Toast—a Vision of Software’s Future

Hints to why their shares popped 60% in their first day

September 23, 2021

TL;DR

- Toast deliberately chooses customers who are more expensive to acquire, churn more frequently, and will pay the absolute minimum for their service

- Despite this (or as I’ll argue later, because of it) Toast has succeeded in building a business that boasts a 110% Net Revenue Retention, 118% Annualized Recurring Run Rate year over year growth, and is serving ~48k customer locations.

- This piece was informed by conversations with over a dozen restaurant operators, top-quartile software investors, and vertical software operators.

Before we start, a quick follow-up: About a month ago, I publicly put out a hypothesis that I called “Double Bind Theory.” My theory stated that companies would allow their most powerful creators to violate content rules out of fear of missed revenue. I was proven right in a spectacular way with the leak that Facebook had a program that allowed millions of its most popular creators to post things like revenge porn and racist/violent rhetoric. Sucks to be right here, but I called it.

When analyzing a company, it is hard to not be sucked in by well-crafted marketing fluff or the chest-thumping confidence of executives. To fight against this emotional pull, equities analysts at hedge funds are trained to ignore how they feel and to instead examine a company’s financial statements with cold, ruthless, American-Psycho-esque rigor. Only once they know the numbers will they deign to examine how the business feels.

If you were to deploy this method of purely quantitative analysis on Toast, your most likely response would be, “What the hell kind of business is this?”

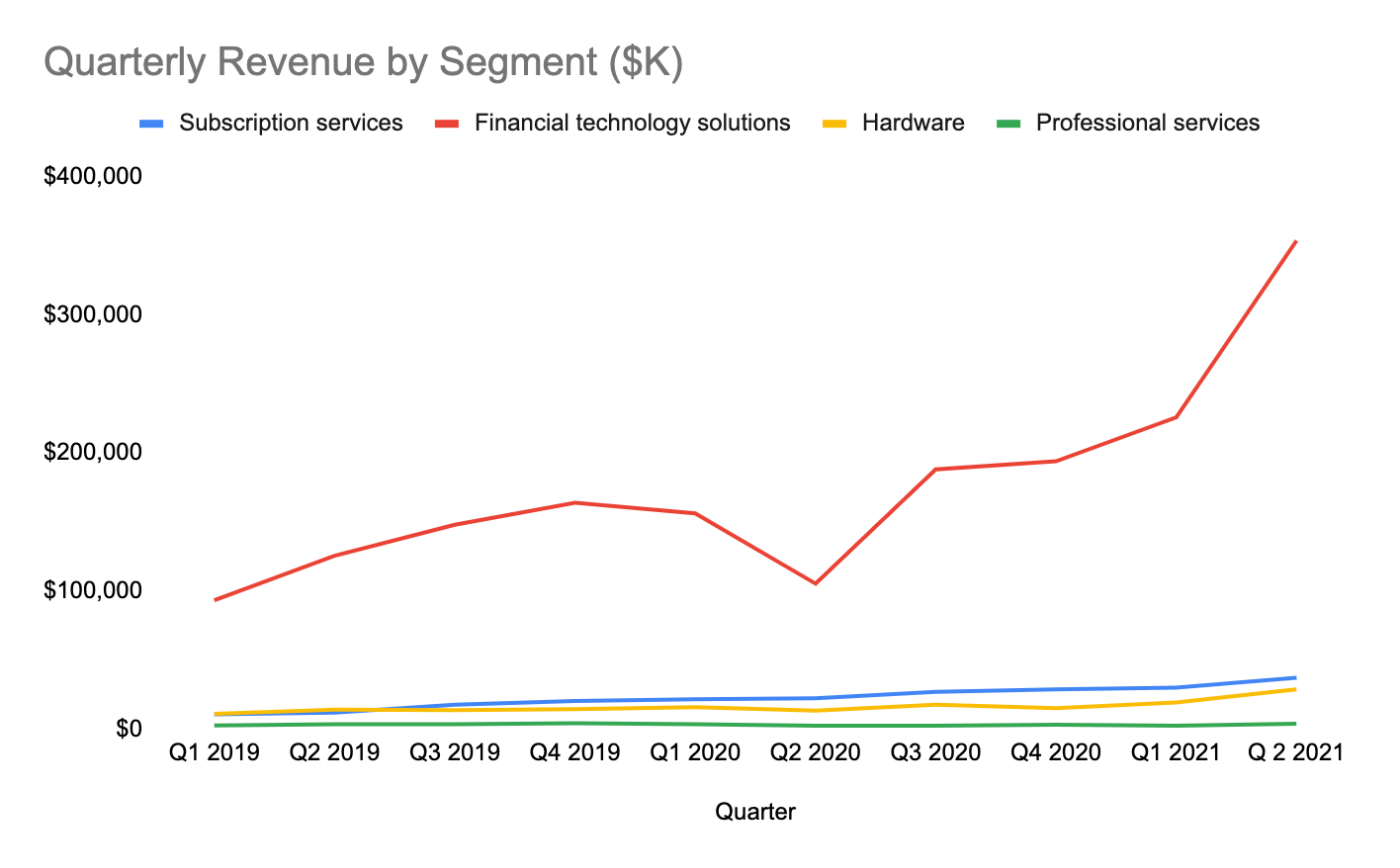

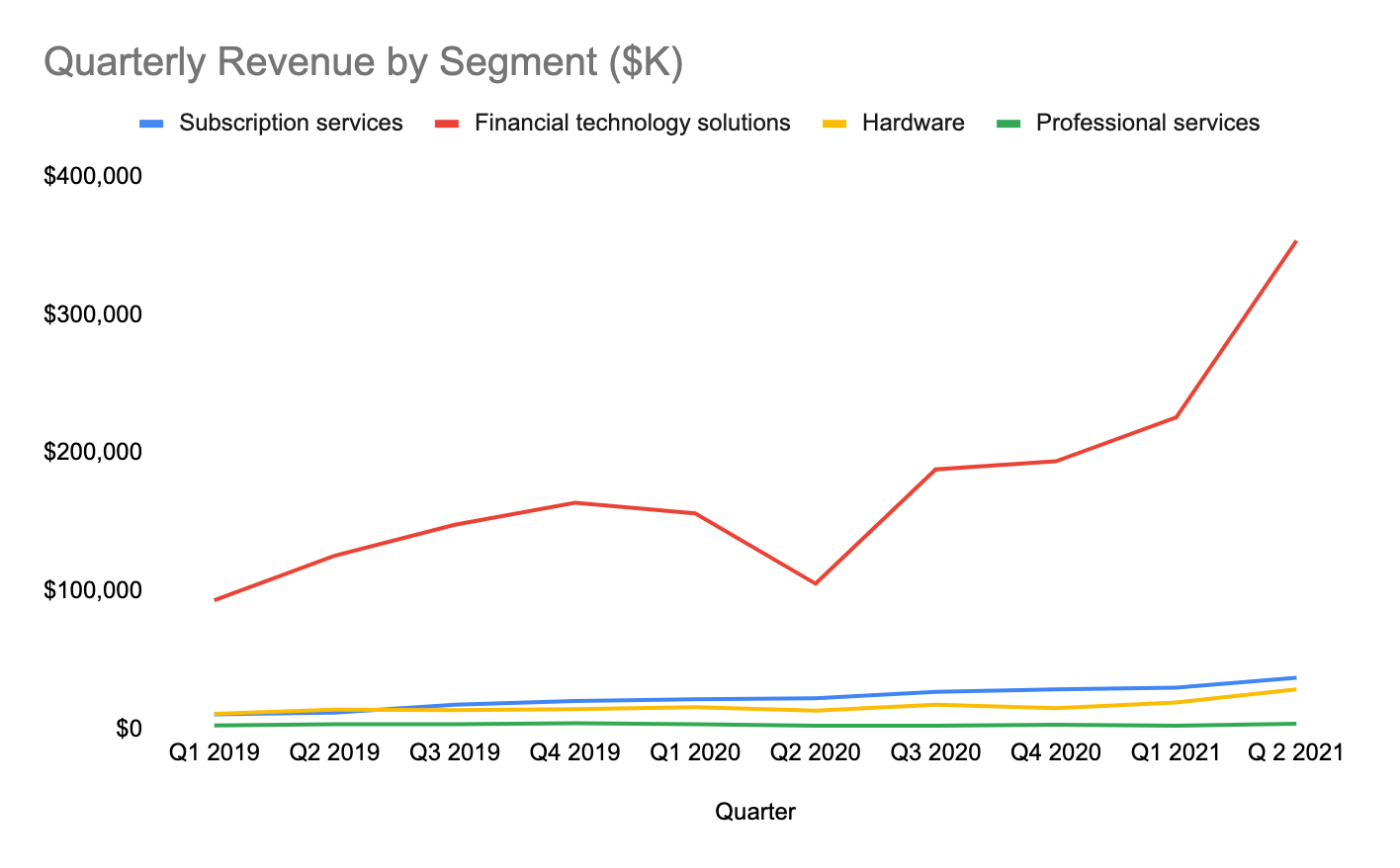

If you just look at the numbers, their revenue streams appear to be a Frankenstonian amalgamation of disparate parts. At their end of year in 2020, there was a line of professional services revenue ($7.7M), subscription services aka software ($68M), Financial Technology solutions aka payments processing ($579M), and hardware ($49M).

Further investigation of their S1 reveals more oddities. Toast deliberately chooses customers who are more expensive to acquire, churn more frequently, and will pay the absolute minimum for their services. The document is filled with pictures of adorable zen-looking customers who are so apparently smitten with their service that they would sell their firstborn versus giving up their beloved Toast products. In contrast, Toast fired its biggest and most important customer last year. They have chosen the opposite of a good software go-to-market strategy by focusing on small and medium businesses.

Despite this (or as I’ll argue later, because of it) Toast has succeeded in building a business that boasts a 110% Net Revenue Retention, 118% Annualized Recurring Run Rate year over year growth rate, and is serving ~48k customer locations.

Discussing how it was able to do this despite choosing the hardest road is useful for two reasons. First, the company just went public (with its shares shooting up 60%) and is something you could add to your portfolio. Two, it is indicative of a larger change in software business models that isn’t quite understood yet. Today, I’ll be publishing (for free!) my analysis of Toast as a standalone company. Later this week, I’ll be sending out a paid article about the future of software monetization. I think we are sitting on the cusp of the biggest change in software businesses not seen since the popularization of SaaS/The Cloud.

But, to lay the groundwork, let’s talk Toast.

What is Toast?

You can blame Toast for making every fast casual restaurant checkout uncomfortable. You know the experience: you order the delicacy of your choice, the cashier rings you up, and then on some sort of tablet, a “would you like to tip” message pops onto the screen. You stare at it. The cashier stares at you staring at it. You try to pretend that you don’t feel their eyes gazing at you. You sweat, they scorn. The whole process sucks and annoys me every time.

That annoyance is Toast.

But Toast isn’t just about tipping. When you placed your order, their software was the database your order was entered into. Their software then sent the request back to the kitchen onto an order screen, noted the ingredients used in your dish and filed it into a report so they know to order more for next week, then handled the payments when you swiped your card checking out. Oh! And they also may have done the financing for the restaurant you were at, administered the payroll for the workers, etc. There’s more! Email marketing tools! Loyalty programs!

In short, they do basically every part of a restaurant besides cooking the food.

Toast is a technology company focused exclusively on restaurants in the United States. Their target market is SMBs (small and medium-sized businesses) that may have a few locations but aren’t giant chains like McDonald’s or Chili’s.

Their customers do not have an easy existence. Running a restaurant is a terrible, horrible, soul-sucking endeavor. 1 in 3 restaurants won’t survive their first year. The average restaurant boasts a measly 3-5% net profit margin (if things are working right!). Labor markets are incredibly tight and there is a huge shortage of food workers. Even if you get the finances and labor sorted, running a restaurant is an all hours, no breaks kind of thing.

The core problem Toast solves is that running a restaurant is so bad in just about every way, that if Toast can just make each experience marginally better they significantly improve their customer's lives.

Toast estimates there are roughly 800k restaurants in the United States, giving them a TAM of ~$15B and a penetration rate of ~6%.

Note: I often talk about how fudged public company’s numbers are. The lie here is that since Toast can’t fully service enterprise customers a decent chunk of this 800k is unobtainable. While they may technically claim the enterprise market is part of their TAM (and thus not get in trouble with the SEC) it is totally disingenuous to include it. They include that risk in their risk section (and thus free themselves from lawsuits if they fail to move upmarket) but it feels icky to me. This is the sort of thing that upsets me. Using the most positive assumptions to sell your equity to people sucks. If anyone at the SEC reads this I demand base and bear cases in S1s!

Their competitor for the enterprise space, Olo, estimates there are 300k enterprise restaurants in the U.S. They probably inflated those numbers a bit too but this helps give you some comparison stats.

Their Financial Shape

By starting with an understanding of who they serve and what problems they solve, we can better understand Toast’s financials. Their 4 revenue lines each help solve distinct problems for restaurants.

Software: Automates as much back office and kitchen tasks as possible to increase margin

Financial Technology Solutions: Integrates payments with software

Hardware: Gives a place for all those payments and software to interact with staff and customers

Professional Services: Helps restaurants transfer all of their previously disparate technology systems into one centralized Toast system.

Payments have far outstripped the rest of the business.

Toast utilizes Hardware and Professional Services as “customer acquisition tools” and price them at/below cost. This further drives the importance of payments from a gross profit perspective.

With their current customer base of Jun 30, 2021, the 47K locations are driving $7,463 of annual gross profit per restaurant. This...is not a lot. And keep in mind that is with payments making 82% of revenue volume versus the preferred predictability/margin of software revenue.

Thankfully, they have been able to build a highly efficient go-to-market engine, with sales and marketing only being 10% of revenue, putting them in the top quartile of software stocks. They are able to find, sell, and close locations with incredible efficiency.

While they have yet to strike a profit, they had $38.8M in free cash flow. Which is what really matters at this stage anyways. Profitability is likely to come as their new customer cohorts continue to mature and the magic of positive NRR allows their income statement to catch up with their cash flows.

To summarize, they are crushing it in a large market. They have an incredibly long runway ahead of them with a <15% market penetration rate. Especially considering the two wild years the restaurant industry has been through, this is a remarkable business.

The Bull Case

I’ve never seen a 10x or 100x returning equity that was wholly reliant on a single company attribute. Instead, it was multiple layers of strategically significant and unreplicable capabilities all stacked on top of each other that made a winner. To make Apple a trillion-dollar company, they boast the best run supply chain on the planet, have monopoly power over their app store, deliver great software on a consistent schedule, and are a top 3 consumer marketer in the world.

Toast shows hints of this type of potential, but nothing overtly obvious. I predict three scenarios that could take it to the heralded realm of 10x returns:

Vertical SaaS Power Play

The playbook for most vertical SaaS providers is to enter with one strong product and then layer additional offerings over time (See Veeva, Shopify, etc). By my conversations with restaurant owners, Toast still very much feels like a payments provider with extra on top. Their existing products are good but not yet incredible. Additionally, there are just many, many more products to launch for Toast. There is no reason that they couldn’t automate away the entire back office function for a restaurant. Why not be Gusto or BambooHR but just for restaurants. There is a path of increased ARR per customer simply by building software for every single aspect of the business.

Most vertical SaaS companies can only capture x% of a business’s activities before they hit an upper limit. Companies don’t want to be overly reliant on one software provider and become commoditized. For Toast, there is a version of reality where this limit does not exist. They can sell products for basically every part of the business. A restaurant competes through geographic arbitrage (ex: I frequently dine at places that I think are just ok because they are close to my house) and a superior product. Whether that product is food, decor, customer service, or some combination thereof, Toast can’t really affect any of that. A bad cook will always burn the bread, regardless of whether Toast is their software provider.

Note: I once chatted for an hour with a Sushi chef/owner in San Francisco. His restaurant had made a total of $50k in profit over 4 years. However, he and his investors were going to make a mint. Their building had appreciated by over a million dollars in value since they bought it.

Look At Me, I’m Your Bank Now: What if instead of expanding their software, Toast poured its entire R&D budget into financial products? What if they were a bank, exclusively for restaurants that handled all of their financial needs? The software would the product wedge to get into the restaurant but the margin would be made by handling payments, loans, etc. There are some early hints of this journey already occurring with the company offering Toast Capital—their lending product. But it is currently less than 1% of revenue. If you could subsidize an entire software suite with just payments volume (current state) could you potentially make it free if you handled all of a restaurant's finances?

This version of the future has massive distribution at an unbelievable growth rate. There is no better growth strategy than just being really freakin cheap.

I’m Going Up or I’m Crossing The Sea: The other scenario is a fairly typical software story. Toast is successful in moving up market or going international with their products. They have many years before this is truly necessary but it would be something that needs to happen in the next 3-5 years.

The worst choice Toast can make is try to do all 3 of these options at once. But each of these scenarios represents a world where the company is a great stock to hold.

The Bear Case

Of course, there are no guarantees in this life and I harbor significant concerns with the company.

Square’d up, Sliced Apart: One of the dangers of identifying yourself as a vertical SaaS provider is that you may choose the wrong market definition. While the vertical you choose may exist, it can be broken apart by various competitors. There are 2 competitive scenarios that could damn the future of Toast:

- Square Comes to Play: Square is a competing payments solution provider that boasts a unique asset—a hugely popular consumer app. Cash App could provide the killer and unreplicable differentiator for Square that Toast could never hope to match. Square’s Cash App has 36M users and the company is currently experimenting with selling ads to them. If a restaurant was told that they could add additional customers just by using Square’s product it would be incredibly difficult for Toast to match it. It is important to note that Square does a lot with restaurants but it serves all different types of businesses so there isn’t the same level of vertical specialization with their product.

- Smaller vertical players eat their lunch: Slice is a well funded direct competitor to Toast that focuses exclusively on Pizza. Writing that sentence honestly feels silly! But keep in mind that there are over 50k pizza restaurants in the U.S. Why couldn’t there be a Toast competitor focused on Tacos? Indian? What’s stopping that from happening? When you think about competing software products, the greater the level of specialization for a specific customer, the greater the likelihood the specializer will win that customer’s business. Pizza has its own unique demands (delivery, customization, and web-based lead gen) that likely justifies Slice’s existence. Whether other food groups need that is yet to be determined.

Churn is never discussed in the entire S1: Continuing my diatribe against bad data being given to the public, Toast never disclosed their churn. I was flabbergasted when I read the document and couldn’t find it. What a company chooses not to put in an S1 can be just as instructive as what they choose to put in. While Toast’s NRR is good for the SMB segment, I would be willing to gamble that their churn is terrible. Otherwise, why not just tell us? Churn breaks the magic cashflow wheel of software businesses. If this isn’t actually working, the whole thing falls apart. There is a chance that payments are doing so well that it improves their NRR enough that a significant amount of logo churn could be hidden without disclosure to investors.

There is every chance this hunch is wrong! And when the Toast PR team reads this, please feel free to contact me and I’ll issue a correction but for now I would assume Toast has a serious churn problem.

Small fish, small returns: Building software for SMBs is a fundamentally different skill set and organizational capability than building it for enterprises. Toast has not demonstrated its ability to move upmarket. And when they do, Olo ($5b market cap) will be ready and waiting having served that segment of the market for many years.

This post definitely isn’t investment advice, but the company is worth examining if you haven’t yet considered its impact on your portfolio. There isn’t really anything else like it on the market today.

What is even more interesting is what a company like this doing so well means for the future of software. It represents something that I think can fundamentally change how we distribute, monetize, and position software products. The ease of embedding fintech means that previously untenable markets are now goldmines, accessible to niche startups. Big horizontal platforms are going to have to fight a lot harder over the next 5 years for sales as embedded fintech unlocks more and more niche markets.

If you are interested in that thesis and how it can affect your portfolio, add your email to the list with the button below. It will come out in the next few days :)

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!