Sponsored By: Uptrends.ai

This essay is brought to you by Uptrends.ai, it's like Google Trends and Wall Street merged into one powerful tool. Get 50% off for your first 3 months by entering the code EVERY50 when you sign-up and jumpstart your financial journey.

Currently, our platform is exclusive to desktop users. So, pull up your chair, log in from your desktop and start leveraging the power of Uptrends.ai to stay a step ahead in the market.

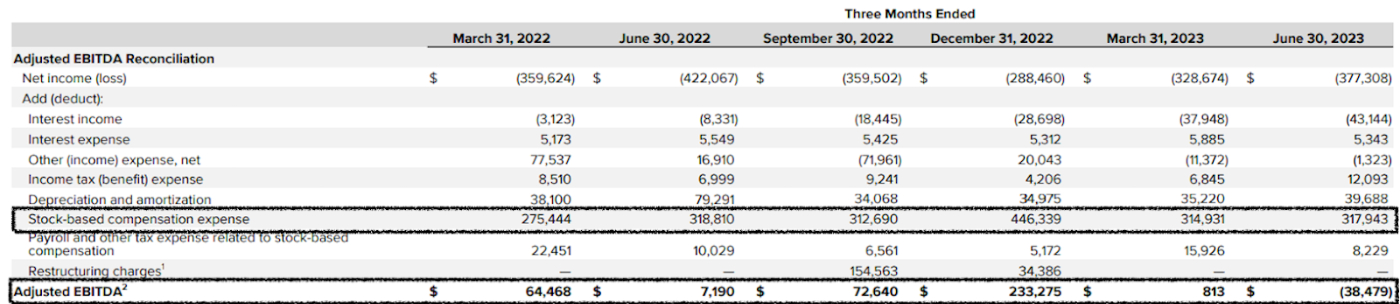

When Snap’s Q2 earnings came out earlier this week, the stock immediately dropped 17%. The company had a 22% jump in infrastructure costs, its revenue was down 4% year over year, and it’s spending $317M a quarter on stock-based compensation.

How did it come to this? In the last year the company has launched GenerativeAI products and a new subscription product, the latter of which has 4M users. The much-predicted recession hasn’t materialized. These are all things that should supposedly make this business hum. Instead, the results were the lovesong of a cat with tinnitus (abysmal, off pitch, very bad).

The answer to the consistent underperformance is simple. The company has failed to address all of the things that were broken a year ago—and the year before that and the year before that and the year before that.

364 days ago I published a piece arguing that “Snapchat’s Probably Screwed.” Today is a follow-up to that original post on what I got right (and wrong). I would propose the company is guilty of two primary sins:

- Using the placebo of “innovation” to hide lackluster growth

- A broken monetization model

To fix the company, there likely needs to be serious layoffs and an honest look in the mirror about what Snap can be.

Snap is an INSERT WORD THAT GIVES JUICY MULTIPLE HERE

For many years, Snap’s investor presentations started with this slide:

This makes no sense. It is like McDonald’s saying they’re a lettuce farm—picking something higher up in your value chain to define your company is nonsensical. Spectacles aside, Snap is not in the business of producing cameras—it sells ads. The company released an updated version on December 13, 2022:

This… is not that much better. A more factual description would be “Snap Inc. is a bundle of messaging and entertainment services primarily delivered through an app.” However, the inaccuracy benefits the company by allowing it to spin a narrative of grand ambitions and experimentation (and justify fat compensation packages).

Picture this - Google Trends and Wall Street merged into one powerful tool. Welcome to Uptrends.ai - your personal stock market news analyst. A first-of-its-kind platform designed to simplify investing for everyone, where chatter turns into valuable trading insights, highlighting trends and events that count.

With Uptrends.ai, trading the news has never been simpler. Better yet, get 50% off for your first three months by entering the code EVERY50 at checkout.

Like a Bloomberg Terminal, our platform is only for desktop users. So, pull up your chair, log in from your desktop, and start leveraging the power of Uptrends.ai to stay a step ahead in the market.

When it was a “camera company,” Spiegel led the organization in a fruitless exercise of hardware development. It launched its first effort, the Spectacles, with a viral marketing campaign in 2017. The device won awards and drove an internet bonanza. Great! Investors were excited. However, the fiscal result was lackluster. Snap overproduced and took a $40M loss while selling fewer than 500K units. For comparison, in 2018 Apple sold ~600K iPhones a day.

This pattern plays out again and again. Using the justification of “I am a genius and the controlling shareholder,” Spiegel has burned tons of cash for middling results.

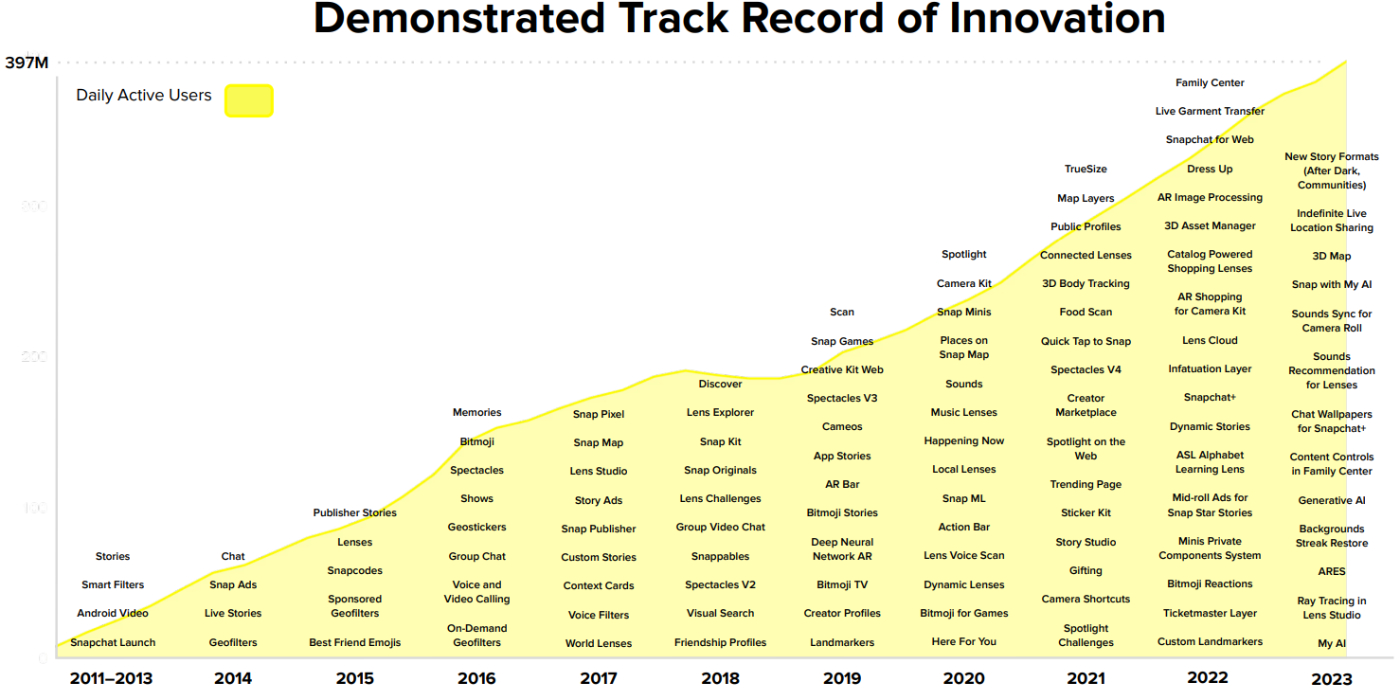

Snap, “the technology company,” has a 10-year history of buying or launching expensive projects that produce completely linear growth. It even proudly displays it! The company has had some version of this slide for years, too. Here is the Q2 2023 edition:

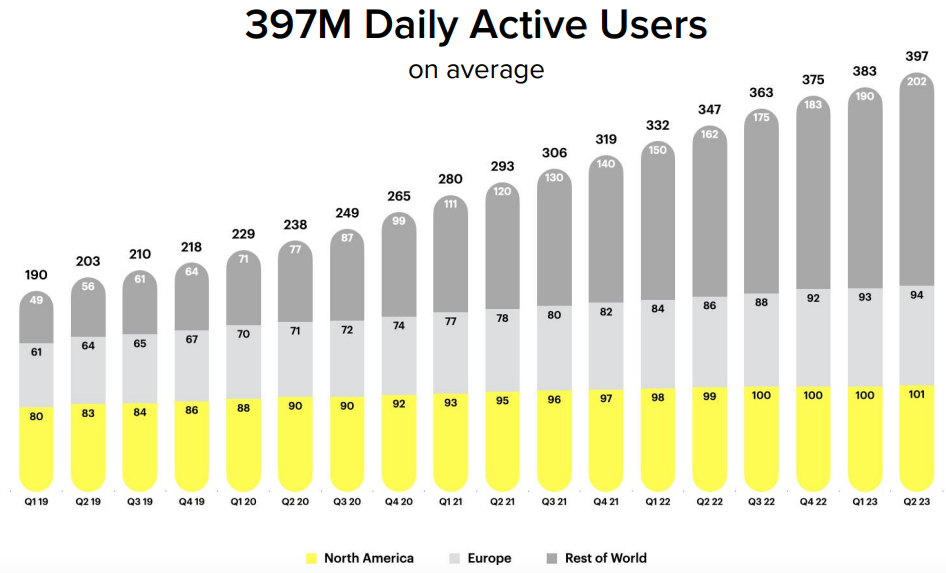

You’ll note a marked uptick in growth in 2018. What was it that drove user growth that year? Was it its Lens Explorer? The Snap Kit? Good guesses, but wrong. It was something that didn’t even hit the list: the company finally released a functional Android app that took off in LATAM and Southeast Asia. Its user growth in North America—the place where its revenue will be determined—has been borderline anemic.

Since 2018, the company has launched 83 products that it believes worthy of mention to investors. That was billions of dollars in R&D and acquisitions and distractions. The result of all this effort was ~200M users. Over the same time period Meta’s family of apps gained 1.5B additional users.

In defense of Snap, the company invented two totally novel media paradigms: disappearing messages and Stories. This does earn it some leeway. However, everything since has been bought (Bitmoji was acquired for ~$100M), copied (vertical short-form video from TikTok), or licensed (MyAI is a reskinned version of GPT4). The Stories feature was launched in October of 2013, so the grace period of deserving an innovation premium has officially run out.

But I mean, that’s OK! Not all companies can be worth a trillion dollars, and all products have a TAM. It could be the case where Snapchat is what it is and will grow linearly for many more years to come. What matters is the financial profile of the company on the way there. And, you guessed it, it’s done poorly there, too.

Typically a business tries to make money

What is the point of a business? If you’re Elon Musk, it's to fill that deep hole inside of you that can never be satiated no matter how many followers you have. If you’re Mark Zuckerberg, it is to prepare the way for our lizard overlords to control the government. If you’re Evan Spiegel, it is to pay yourself lots of money. As others on Twitter have pointed out, the company has given out $7.8B in stock-based compensation while simultaneously posting -$9.2B in net income.

If you were being generous, you might assume it was running the Amazon strategy of never being profitable while simultaneously being cash flow-positive. Cute, but wrong. The company has produced -$870M in free cash flow since its IPO. It has only been cash flow-positive in 2021 and 2022, with 2023 being net down $16M.

It’s done this while currently being valued at only ~$17B!

Even worse, the company has done so while all equity on the market isn’t allowed a vote in the proceedings of the company. The co-founders own shares that give them near total control. What originally raised my ire with Snap is that last year they voted in a bylaw that allowed the founders to sell as much stock as they want without reducing their voting power. It’s giving shareholder disrespect.

I’m actually sympathetic to the cause of founder majority shares. Founders deserve more latitude and benefit of the doubt than the markets give them credit for. However, if Bezos can build Amazon into a trillion-dollar company while not having voting control, then surely Spiegel could at least reliably post positive net income.

I could excuse these kinds of multi-year losses if the company was building something that was going to be cash positive in the future. But all this loss has only produced subpar growth, a management team distracted by side projects, and an abandonment of the only thing that matters: fixing the ad business.

Dude, where’s my ads?

One of my red flags for an executive team is when they spout some variation of the phrase “diversifying our revenue streams.” Becoming a multi-product company is natural and good. More money is always better. However, when an executive farts out jargon that sounds like the sensual nighttime whispers of a Harvard MBA, it does not inspire confidence. Instead, it suggests a flailing about, a desperate desire to find something to cover the mistakes made in the primary business.

In this latest earnings call, I heard it said four times.

The team was particularly proud of the Snapchat+ offering, which allows power users access to the web app and other beta features for $3.99 a month. There are currently roughly 4M subscribers, producing a ~$200M annual revenue run rate. That is great! It is also only 1% of its total DAU activation rate—an abysmal conversion percentage that only looks good because Twitter (X?) Blue is so, so bad. By comparison, it’s only 4% of last year’s total revenue. In this quarter’s shareholder letter there was also mention of an enterprise SaaS offering that had no sales figures attached.

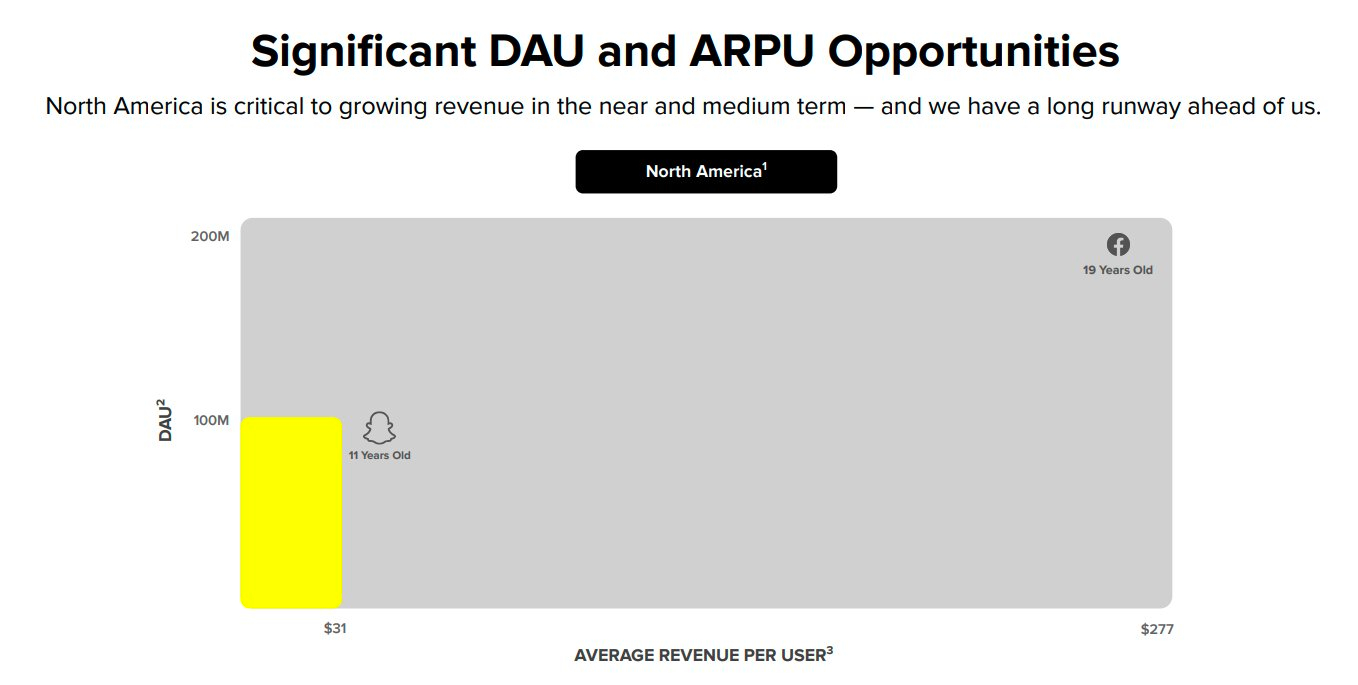

This diversification is fine from a business strategy perspective, but it acts in complete narrative dissonance from the story Spiegel has been telling. The company is always talking about how much room to grow the ad business has.

In this slide the company brags how, 11 years in, it’s half the size of Facebook’s North America users and 11% of Facebook’s revenue per user. At a certain point this slide is no longer a good thing! Eleven years is plenty of time to figure out how to sell an ad. After a while, it demonstrates management’s incompetence versus the opportunity the company has. I think we are at the former.

Snapchat’s ad machine has been middling for years, but Apple’s App Tracking Transparency (ATT) policy broke the company. Snapchat has the functionality that makes digital advertising special, like auction mechanics and auto-targeting, but it’s a lot worse at it in comparison with Meta. (Ad performance is a complicated topic, and I don't want to lose the plot of this post, so if you want to learn more about the intricacies of Snap's ad business, read my previous essay on Snap’s ad problems).

In my conversations with marketers deploying millions in ad spend, I received the same feedback: “You can run a profitable campaign, but with Snap’s poor targeting, terrible attribution, and smaller user base, you run out of juice really quickly. Meta can scale almost forever.” With Meta crushing earnings and seeming to have solved ATT, Snapchat’s inability to do so indicates long-term issues with the health of this business.

While the team pays lip service to using machine learning to solve ATT, they can’t seem to get it right. The whole point of an ad system is that it works without a large sales team. Instead, Snapchat’s system is so bad they have to teach every advertiser on how to use it correctly. Here is Spiegel on this week’s call:

“So, what we've been trying to do is scaled out with our go-to-market efforts. So, for example, we released a new dashboard for our team to be able to make sure that advertisers are sharing signals correctly in a privacy-safe way. That's helping us find these configuration errors that if we can correct can lead to much stronger results for advertising partners, and we're definitely taking a more consultative approach with clients as well. So, I think for e-commerce advertisers and purchase-related conversions, we're seeing a lot of progress there.”

Allow me to translate: “Our system is so confusing and hard to use, we have to teach every important customer how to make it work.” I’ve been listening to Snap’s earnings calls for years and feel like I’ve heard a variation of that sentence every single time.

“Progress on direct response is just a quarter or two away.”

“Advertisers are excited with their early results.”

“Thank you for paying for my $120M house.” (That last one might not be real, but it’s implied.)

Meanwhile, Meta has grown faster, monetized better, and executed better in every way.

The point is this: right when the company needs to fix its ad machine, it’s bragging about diversification.

I am not without flaws (and a fix or two for Snap)

These are all versions of complaints I made last year. While Snap+ is new and exciting, it is a rounding error in the scope of the business. The company has to fix its ad machine.

But I was wrong about one thing. Despite the title of last year’s piece, the stock price is actually up year over year.

Whoops!

However, this quarter is the second in a row that the company has posted a revenue decrease year over year. My original thesis about the company being in real trouble was correct. What I got wrong (because I didn’t cover it) was whether the stock was priced correctly. This is not a stock picking newsletter, and you should never trade based on what I write.

Even with the losses and distractions and too-powerful founders and killer competition and ad disasters, this is still a business that I hope can turn around. Elon has proved how incredibly hard it is to destroy network effects. You can lay off lots of people and make tons of product mistakes, and people will keep using the service. Snap could probably cut staffing by 50%, turn cash flow-profitable, and put all its time, focus, and attention on fixing the ad business. It has a healthy enough balance sheet that the company can push through a period of retooling. It would require Spiegel’s total focus—something I’m not sure he is willing to do.

I’m rooting for Snap to win. If not, Elon will probably buy it and rename it Y (and no one wants that). I really don’t want a world where you have to be Google or Meta to succeed at consumer social. Competition and choice is healthy for the world. We should all be cheering Snap on. I know I am.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Thanks to our Sponsor: Uptrends.ai

Experience finance like never before with Uptrends.ai, the first market monitoring platform for the everyday investor. Just as Google Trends tracks what's hot, Uptrends.ai deep-dives into the financial sphere, unearthing the trends and news that could make or break your portfolio.

You can get 50% off on your first three months by entering the code EVERY50, and step into the future of investing today!

Please note, our platform is currently available for desktop users only. Make sure you sign in from your desktop to experience the future of market news analysis. Start trading smarter with Uptrends.ai today.

Comments

Don't have an account? Sign up!