Robo-Coaches Are Here, The Perils of Niching Down, and more!

Everything we published this week

May 7, 2023

Hello and happy Sunday!

AI Is Transforming Media Forever, Here's How

Dan Shipper / Chain of Thought AI is poised to revolutionize the media landscape, opening new opportunities and presenting potential risks for writers and media companies alike. Dan Shipper delves into the ways AI can change written media, including automating commodity content creation, unbundling research and narrative, and giving voice to unwritten stories. While AI still lacks the unique human touch in writing, combining AI and human skills may lead to increased creativity, productivity, and experimentation in the world of media.

Robo-Coaches Are Here

Nathan Baschez / Divinations

The debate around AI-generated advice heats up as people are starting to credit ChatGPT for transforming their lives.

But what makes AI-created advice special? Nathan Baschez argues that convenience, personalization, and continuous improvement play major roles.

AI systems like ChatGPT cut through the information clutter, providing efficient and tailored advice in a conversational format. This fosters an ongoing dialogue, simulating the dynamic interaction of a human coach. Combined with the AI's ability to learn and improve from user feedback, this shift in information consumption has the potential to revolutionize our educational systems and the way we share knowledge.

The Perils of Niching Down

Rob Hardy"Riches in the niches" is the conventional wisdom of the creator economy. But does niching down also destroy your spririt ? Rob Hardy, the once self-proclaimed "Niche Guy," challenges the creator economy's persistent advice to specialize, revealing how it can lead to discontent and lack of authenticity.

In this essay he shares his journey of self-discovery, from initially embracing niche strategy to rejecting it in pursuit of true fans who appreciate him as an evolving, multifaceted individual.

Twitter's Killer App: Real-Time Search

Andre PlautTwitter's unique real-time data could potentially change the game for search, but the platform remains underutilized. In this essay, Andre Plaut explores how Twitter's real-time search capabilities, which no other tech giant possesses, could answer users' questions about current events and situations in their vicinity.

Will Twitter seize the opportunity to revolutionize search and secure its place in the tech world?

7 Reasons Media Is a No-Good, Horrible, Rotten Business That I Love Anyways

Evan Armstrong / Napkin MathThe media industry is facing a turbulent time—as usual. Evan Armstrong explores the struggles and triumphs of the industry, from the decline of Vice to the success of Netflix and The New York Times.

Despite numerous challenges, such as the difficulty in monetization and the rise of AI-generated content, Evan believes that leveraging technology and individuals with unique talents can lead to a bright future for the media landscape. So, the industry might be a no-good, horrible, rotten business, but there's still hope and love for it.

Succession Episode 6 Review

Hey there! As a fun addition to the Sunday Digest, Evan will be writing a mini-review for the final season of Succession. Each review will discuss the themes, writing, and dynamics of the show.

“I think it’s hard to make houses seem like tech, ’cause we’ve had houses for a while now.”

This episode of Succession had discussions on multiples, financial forecasts, and product launches. It is rare that spreadsheet debates are exciting but such is the skill of the Succession team. The big debate centered around what multiples they could juice out of their new segment “Living+” a tech-enabled housing development.

I have like 9 NDAs that I can’t violate here, but I need you to know: I have done work on an identical project for a multibillion-dollar corporation. I was the guy on the receiving end of executives screaming, “Just make the numbers work!” I have literally been asked to “juice the forecast” and “get us tech multiples.” I have had the experience of being battered with corporate buzzwords until I agreed to bump up the growth rates. It was so spooky to watch this episode of Succession that I materially increased the likelihood that life is a simulation.

So for today’s review, I’ll reiterate that yes, this is still probably the greatest TV show of all time. This episode continues this pattern of perfection. Go watch the show dummy.

But this is Every, where we pair great writing with people who have operating experience. Today, I am that guy. So, let's talk home valuations and tech multiples.

Living+ is real

A company can increase its value in 3 ways:

- Grow revenue

- Decrease costs

- Change nothing about the business and get investors dumb enough to value them more highly

The final option is surprisingly compelling for executives. A public company executive’s job description is mostly “manipulate people.” Getting people to do what you want is really what we are asking CEOs to do—we just hope that what the CEOs want is what is good for the company/shareholders.

So it is always tempting to play a “find the greater fool” game until a CEO leaves a company. If they plan to leave in a few years, getting a CFO to talk about increased growth is the best way to increase short-term value. Eventually, the bill comes due, but most of the time you won’t be there to deal with it. As a sidebar: this is exactly what is happening behind the scenes of an IPO! A company is shopping for a group of long-term investors who will give them the highest valuation multiple possible and then never sell their stake. This is literally the goal.

Anywho, one of the best ways over the last decade to get stupid investors was to utter that magic password, “technology.” Suddenly the market would reward you with an increased multiple even though you weren’t doing anything materially different. The latest version of this is companies suddenly bringing up AI in their earnings call and juicing their valuation. Buzzfeed did this to a handy 260% valuation jump recently (that bump is now gone, for them the bill arrived sooner than expected.)

Homebuilders knew this and tried to get in on that juicy tech action. Take Lennar Homes (this was not the company I worked with, just to be clear). They are one of America’s largest home developers and announced a partnership with Amazon in 2018 to build “experience showrooms” together. The idea is Lennar would integrate Alexa products and this would, somehow, magically, make people buy houses. From CNBC:

“There’s cross-pollination that could happen, where somebody may walk in the door interested in an Alexa product, and they may say really, I’d love to have this home,” said David Kaiserman, president of Lennar.”

Dear reader, this is dumb. This is like proposing to your spouse because you like their Apple Watch. Still, the Lennar PR team pumped this narrative hard. They scored coverage in USA Today, CBS News, NPR, PBS, Los Angeles Times, CNBC, TechCrunch, and VentureBeat, among many others.

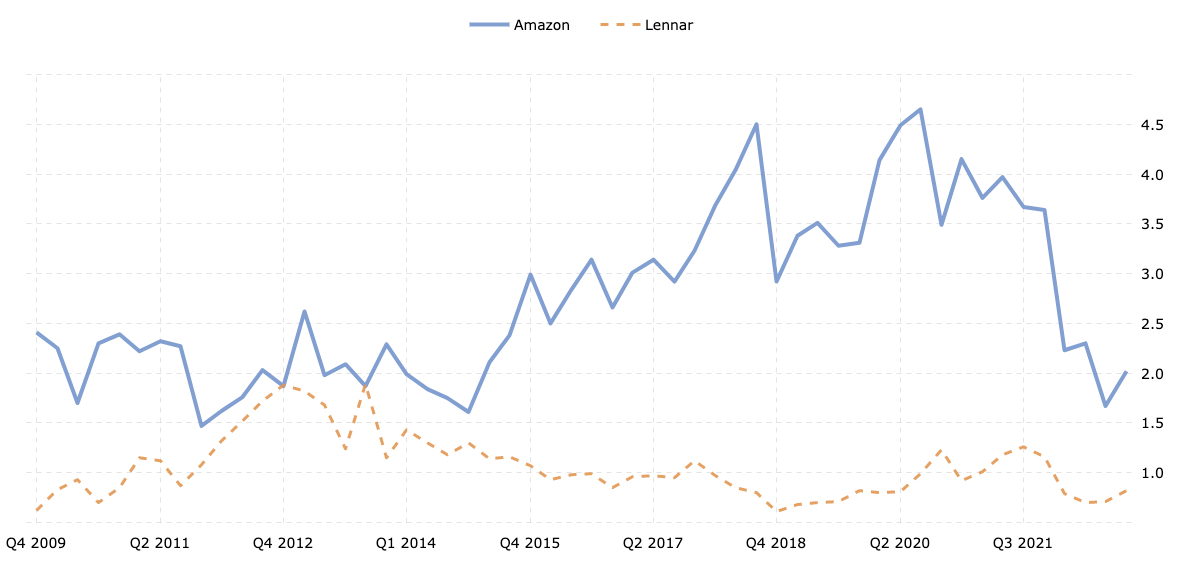

Everyone involved here knew this was a load of crock. It has never again been mentioned by either company (though there is still a landing page on Amazon). Smart home devices are not why people buy houses. But I think the answer to why this happened is in the chart below comparing Amazon’s and Lennar’s price-to-sales (P/S) ratio.

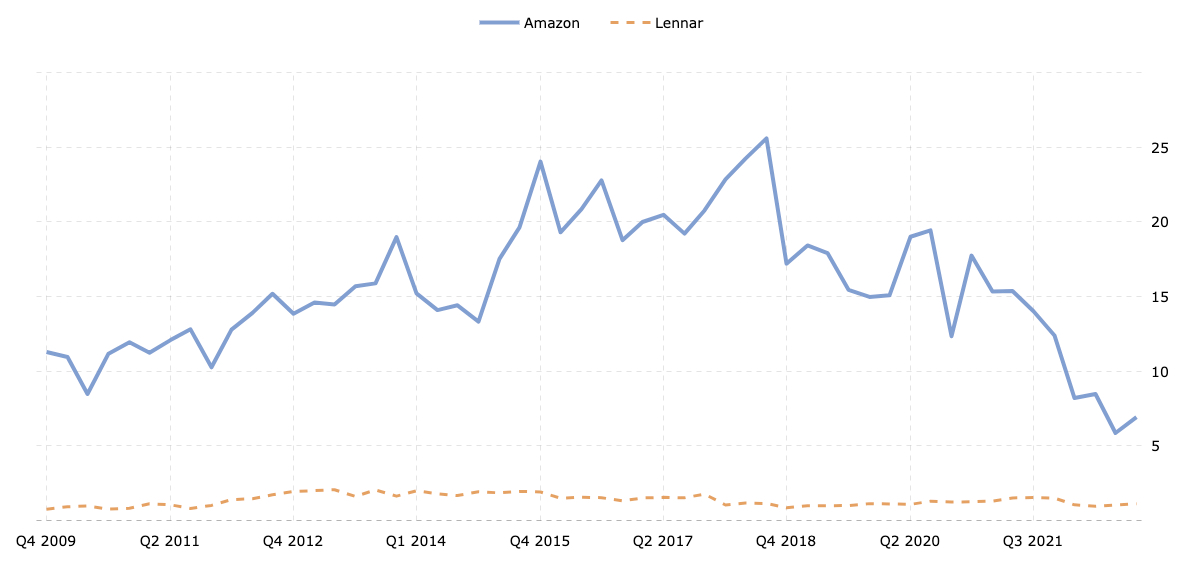

2018 was the absolute bottom for Lennar. They were trading at the same ratio they were at the bottom of the Housing Crisis! It’s the same story with the Price/Book ratio:

Lennar simply wanted more street cred! It wasn’t a homebuilder. It was a “tech company” building a physical space where they could layer in machine learning and recurring services.

I recognize I am being deeply cynical here. It could be that Lennar really did believe this and wasn’t engaged in blatant greater fool tricks. But I doubt it. If you look around, you can find basically every industry that wasn’t tech doing some version of this for the last decade. Most prominently was a real estate company—WeWork. Living Plus is the residential version of WeWork. That company rode “tech” to a 49B valuation and is currently trading $324M.

Succession

I haven’t even touched the “tweet passive-aggressive thing to manipulate deal mechanics” move that Mattson pulled. This happens! It gives flashbacks to the Elon/Twitter fiasco. I’m really looking forward to this week—hopefully, they include more spreadsheets, just for me.

That's all for this week!

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!