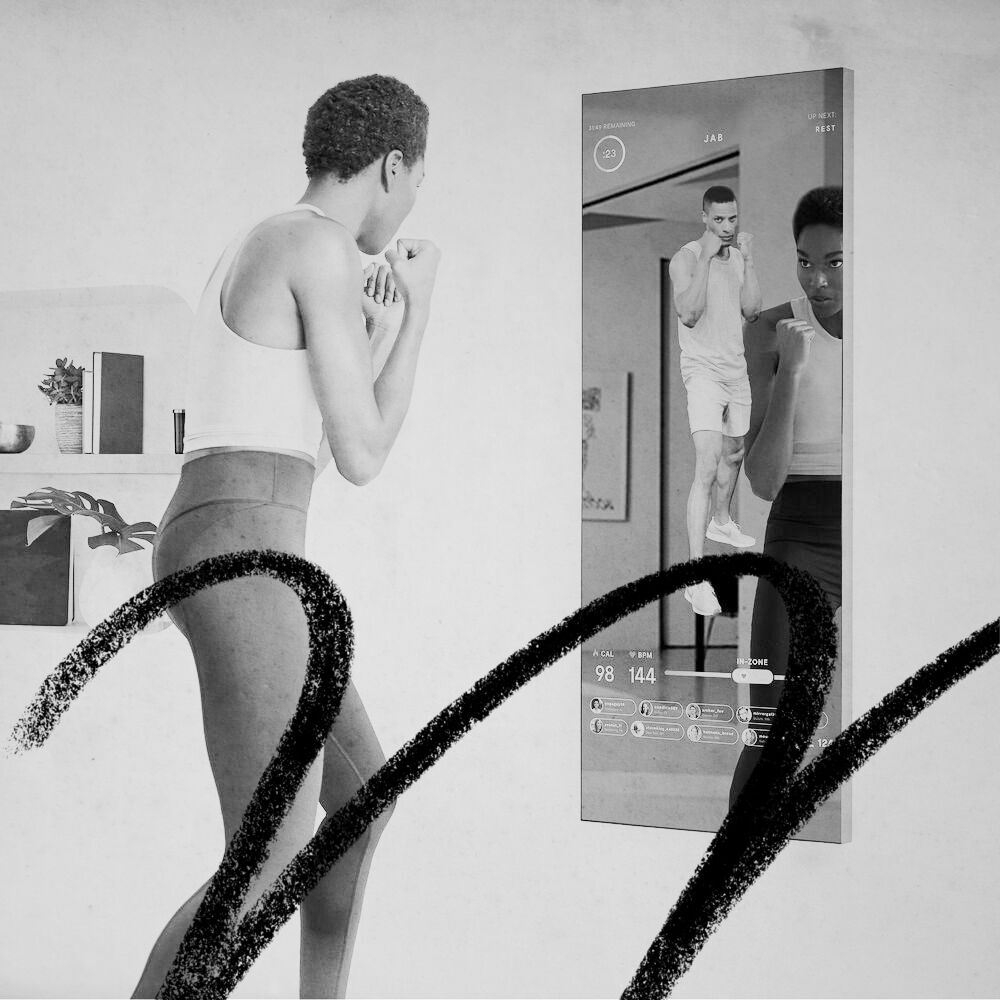

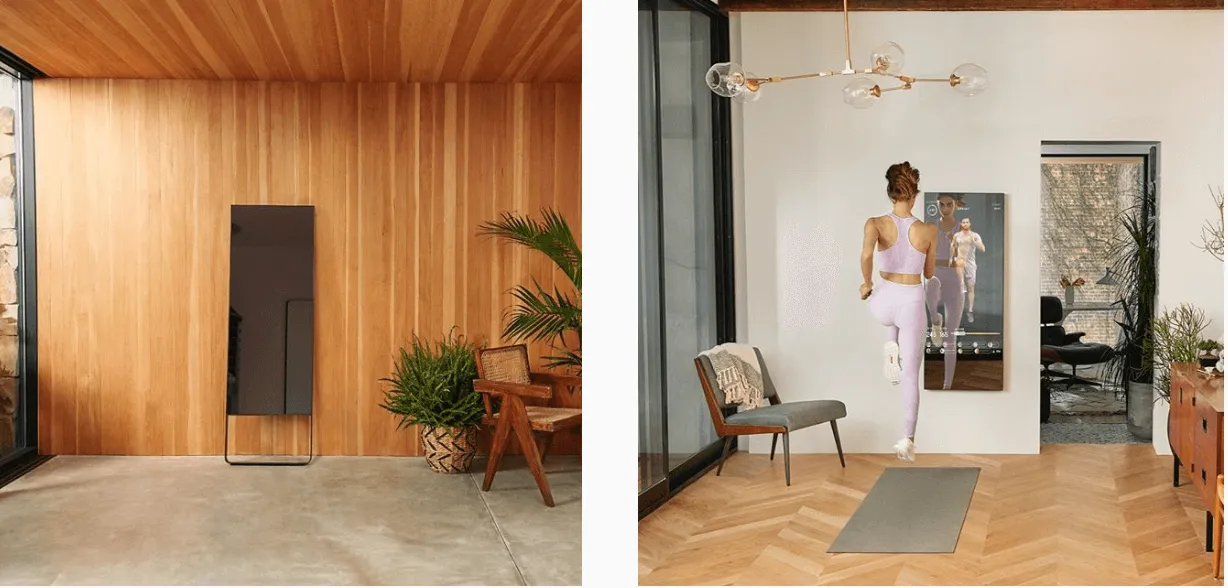

Last week, lululemon acquired the home fitness startup Mirror for $500 million. Mirror sells you the equivalent of a beautiful, giant iPad that hangs on your wall for $1,495. Then, if you pay a $39 monthly subscription, you can use a mobile app to turn the Mirror into a fitness class. Both on-demand and live classes are available for everything from yoga to boxing.

You may be wondering why a company that makes yoga pants is buying a company that makes smart mirrors and fitness videos.

Instead of looking at it that way, consider a different frame. Both companies target the same customer: affluent millennials who like to workout and stare at themselves in a mirror.

Kidding aside, this acquisition makes a lot of sense for lululemon. It goes deeper than simply marketing to the same demographic too. A few reasons why lululemon scooped up Mirror:

- Added a recurring revenue stream (something they didn’t have before)

- Opportunity to cross-sell Mirror to their existing customers

- Earn a spot in the connected home with a new hardware product

And despite these great reasons, there’s also some evidence to suggest that customers might not be all that excited for Mirror.

Was it a good acquisition for lululemon? Or will it flop like so many other cross-sector M&A deals?

Let’s figure it out.

Subscription Hardware

Hardware is not typically a great business. From a post I wrote on Sonos earlier this year:

Consumer durables is a tough business, and hardware is no exception. There are two issues.

First, in a hardware business model, the customer only pays once but extracts value over several years. For Sonos, a customer might buy a speaker for $399 and use it for 10 years without paying Sonos again. Contrast this with a company like Spotify — the customer receives value each month and also pays Spotify $10 each month.

Second, the value proposition doesn’t change much with each cycle upgrade. Cars are a great example of this — most of the value to the customer is having an independent transport that has plenty of storage, includes seating for the family, and is safe. Regardless of whether a car is built in 2010 or 2020, most of those things don’t improve so there’s less of a need to upgrade.

However, Mirror isn’t a typical hardware company: they designed their business with recurring revenue in mind. While Sonos, GoPro and Fitbit struggled (well, are struggling) to start a product line that earns recurring revenue, companies like Mirror were built for it from the start. For $39 per month, subscribers get access to live and on-demand workout classes.

Pure hardware companies like GoPro and Sonos trade around 1x revenue while Peloton (the closest subscription-first public comparison we have to Mirror) is trading at around 11x revenue. With that in mind, lululemon buying Mirror for $500 million — 11.1x their 2019 revenue and 5.0x their 2020 projected revenue — looks like a good deal.

If lululemon were buying a standalone hardware business, I’d be skeptical of their ability to turn it into a stream of subscription revenue. But Mirror immediately gives lululemon a monthly charge on consumers’ credit cards, something they didn’t have before.

Cross-Sell Mirror into lululemon

At first glance, there’s one obvious reason why lululemon purchased Mirror: cross-selling Mirror’s product in the lululemon marketing machine.

Lululemon has one of the best owned-distribution platforms in the world. They have 489 company-owned stores that do extremely well. In 2019, their sales per square foot were $1,657, compared to the retail industry average around $325, giving them the highest sales per square foot in all of apparel.

Both companies target similar psychographics and have similar ways of doing business. Both products target the same customer: physically active and affluent men and women. They also both own the entire customer experience. Lululemon does this by selling apparel mostly through their website and their company-owned stores. Mirror does this by selling direct-to-consumer online paired with white glove delivery and installation service (which has received several glowing reviews).

It’s easy to imagine lululemon replacing every mirror in their store with a Mirror. Customers could try it out in-person. It may seem silly, but it could have a huge impact on sales. For hardware especially, physical interaction with the product can make the difference between “curious” and “purchased”. They can also list the Mirror product on their lululemon website and in lululemon marketing emails. Exposing the product to so many qualified leads will result in a massive uptick in sales.

One other benefit of Mirror: it’s coming onto the scene at the perfect time. Peloton is firmly in the zeitgeist. Not only has the investing community seen the power of these kinds of companies after Peloton went public, but people are familiar with Peloton on a national level. It’s important for marketing spend: when people talk about Mirror, it’s easy to mention it in the same breath as Peloton. Mirror (now lululemon) doesn’t need to start from scratch and educate consumers nearly as much as a few years ago.

Connected Home

The most interesting opportunity, however, isn’t in traditional cross-selling through marketing emails and retail stores. Instead, it’s using Mirror as a new direct sales channel into the homes of millions of active customers.

This idea is well-summarized by Michael J. Miraflor on Twitter:

Mirror instructors will be wearing Lulu 100% of the time. If they can achieve economies of scale w/ hardware, Mirror could be a direct sales channel (a la Amazon Echo). I still remember 2+ years ago when Peloton instructors were allowed to sport Nike, Adidas, etc. No more.

One of the biggest concerns with lululemon is that growth might stall. They may have saturated the US market already. They have a large store footprint. They’ve extended into several product lines and categories. This acquisition not only gives them a completely new product to sell. But it also gives them a permanent place in the home.

What future could lululemon be imagining with the Mirror? A couple ideas:

Measurements and fittings. Clothing returns can run as high as 40% and cost $15 per order. Lululemon has mentioned that their return rates are very low -- which has been a big drive of industry-leading margins -- but it can always improve. It also serves as a unique brand proposition. Other apparel companies would require you to use a phone or computer camera for this kind of service. And even if it’s not just for reducing returns, the experience of virtually trying clothes on can be a unique feature that Nike or other retailers wouldn’t be able to offer in the same way.

Coaching and training. Currently Mirror offers personal training at $40 for 30 minutes. This could be extended into nutrition and wellness as well. Lululemon is a highly trusted brand and having a device like this already in your home gives them an opportunity to sell additional services. Lululemon has already been expanding into courses and experiential stores to extend their powerful brand beyond apparel. Mirror gives them another new avenue to accomplish that goal.

Also imagine the possibilities to create content with their ambassadors. Lululemon has always taken a unique approach to distribution. Instead of paying celebrity athletes that have high exposure millions of dollars in sponsorships, lululemon relies on a network of ambassadors:

Instead of paying for traditional endorsements, the yoga-focused brand has built an ambassador program of local influencers, elite athletes and outstanding yoga instructors who create community, provide feedback on product and partner with Lululemon on social impact programs.

This Reddit comment provided a succinct summary of what it takes to be an ambassador:

Do cool fitness stuff in your community and get to know the managers of your local store.

If this is how lululemon sources their ambassadors, they already have a group of people who know who they are. If the ambassadors start hosting classes through Mirror, there will be even higher demand for both Mirrors and the clothes that ambassadors are repping.

Telemedicine. While Mirror could be viewed as nothing more than a giant iPad strapped to a wall, there are cases outside of apparel and fitness that would benefit from a full-body view. One of them is telehealth. With the rise of remote healthcare, this could be a growth avenue down the line.

While Mirror doesn’t offer any of these services yet -- and may never offer them -- Mirror is a piece of real estate inside your house. Something that you use every day. Most Americans only have a few devices they interact with everyday (and the number of branded devices is even smaller). If Mirror can install their devices, adding services later becomes easier.

A Calculated Moonshot

Apparel companies don’t have a good history buying technology companies. The most notable example is Under Armour with the purchase of MyFitnessPal, Endomondo and MapMyFitness. As Nathan and I wrote in a previous article:

Their competitor Under Armour, on the other hand, spent over $700m purchasing three fitness apps and tried to move into a new category: connected fitness. It was a brand new business model (subscriptions & advertising) and introduced technology to an apparel company. Fancy! But growth in the “connected fitness” segment slowed shortly after the acquisition, and it’s one of the reasons Under Armour’s stock has fallen since their IPO.

So why would this one be any different? Well, there’s a good chance it’s not. We shouldn’t be surprised if lululemon writes down the goodwill of this acquisition to zero in a few years. Mirror is risky. And it’s in a completely different business than lululemon.

But what if we take a different view and say that the Under Armour acquisitions weren’t a failure as much as a gamble that didn’t pay off? If the metaphorical flop was a king instead of a seven what would the narrative look like?

This line of thinking isn’t unfamiliar to other highly-profitable companies. Taking big bets that are adjacent to (or completely outside) their core business is what tech companies have been doing for a long time. A quick list of acquisitions that were outside the core business:

- Google: DeepMind, Waze, Nest, FitBit

- Facebook: Oculus, CTRL-labs

- Amazon: Kiva, Twitch, Whole Foods, Ring, Zoox

What if we view the Mirror acquisition not just as the projected future cash flows of the business plus synergies with lululemon, but rather as a call option on the possibility that gyms don’t return to normal for a couple years?

We are entering the golden age for home gym equipment. Enthusiasm for fitness is at an all-time high, but gyms are closed. Mirror fills the gap: an exciting fitness option inside your home.

Lululemon is one of the most profitable apparel brands in the world. They have cash on their balance sheet and handled the pandemic about as well as anyone. Lululemon bought Mirror for $500 million and they have a $40 billion market cap. This acquisition is just large enough to make a difference and just small enough to not cripple lululemon if it fails -- the perfect size for a moonshot.

Just a mirror?

Despite my optimism, it’s far from a guarantee that Mirror will be successful. I looked at several independent reviews for the Mirror and if there’s a summary of the comments it’s this: Mirror is “nice to have”, but not “need to have”. A few examples:

Toms Guide gave it a 3.5 out of 5 saying: The Mirror is a little too expensive for what it offers, but the classes will definitely make you sweat. Get it if you love to work out at home but need to save on space.

CNET gave it 3 stars out of 5. They said: Mirror's variety of classes, efficient mirror-screen design and simple app make it a suitable, albeit pricey, at-home substitute for the gym.

There isn’t a Reddit page for Mirror yet, but there was some chatter on the r/pelotoncycle subreddit. A few notable comments:

Definitely not as functional as the bike or tread but it is very aesthetically pleasing! I just wish peloton bought these guys so I can use it with peloton content lol

I think this should be Peloton @peloton next product. It’s pretty simply for them really they already have the platform, the classes and hardware, the mechanics and technology of the smart Mirror is easy as pie. I’ll buy one when Peloton has it. [Emphasis mine]

Of course a Peloton subreddit will have comments like this -- there certainly were glowing Mirror reviews as well -- but the larger point remains: do people care enough about the Mirror community to pay $39 every month? And not only that, but do they actually use it often such that they are excited to tell their friends about it?

Notably, there isn’t any data on Mirror customer churn. Lululemon didn’t publish any of it, sure, but Mirror only launched their product in September 2018. That’s just not a lot of data to work with. A lot of these questions are still up in the air, even for the company.

But at the same time, customers don’t reduce a buying experience to it’s spare parts like analysts are prone to do. The Mirror is a beautiful product. And it’s now affiliated with a grade A consumer apparel brand with an attentive customer base.

I wouldn’t bet on them without the help of lululemon, but now they are in a great spot to succeed.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!