How Chegg Grew Their Share Price 20x In Four Years

A textbook example of digital evolution

September 18, 2020

In the mid 2010’s, Chegg seemed like it would be yet another eCommerce flame out. High flyers like GroupOn and GoPro were starting to crash and many investors assumed textbook rentals would succumb to a similar fate. A fine business, but a lot smaller than initially expected.

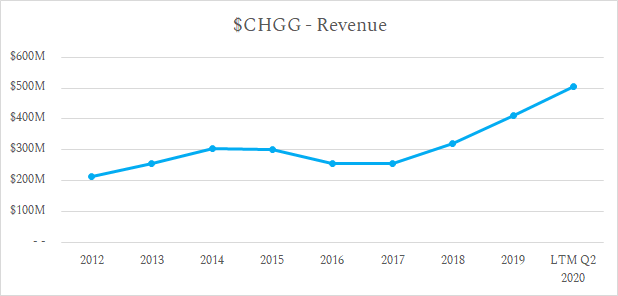

In 2015, Chegg’s revenue fell 1%. In 2016, it dropped 16% further. The business was in the midst of a transition from physical textbook rentals to textbook question solution subscriptions and the future was murky. In early 2016 the stock traded for just over $4.

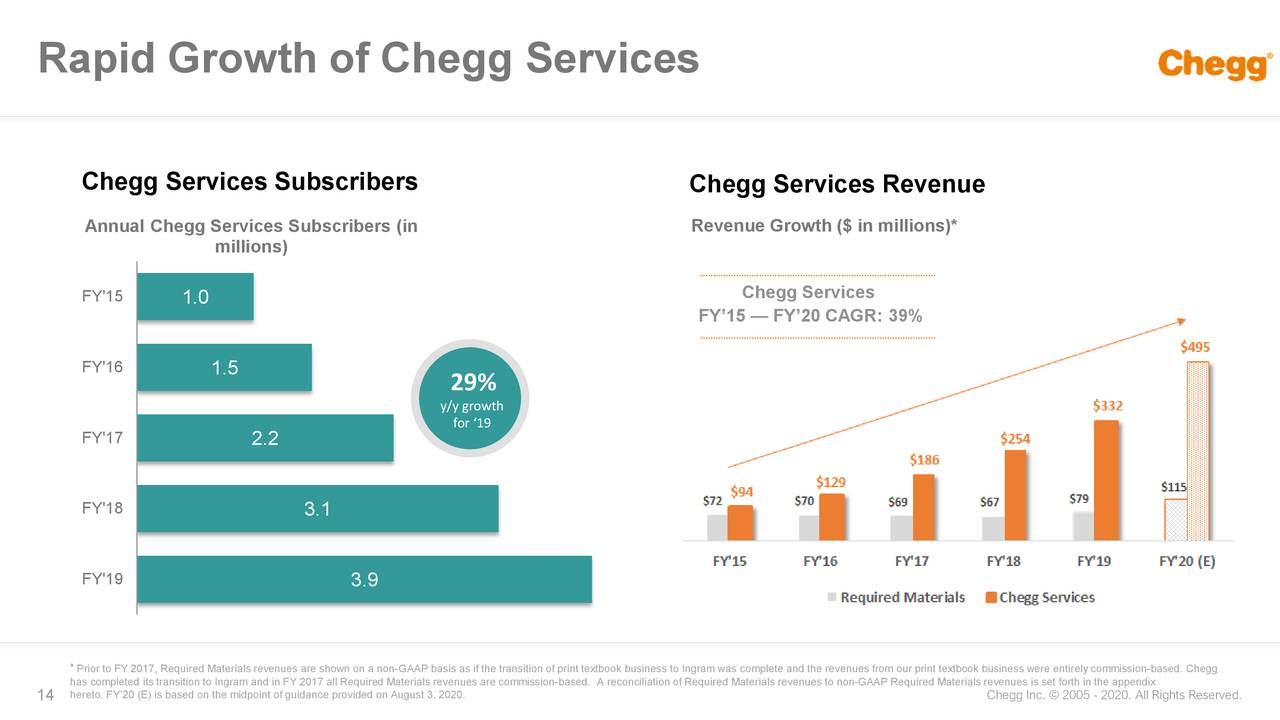

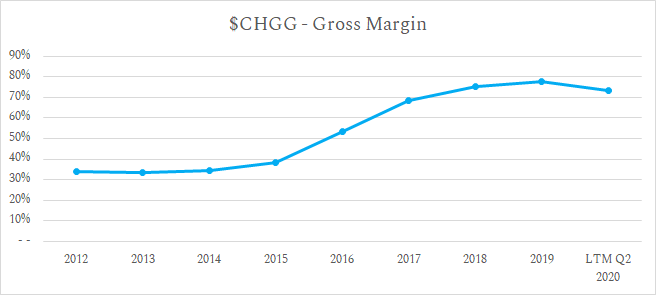

But then things started to change. Margins started improving, and the digital subscription business took off.

Source: Chegg Investor Relations.

On August 7 2020, the stock reached a peak of $86.98, a return of over 20x from it’s 2016 lows.

Chegg 5Y stock price chart, via Finbox.

Chegg was often referred to as the “Netflix of textbooks” due to their textbook rental business model, and years later CEO Dan Rosensweig would borrow another strategy from Netflix: allocating resources away from a dying business line into a growing subscription business. Textbook rentals are more or less a commodity. Chegg pivoted out of the business and leveraged their brand resonance with college students to build a direct-to-student subscription product.

In this post, we take a look at the origin of Chegg, how they grew their textbook rental business, why they shifted out of it and into subscription, and what we can learn from them. Let’s dive in.

Collegiate Origins

Usually when I write about companies, I don’t bring up my university alma mater. A land-grant university, Iowa State University is principally known for strong programs in agriculture and engineering (aerospace especially). But today’s post is a rare exception: Chegg was founded by Iowa State students almost two decades ago in the thriving metropolis of Ames, Iowa.

Originally called CheggPost, co-founder Josh Carlson and a couple friends built a “Craigslist for Iowa State” in the fall of 2000. They sold everything from couches and golf clubs to computer monitors and textbooks. The name Chegg comes from mashing together “chicken” and “egg” — how they thought about the job market after college. Every job required experience, but in order to get experience, you needed a job.

A couple years after launching the site, the founders saw that textbooks were the best performing category. Then the thought occurred to them: instead of being a marketplace, what if they bought the inventory themselves? At the time, they were just collecting a fee for the posting. If they owned the inventory themselves, they could earn a higher margin.

Around the same time, Aayush Phumbhra began his MBA at Iowa State and joined with the others to build CheggPost into a bigger business. They incorporated in 2005 and took the concept nation-wide in 2007 under the name “Chegg”.

After a few years of rapid growth, Chegg needed a more experienced management team to take the company public. They turned to Dan Rosensweig, who had quite the background himself.

In the 1990’s, Rosensweig was the executive behind PC Magazine growth into the largest computer magazine in both audience reach and revenue. Along the way, he sold advertising directly to some of the most successful technology CEOs of all time, including Michael Dell and Bill Gates. He also spent four years as the COO of Yahoo and was the main negotiator that offered to buy Facebook from Mark Zuckerberg for $1 billion. While the deal never went through, Rosensweig’s background in media set him up for success when he took the reins at Chegg in 2010.

Issues with Textbook Rental

In 2014, Chegg found itself with a tough business. They were buying textbooks and renting them out at increasingly deteriorating prices. Competition (from Barnes & Noble and Amazon in particular) threatened a business that didn't really have a moat. While it was clear this was the future — depending on the format, rentals are 10% - 80% the cost of buying textbooks — textbook rentals were a commodity business.

There is no product differentiation (professors listed a textbook for a course, and that’s what everyone bought) and the supply base of textbook publishers was already an oligopoly with five firms making up over 80% of the market. The price of rentals would fall to the cost of customer acquisition and profits would vanish.

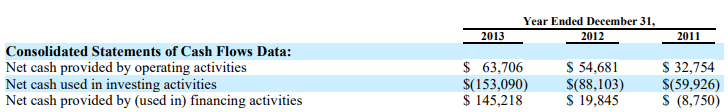

In addition to being hard to differentiate, textbook rentals were also capital intensive. From their 2014 annual report, we can see that capital expenditures dwarfed cash flow from operating activities. There was a massive amount of capital being deployed into textbooks: in 2013 alone, Chegg spend $122.2 million on textbooks and only produced $63.7 million in operating cash flow.

(Source: Chegg 2014 Form 10-K. Purchase of textbooks represents $122.2M, $104.5M and $74.1M in 2013, 2012, and 2011 respectively. Purchases were offset by textbook liquidation of $38.0M, $34.1M and $30.9M).

At the time, Chegg distributed around 5-6 million textbooks to students each year. If we assume a three year useful life (the number Chegg cites) then they might purchase 1.8 million textbooks each year. Textbooks retail around $100, so if they got a wholesale discount of, say, 30%, they might get each textbook for $70. 1.8 million textbooks times $70 per unit equals ~$128 million, which lines up pretty close to their 2013 annual textbook expenditure of $122.2 million.

But the tough part is that the large investment didn’t pay off right away. As with any fixed asset (an asset with a useful life greater than a year), the company pays cash for something that will produce returns over time. With a rental, it might take a year or two just to get the initial investment back. And with a gross margin of 26%, it can take several semesters for Chegg to earn that cash back.

Pivot to Capital-Light Model

Around that time, Chegg made the first major shift to their business model. In order to free up capital, they made a deal with Ingram Content Group (the world’s largest book distributor).

Essentially, Chegg transformed from an eCommerce model to an affiliate model. Previously, Chegg the bought the textbooks, stored them, marketed them, and distributed them all on their own. Under the new partnership, Ingram would own and store the inventory in their warehouses and also handle distribution, shipping and logistics. Chegg would still maintain a relationship with the student and determine the textbook catalog and pricing. In this model, Chegg earned about 20% off the top of every transaction.

The result of this was twofold: lower revenue and higher margins. Instead of collecting 100% of the rental price, Chegg now only collected 20%. But that 20% that they now collected was much higher margin. They didn’t have storage, shipping and logistics to pay for anymore. The remaining costs were the licensing fees for the content. Looking at their revenue and gross margin over time, you can see this transition play out quite clearly from 2013 to 2018.

Source: Chegg company filings.

While a lot of the growth on the revenue was from Chegg Services (more in the next section), the early gross margin expansion was largely due to this distribution deal.

Chegg Services

Alongside the textbook rental segment, Chegg was also growing their Chegg Services business. Chegg Services includes everything that isn’t related to textbooks or other required course materials. Let’s do a quick walk through of what it includes.

Chegg Study

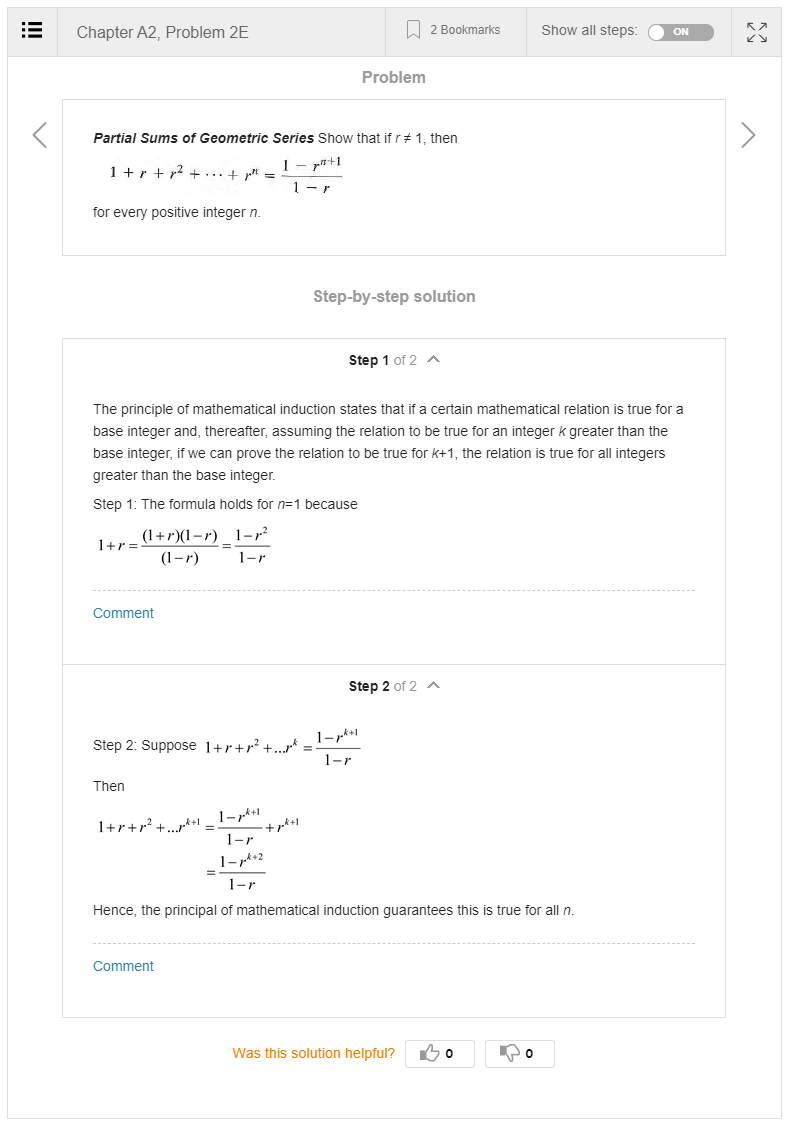

Chegg Study is the flagship product that most students (and recent graduates) would recognize. It includes textbook solutions — step-by-step answers to the questions at the end of the chapter — in addition to several other offerings such as Expert Q&A where students can ask a question and get an answer in under four hours.

Example of a Chegg Study Textbook Solution

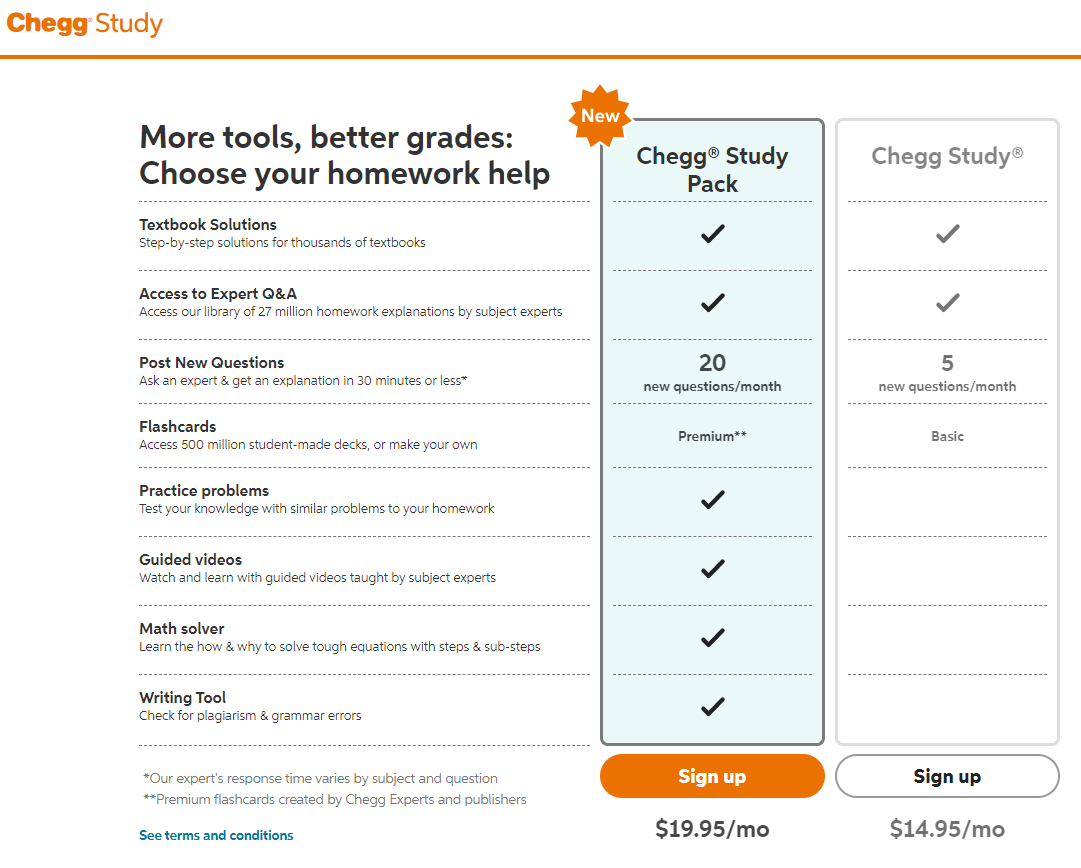

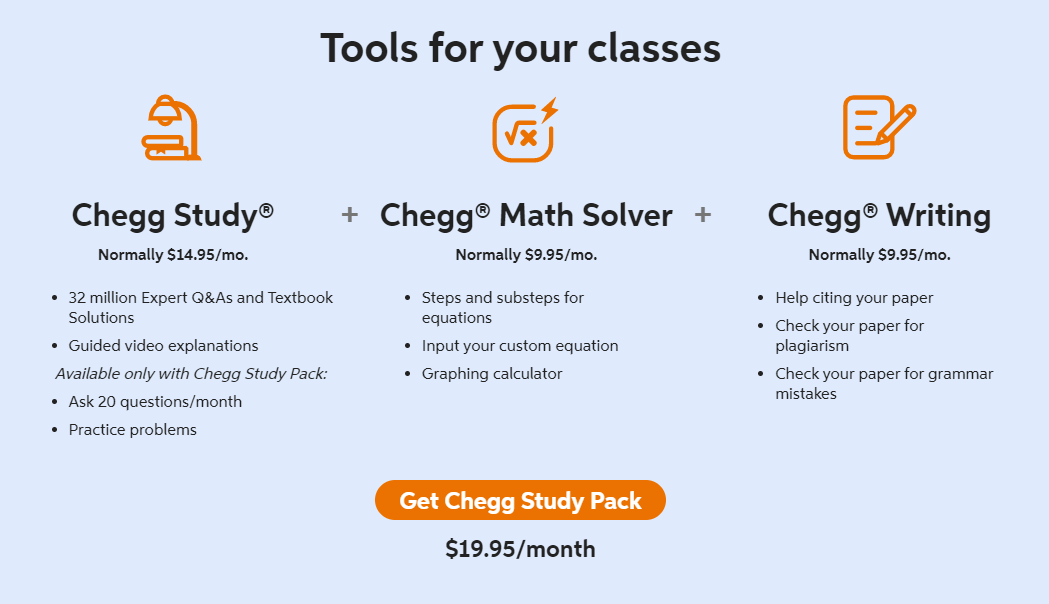

Chegg Math Solver & Chegg Writing

Beyond the core offering, Chegg has also built out additional modules that particular sets of students can use. These include Chegg Math Solver (plug in your equation, software solves it) and Chegg Writing (writing & grammar help, along with a plagiarism check).

Chegg Study & Study Pack

Chegg Tutoring

Chegg also has online tutoring, one of their best products. While most tutoring services source their tutors in the US — and end up charging $60-$200 an hour — Chegg has a different model. Their tutors come from overseas, but are heavily vetted. The result is a $20 per hour service that works really well.

But the most interesting part is how all of these pieces work together to create a brand and ecosystem. Anyone who has studied education businesses knows that the content is a commodity. For better or worse, there haven’t been any major advancements in the field of educational knowledge retention. So differentiation in an education business is created using other means. For Chegg, this is distribution.

While Khan Academy, Udemy or other sites might have the same content available, students are willing to pay for Chegg because it’s a better search experience. The answers and videos are tied to learning outcomes that students are faced with right now. They are tied to the problems they are working on instead of an arbitrary search.

Videos on Khan Academy are hard to find — not because their database is poorly indexed, but because any query made by a human isn’t likely to find the right content with high accuracy. Videos on YouTube are often too specific (drifting into content outside of the textbook) or not specific enough (watching a 30 minute video for 3 minutes of desired content). And Google search queries of questions usually point back to Chegg. So Chegg has an advantage because they can place the content exactly where the students need it.

Current Market Trends

Over the past several months, Chegg’s stock has taken off. Their investment in digital products has been paying off for a two key reasons.

Covid-19. There’s now a greater need for digital services and Chegg has one of the best platforms and brands to service that need. Covid is likely to create a permanent need for more learning online. On one hand, this is great for Chegg.

However, one concern with the shift to online learning is that students are cheating more with Chegg. While the company says this doesn’t happen, anyone who took engineering classes in colleges knows that it does.

Supplementing Education. But it can’t just be the pandemic. There are hundreds of online education companies to choose from. What makes Chegg stand out?

2U is an interesting competitor to look at. 2U makes it easy for universities to take their existing course content and turn it into online degree courses and lectures. However, there’s a key difference between 2U and Chegg: Chegg builds off of the current system while 2U goes around it.

While I’m as frustrated with our current higher education system as the next person, it’s not going to disappear anytime soon. College is still the strongest credential in the United States. And while an idealized world might be filled with democratized education, most people don’t have the desire (or discipline) to stray from the status quo. Selling “better grades” is a great value proposition, and that’s what Chegg does.

Additionally, the media seems to be making a bigger deal of the declining university landscape then what’s actually happening on the ground. From my last piece:

For example, there are more students going back to university than you might think. American Campus Communities is a public real estate investment trust (REIT) that owns and manages real estate in college towns. They own 159 student housing properties containing about 96,400 beds. And as of July 2020, they are 90% pre-leased for the upcoming year, only down 3.4% from last year. That’s not a very big difference considering the perception of Covid-19 in the media. And while this is university, not grade school, and it’s housing, not transportation, it does show that parts of the education system are operating at near normal levels.

Chegg is a bet that students will continue to need online learning resources. As colleges move online, Chegg’s value for students continues to increase. And even if our education system does change, Chegg is still a leader in online education and has a strong brand to boot.

Key Takeaways

Identify Underutilized Assets. Most of the time when you hear audience-first, you think of building media assets. Start a newsletter before launching an information product. Start an Instagram before launching a fashion brand. But audience-first could also develop from other means, such as eCommerce. In Chegg’s case, it was textbook rentals before launching a digital subscription. The brand and audience was built before the high margin product, something we are seeing in a few other forms these days (hardware, for example, with the Peloton model).

Don’t Be Afraid to Pivot. This is one of the hardest things to do, especially as a public company. But with the stock price depressed, Chegg had to make a move if they wanted to create value for shareholders. Sometimes “what got you here won't get you there.” Do you have a superior brand, technological advantage, network effect or other moat to protect your advantage? If not, is there an area you can pivot into where you might create one? It can be hard to ask these questions -- and even harder to shift an organization -- but sometimes it’s required to stay alive.

Additional Reading:

- [CHGG – Chegg] Low Cost Channel to Bundled Ed Tech and Challenges in the Publishing Industry by Scuttleblurb Paywall; Highly Recommend

- TC Teardown: Chegg is A Money Machine by Steven Carpenter via TechCrunch

How did you feel about this post?

Enjoy this post? Subscribe to Napkin Math Premium

We’re striving to make Napkin Math Premium the best possible resource for finance and investing analysis.

When you become a member you’ll get additional in-depth articles only available to subscribers, including:

- How Datadog became the $25 billion leader in Observability

- Why The New York Times is going to continue to grow at breakneck speeds

- Why school bus operators are an overlooked investment opportunity, and a database of 60 companies to get you started

Napkin Math also comes as a bundle, so when you subscribe you also get access to 4 other paid newsletters: Divinations, Superorganizers, Praxis, and Means of Creation.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!