Death of a Flywheel

Amazon and Berkshire Hathaway got really big. Here’s why it might kill them.

December 5, 2023

Sponsored By: Graft

Unlock your potential with Graft, your personal no-code platform for building and deploying AI solutions. Graft simplifies the power of cutting-edge AI, making it accessible and easy to use for everyone.

No coding expertise? No worries! Our intuitive platform allows you to seamlessly explore and apply advanced AI models. Ready to elevate your personal and professional growth with AI? Discover your potential.

Last week marked the passing of Charlie Munger —a pivotal figure in shaping Berkshire Hathaway into one of the most extraordinary companies of our era—at 99 years old. His legacy extends beyond his business acumen; Munger was a philosophical thinker whose insights have been compiled into a book, influencing millions. This article is an enhanced version of my previous analysis on Berkshire Hathaway and Amazon, offering deeper insights. It serves as a precursor to my review of a new edition of Munger's book that we'll publish on Thursday. —Evan

Amazon and Berkshire Hathaway are in the midst of an identical, potentially fatal crisis: they are simply too successful. It’s new America, one of silicon and servers, versus old America, a nation of steel and Coke syrup.

Amazon is the fifth most valuable company in the world at roughly $1.5 trillion. Berkshire Hathaway is the eighth most valuable at $776 billion. They are also revenue giants, with Amazon pulling in $513 billion and Berkshire doing $234 billion in 2022. At this valuation and revenue size, there are very few opportunities available to meaningfully grow either business. While this is a wonderful problem to have, it is a crisis nonetheless.

The two companies pursue wholly different capital allocation strategies to combat this problem. Amazon runs hundreds of experiments at once and has flailed into all sorts of large capital expenditures, from movie studios (an $8.5 billion purchase of MGM) to internet satellites ($10B in expected capital spend) to healthcare (a $3.9 billion purchase of OneMedical). Berkshire mostly does highly concentrated buyouts or public equity purchases. Its big move this year was getting majority ownership in a gas station chain ($11 billion for a stake in Pilot).

All companies face this at some point in their existence, no matter their scale. I call it the scaled-out problem: growth plateaus for a particular business line as the marginal cost to acquire additional customers outstrips their lifetime value. Companies have to diversify their markets, their product mix, or both. If they don’t, they face a slow death by decay.

This conundrum can manifest on the scale of yeeting $10 billion dollars into satellites, or it can be as simple as a local diner expanding into Sunday brunch. By examining this problem in its most scaled, most extreme version (Amazon and Berkshire Hathaway), there are truths revealed about investing and operating that apply to everyone.

Graft is more than an AI platform; it's your key to unlocking a new era of personal efficiency and creative problem-solving. Leveraging the strength of top-tier AI foundations, Graft brings sophisticated AI tools to your fingertips, regardless of your background or industry.

This platform enables you to explore and customize AI solutions that fit your individual goals. With Graft, you're not just experimenting with AI; you're building with it. Discover how you can transform your ideas into reality with Graft.

Amazon’s flywheel(s)

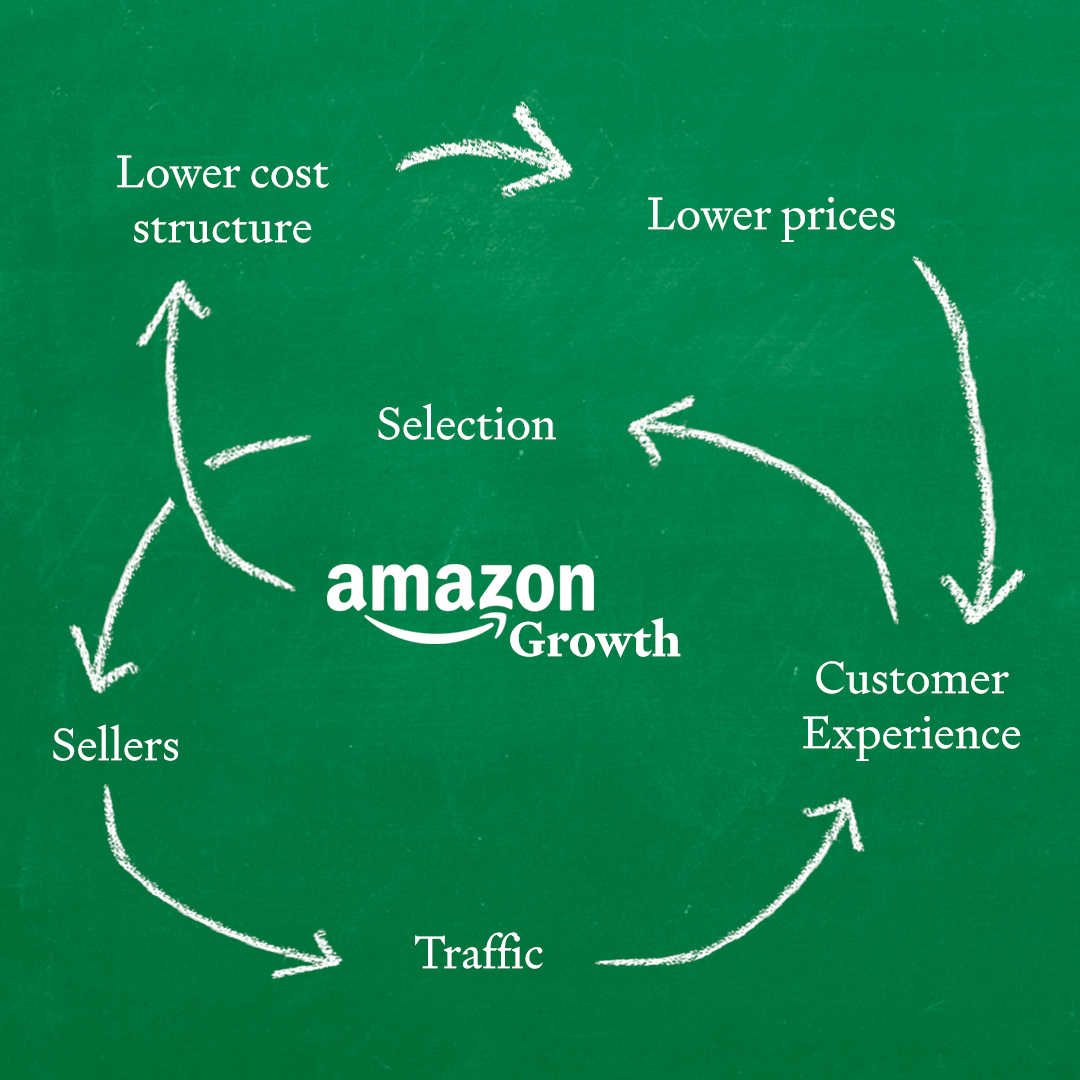

The bigger Amazon gets, the more consumers and suppliers the company has, so it can get ever lower prices and ever better selection.

Amazon’s target market is the entirety of consumer retail spending, a $8 trillion-plus annual category in the U.S. alone. While it started with books, the vision was always to become “the everything store." The initial expansion was simple. It went from books to other forms of media to children’s toys—products that were pretty similar to one another. At the beating heart of this was Amazon’s flywheel:

However, as Amazon expanded to more categories, it found that not all consumer packaged goods are created equal. During a conversation I had with a strategy lead at Walmart eight years ago, he spent an hour complaining about “toilet paper and its shitty economics.” Toilet paper is bulky, consumers are sensitive about the price, and it is relatively cheap. At the time, making last-mile delivery profitable was nearly impossible for Walmart. It is unclear to me if the company ever solved this, but there are dozens, if not hundreds, of similar problems on the path to becoming the everything store: products that look good initially end up being far less profitable then the initial customer-product fit of something such as books. Books are small and can take a beating, making them perfect for e-commerce, while toilet paper’s bulkiness and low cost made it tough to get right. All expansion happens like this—easy-to-sell products and markets progress into harder ones. Expansion means additional dollars of revenue become harder and harder to acquire.

Think of it this way: a company is powered by a flywheel, but the longer that flywheel spins, the less efficient its motion. Eventually sand gets in the gears. Each additional unit of speed is harder to gain, and you have to add new flywheels to get the machine moving again.

And this challenge began early for Amazon. Amazon’s category expansion was already difficult when the company started work on AWS in 2003—a flywheel with only marginal similarity to its plan to sell consumer goods. With the 2005 launch of Amazon Prime and the AWS launch a year later, the company successfully expanded its business. It turned out these were enormously successful bets. They shifted the flywheel of the company from that of the best retailer in the world to having the best culture of innovation in the world. They also shifted the CEO’s job to that of pure asset allocation—deciding where to make these bets.

Berkshire’s flywheels

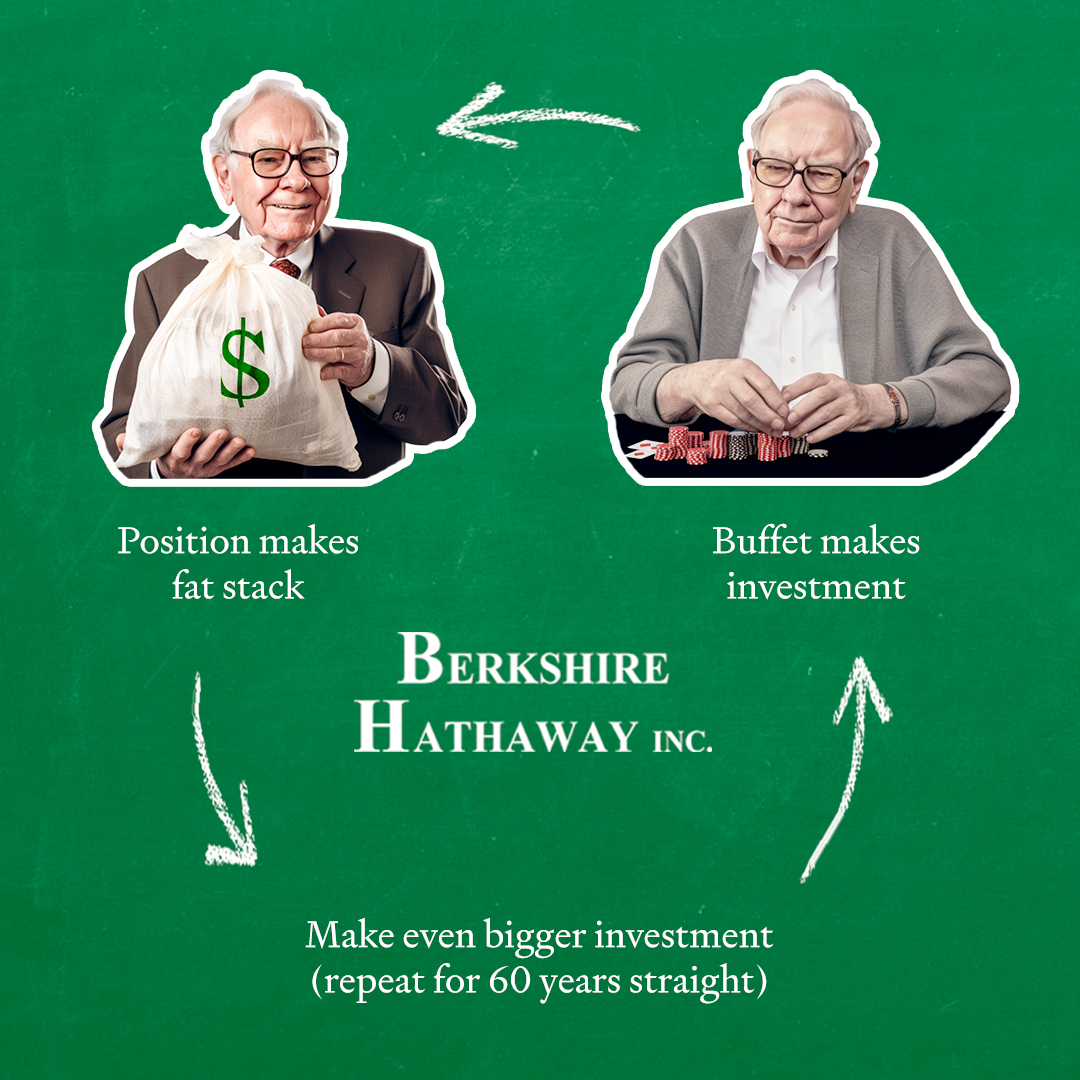

Warren Buffett and Berkshire’s flywheel looks a little different: make money—lots of it—and keep giving it back to the guy who made it to see if he can do it again.

There is more complexity to this, but there also kind of isn’t. Berkshire Hathaway is a hedge fund with a unique strategy that also happens to be publicly traded. Its playbook has shifted multiple times over the years, but right now it looks something like this: it operates a bunch of boring, cash flow-positive businesses (like gas stations) and uses the excess cash from those companies to buy a mix of public and private equities. Sometimes, it will also buy companies outright to add to the stable of high cash flow businesses.

A finance mentor once told me that “only one person gets the investing edge of being the smartest man alive.” You could make a pretty good argument that that person is Warren Buffett. And if you did happen to have the smartest guy alive running the ship, an intelligent strategy would be, “Just do your thing, dude.” But when the strategy is “old dude think good,” a company can only scale as far as he can. Buffett is remarkable because he went further than anyone else in human history, but he is still human (and 92). With Charlie Munger’s passing, this risk is more present than ever. The company has a succession plan in place, but still, no one there has yet to show the investing powers of the Buffett and Munger partnership.

To get a sense of the difference in scale Berkshire has gone through it’s useful to compare two of its best positions. In 1972, Berkshire Hathaway bought See’s Candies for $25 million. In 2019, See’s Candies did pre-tax revenue of roughly $2 million. This is an incredible outcome. Two billion dollars for some mid-tier chocolates is not shabby. However, this hugely scaled, profitable business only contributes .85% of revenue to Berkshire. To get a 10% growth rate out of similar investments now, Berkshire needs to acquire 11.7 See’s Candies every single year.

By contrast, Berkshire’s largest public equity position is in Apple. From 2016 to 2019, Berkshire Hathaway acquired about $36 billion worth of shares in the company. Those shares are now worth over $110 billion. While it’s not the highest internal rate of return (IRR) Buffett has ever achieved with an investment, it will go down as one of the greatest investments of the past 100 years in terms of absolute dollars returned.

But there is only one Apple! There are only so many stocks that can do this for you. And there is only one Buffett.

The firm started diversifying its leadership team in 2010 with the hiring of various senior operators and investors, but it is still tough to see how the company gets much bigger. Adding additional flywheels, in the case of Berkshire, means adding additional people who can intelligently deploy capital. And they still have to be able to find positions that are big enough to move the needle for the company.

Abstracting the scaled-out problem

A gross oversimplification of a company’s life cycle would be something like this:

- A company makes a successful product that gets it stupid rich.

- The company builds or acquires nearby opportunities with excess cash as its core market’s growth starts to run out.

- Repeat ad nauseum, spreading the company further and further afield.

- Eventually, the company holds a grab bag of uncorrelated assets that will kill the company if they underperform.

When it comes down to it, a company’s success relies on the CEO’s ability to make the right investment decisions. For a startup, it might be building feature A or B. For Amazon, it is whether to buy Whole Foods or MGM (or both). For many public companies, the best capital allocation decision is to give money back to its shareholders. Fundamentally, we are talking about the same calculation—return on invested capital (ROIC).

In the life cycle I describe above, the company only dies if the uncorrelated assets underperform. What has made Berkshire so stupendous is that its loosely-related bets did incredibly well. That’s the Buffett magic.

Theoretically, you could have a regular, non-hedge fund company of Amazon’s size with a random grab bag of garbage if the ROIC stayed the same. The income statement would still be calculated with the exact same formulas. It just turns out that is nearly impossible to do. Human beings are terrible, terrible, terrible at consistently deploying capital in an ROIC-positive way.

In fact, Buffett made and won a $2 million bet that—including fees, costs, and expenses—an S&P 500 index fund would outperform a hand-picked portfolio of hedge funds over 10 years. He made the bet in 2008 and won it in 2018. An actively managed portfolio will, statistically, perform worse over the long run.

Boards always implore companies to “stay in their lanes” because the investment decisions are less about generic asset allocation and more about aligned capital deployments. All the strategy books urging operators to build “synergies” do so only because those synergies make it easier for the core assets to be successful. For example, in Amazon’s retail business, a correlated asset is Amazon Prime. Amazon’s consumer products are tied together with a consistent user identity and subscription.

What makes Berkshire remarkable is that it continues to perform (more or less) despite having a bunch of random junk. What makes Amazon remarkable is that it has, in the past, shown the ability to do innovative things that end up being hugely valuable.

So the natural question is how to handle this problem if you aren’t Jeff Bezos or Buffett. How do you solve the scaled-out problem?

Solving the scaled-out problem

If growth plateaus in your company’s central business line, you could take Amazon’s approach (empower thousands of people to do small experiments), or you could take Berkshire’s (empower the GOAT trader to make large bets). Either way, it is a risky position. Ultimately, the lesson for all companies is that success can be a double-edged sword, and growth can come at a cost.

And I’m not sure you should continually expand.

Part of the reason Berkshire’s bet on Apple's stock has been so performant is because Apple realized there wasn’t a good way to deploy its capital. Instead, it returned capital to shareholders with stock buybacks and dividends. This is good—the best fiscal outcome for a business might be to spend to become a monopoly and remain there for decades, returning capital to its shareholders.

However, top performers and executives usually have little interest in simply protecting an asset. CEOs tend to want to aggressively grow companies in order to increase their comp and prestige. Good luck convincing a killer to be the steward of a slow decay.

There is no clear answer to how to solve the scaled-out problem. This is the point. These companies took opposite approaches and were both successful to the tune of hundreds of billions of dollars. Similarly, I have seen egalitarian startups thrive, but I’ve also seen cruel dictatorships outperform.

Sometimes you need to bet on your team, and sometimes you need to bet on yourself. But Berkshire and Amazon both make it clear: you need to know what you are betting on.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Thanks to our Sponsor: Graft

Special thanks to our sponsor Graft, your ally in the AI revolution. Graft is committed to democratizing advanced AI technology, making it accessible to individuals and professionals alike. It's time to venture into the new frontiers of AI with a tool that simplifies the journey and amplifies your capabilities. Embark on your AI exploration with confidence and curiosity. See what you can achieve with Graft.

Comments

Don't have an account? Sign up!