Finding Power: How To Do Market Analysis

A step-by-step process for uncovering the power dynamics that govern any industry

July 20, 2022

Sponsored By: Tal&Dev

This article is brought to you by Tal&Dev, the talent acquisition platform that is smarter, faster, and cheaper than a headhunter.

Market analysis is usually boring. It’s a fill-in-the-blank exercise that reveals little about the sources of power that shape an industry, or the history of how the governing dynamics emerged.

But it doesn’t have to be this way. Good market analysis is fascinating. It uncovers answers to deep questions, such as: why do some companies in an industry play such an indispensable role that they become huge, profitable, long-lasting businesses? And why do other companies in the same industry end up short-lived, thin-margined, and small? These are mysteries that should be fun to unravel!

There are many ways to approach the challenge. No single factor is decisive. For example, execution and all its subcomponents (leadership, management, finance, ops, etc) are of course key to any individual company’s ability to successfully accomplish their plan. But I focus on strategy rather than execution when I study an industry, because brilliant execution of a flawed strategy still yields a bad business, and for any possible good strategy, someone is probably going to figure out a way to execute it. In other words, execution is necessary but not sufficient. And while execution is of course a worthwhile area of focus, I am personally more interested in the strategy side.

The question is, what kinds of strategies generate market power?

To answer it, I developed a process that fuses together the ideas of the three most important theorists in business strategy: Clayton Christensen, Michael Porter, and Hamilton Helmer. (Two Harvard PhDs and a Yale PhD, in both economics and business—they know their stuff.) I’ve studied their work basically full-time over the past two years and as a hobby many years before that, and their teaching on how markets work has probably been the single most important factor that enables my writing to reach 50k+ subscribers each week.

So this week, I decided it would be fun to lay out the process I use for analyzing an industry. I hope it’s useful to entrepreneurs, who need to find the right entry point that will give them the best chances of success, and to understand the motivations of the incumbents they might wish to sell to or partner with. I also think it’s helpful for anybody who wants to understand and contribute to the business strategy context that shapes the work they do every day. I think this kind of analysis is also critical for investors, who obviously want to back businesses that will end up with (or sustain) some sort of market power.

Of course, this stuff is not as scientific as I would like it to be. We’re not talking about molecular biology, where we can pin down cells in a microscope and manipulate them millions of times to understand exactly how everything works. But I am fairly certain there’s more to business success than just luck. I think certain principles of strategy are knowable, and of course any good strategy is based on an accurate perception of the terrain around you. So while this isn’t a silver bullet, and I can’t promise any specific career results, I can at least say that I am betting my career as an entrepreneur and investor on it, and personally believe knowledge of strategy has lots of value. There’s a reason it’s taught in every business school and obsessed over by most top founders, investors, and CEOs.

With this preamble out of the way, let’s proceed!

Sponsored by: Tal&Dev

Headhunters work, but they are costly and don’t know your business very well, potentially leaving you with a huge bill and an employee who quits two months after walking in the door.

Tal&Dev aims to change that.

Tal&Dev is a career-matching platform that screens every applicant for a position and returns a short list of the best matches, complete with a report on each candidate’s ambitions, effort profile, and workplace preferences so that employers have a better grasp on a prospective hire’s long-term engagement– for less than half the price of most headhunters.

But it gets better. Tal&Dev only charges based on successful hires and provides a money-back guarantee for anyone who leaves before 6 months are up.

The Process

Here’s how to analyze a market:

- Define the market. You can go as broad or narrow as you want, but what’s most important is that you nail down A) the job-to-be-done / use case, and B) the general product category that serves that use case.

- Identify the basis of competition. Why do consumers choose one product over another? What attributes are most important? Which are good enough, where no further improvement is felt? And which dimensions of product quality are felt to be lacking and in need of improvement?

- Map the value chain. What is the chain of activities that needs to be performed for raw resources to get translated into finished products? What companies are involved, and which activities do they control?

- Locate the position of power. Which activities in the value chain shape the end-user’s experience the most? These are the key activities that relate to the basis of competition. Which companies perform these activities? Who does it best?

- Trace the source of that power — Using Hamilton Helmer’s 7 Powers as our list of options (scale economies, network economies, counter-positioning, switching costs, branding, cornered resource, and process power) we’ll see which one has the biggest impact on the user experience, and therefore is the source of their power.

If any of that felt a bit fast or confusing, don’t worry! We’re going to walk through each step in more detail next.

But before we do, one final note: the most important thing to know and remember about analyzing a market is that all power ultimately stems from finding a way to play an indispensable role in some important chain of economic activities that translates supply into demand. If participants in the chain don’t need you—either because what you offer isn’t useful or because there are many alternatives—then you’re not going to have much bargaining power in the market. But if what you provide is indispensable, you are in a good position to grow, extract profits, and last a long time.

And with that, let’s now go over each step in the process.

1. Define the market

First, you have to define your area of focus. This involves two somewhat arbitrary decisions: picking a specific job-to-be-done (i.e. use case) on the demand side, and narrowing down to a specific product category on the supply side. Once you’ve settled on definitions of each, then you can start looking at what players are essential to this type of exchange.

There are two common mistakes people make when defining their market.

The first mistake is to pick a generic market definition that has little bearing on what you’re actually interested in, and confusedly use it as a stand-in for the real market you would like to go after. For example, let’s say you wanted to make a business newsletter company. (Why anyone would want to do that, I do not know 😆). To properly understand your business you might actually want to analyze multiple industries. Sure, you might want to look at existing business newsletters, but you also might want to look at business book publishing, newspapers, or even business content on Twitter. New products rarely slot in perfectly to existing markets, so it’s useful to analyze the status quo with a bit of healthy detachment. Official categorization schemes like the NAICS (North American Industry Classification System) make it seem like the economy is composed of atomic, permanent, industries that were handed down from God, but in reality the lines between industries are blurry and constantly evolving. So you should think more like an evolutionary zoologist, and less like an old-school Linnaean taxonomist that believed all earthly species were set in stone since the beginning of time.

The second mistake is to pick a job-to-be-done that not many people actually really have. This is really common for startup founders. We like to invent things that don’t solve real problems. The rest of your analysis doesn’t matter if you misunderstand the reasons people buy products in this market in the first place.

Speaking of jobs-to-be-done (henceforth referred to as JTBD), I want to quickly offer a definition and some background context for anyone reading this who is unfamiliar. Basically the framing is that people don’t “buy” products, they “hire” them to perform some job in their life. It’s based on the classic quip that people don’t want a quarter-inch drill bit, they want a quarter-inch hole. There is a huge literature out there for people who want to dive deeper into JTBD theory, but the idea is to figure out what kinds of situations people might find themselves in, what kind of pain they might experience, and why they might go looking for solutions to that pain. For instance if you’re reading this post you’re probably either A) actively thinking through a big business decision/problem, or B) interested in coming up with a good business idea, or C) want to sharpen your skills of predicting what companies you think will succeed or fail. In these situations it’s useful to be able to quickly analyze an industry, so you “hire” a nerd like me who reads Michael Porter all day to guide you through the process and tie together multiple proven intellectual frameworks.

Here’s an example of how a market definition should look:

- Product category: business writing delivered via email newsletter

- Job-to-be-done: understand what’s happening in the industries I care about at a deeper level than the news will tell me about, so I can make better decisions and advance my career.

You might want to go deeper and expound on each of these bullet points in many paragraphs, or you could just leave it at this. You’re not doing an assignment for school, you’re satisfying a personal need to feel like you understand a market. Capture as much detail as you feel you need to in order to move forward with confidence!

Ok, that’s it for the first step. Once you have the demand and supply pinned down, it’s time to figure out what the most important attributes are of the products that connect that demand and supply.

2. Identify the basis of competition

The basis of competition is the collection of product attributes that cause customers to choose one product over another. For example, you might choose a smartphone on the basis of price, photo quality, and screen size—or, more realistically, a subconsciously prioritized list of these and many more factors.

Of course, everybody has unique preferences, so the best we can do is come up with a list of priorities that is reasonably representative of most people, or divide the market into a few main segments (clusters of people with similar preferences).

An important reminder: don’t forget about marketing and distribution! If someone doesn’t know about a product or doesn’t encounter any persuasive information about it, they probably won’t choose to buy it.

The hard part about determining the basis of competition is figuring out what people actually think. Often people’s priorities aren’t that clear to them. They may say or even think they want one thing, then act a different way when push comes to shove. There are all sorts of interesting psychological theories about this (my favorite of which is contained in the book The Elephant in the Brain) but needless to say, discovering the truth here is more art than science. Honest introspection and judgment-free observation are just as powerful tools as user interviews and surveys.

With that difficulty in mind, I think the easiest way around it is to just look at what is selling, and ask yourself what’s different about it as compared to the alternatives. Sometimes it’s actually more valuable and easy to see the differences when you compare #1 in a market to a really small competitor. Often #1 and #2 are really serving slightly different jobs-to-be-done, which is why they’re both successful.

Just like step 1, you can capture this in as much or as little detail as you want. Here’s an example from my market:

The basis of competition for business writing delivered via email newsletters is…

- Relevance - does the content speak to things I can relate to my personal experience?

- Clarity - do I understand what it is trying to convey?

- Surprisingness - is it unexpected?

- Importance - does it feel like knowing it will make a difference?

- Truth - is the information accurate?

- Fun - do I enjoy having this voice in my head?

This might not be exactly right but I think it’s pretty close.

Ok! Let’s keep going.

3. Map the value chain

After we figure out what the basis of competition is, it’s time to create a map of the value chain. Essentially we want to lay out in as much detail as is practical all of the companies and activities involved in the creation of value for this market.

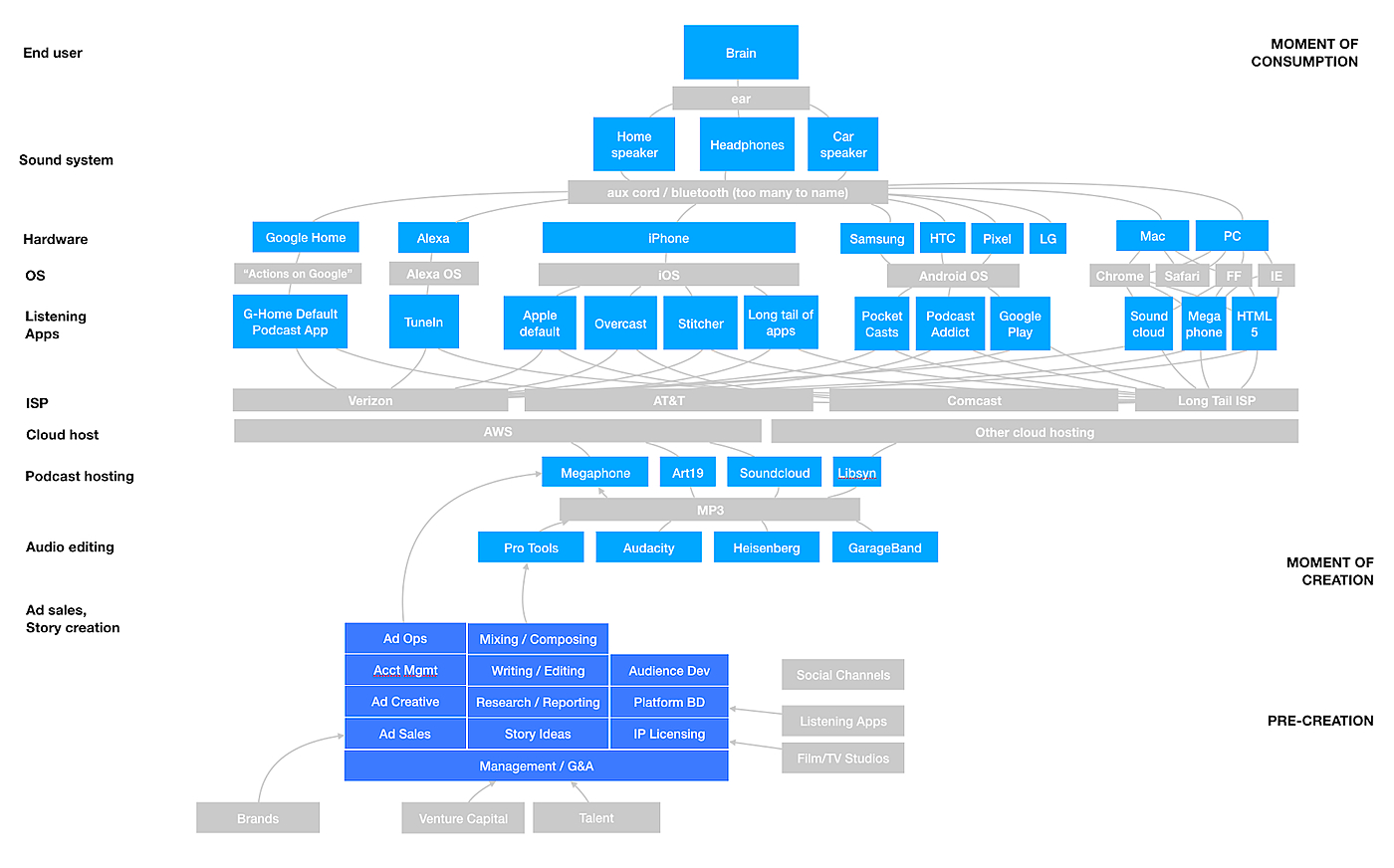

For instance here’s a map I made of the podcasting value chain when I got a job as head of product at Gimlet, a podcast network that ended up getting acquired by Spotify.

(Click to see full-screen)

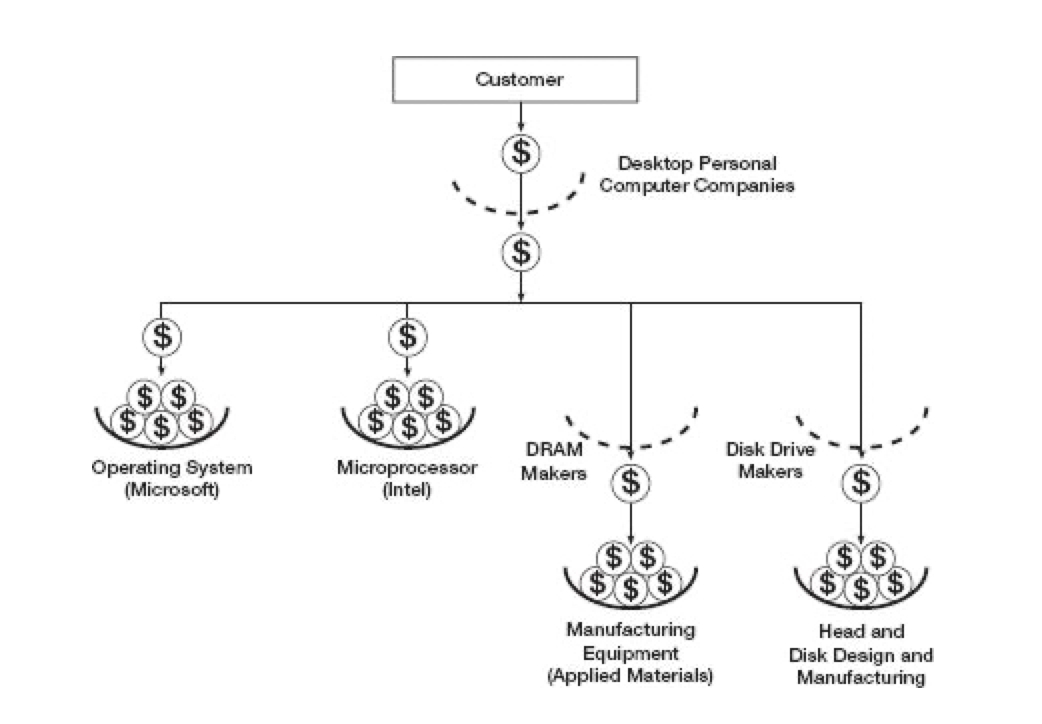

What would be even better was if this visualization showed the relative economic value and power captured by each step. For example, here’s a diagram of the desktop PC industry in the 90s, from Clay Christensen’s best book (in my humble opinion), The Innovator’s Solution:

It shows how some positions in a value chain end up capturing economic value, and others end up commoditized where the money “falls through” to the layers beneath.

It may not seem clear at first why exactly we are mapping the value chain. There are two reasons.

First, it’s just an important excuse to understand in detail everything that happens in the industry. This is a sort of technical/economic architecture that is often complex, but much easier to master if you lay it all out visually.

Second, we’re doing it so that we can perform the next step of our analysis, which is key.

4. Locate the position of power

Here’s where we really get cooking.

From the title of this section alone, it is probably not clear what exactly we should do next or what it even means. That’s why there are a couple sub-steps to this part, which should make it more clear. They are:

- Re-read the “basis of competition” you wrote down

- Look at your map. For each activity, ask yourself how big an impact it makes on the “basis of competition.” Put one star next to anything that has a discernible impact, and two stars next to anything that has a huge, decisive impact.

- If there are multiple important bases of competition, and different activities have a different impact on one or the other, you could color code them or come up with some system to remember which activity has what impact on what basis of competition.

Perhaps an example will make this more clear. Again, returning to the “business writing delivered via email newsletter” example, I might consider activities such as “talking to friends” and “browsing tech Twitter” as helping me get a better sense of what’s relevant to my readers. And I might consider “reading fundamental books and papers” as helping me stay close to what’s important and true. And “running ideas by colleagues” as a good activity that helps me figure out what is going to be surprising.

So these are some of the key activities, but let’s go deeper. One of the eternal bases of competition is always distribution and marketing. Newsletters tend to get distribution roughly proportional to the size of their current readership. If I have an audience of 50k (I do), and I write a banger, then it might be shared by twice as many people as when I had an audience of only 25k. Or if I was on Substack and my newsletter got recommended by other newsletters, then I would be shown to their readers like this. This gets more powerful and drives more growth as more newsletters and readers join the network.

In other words, different activities have different attributes, some of which are more powerful and harder to copy than others—making the entity that controls that activity more indispensable.

Which brings us to our final step…

5. Trace the source of that power

For each activity that makes a big impact on the user experience and forms the basis of competition, think about what it takes to be able to do it well.

Some activities, like reading a lot, take time, energy, discipline, and a little bit of money. It’s not necessarily easy to copy, but it’s also not that hard. The vast majority of business newsletter writers haven’t gone full-time, so as long as I use my time wisely I have a relative advantage over them, but for all of my peers that have made this their job I don’t have an edge on this dimension.

(It might seem trivial but I think simply going full-time on Divinations was a huge part of the reason it succeeded where a lot of other writers struggled to get off the ground. It wasn’t anything magical about my writing abilities, I just created more time, which created a slightly better product, which got the whole thing off the ground that much faster.)

Other activities, like having a large influential reader base, are much much harder to copy. For instance, because Ben Thompson has such a huge audience with so many powerful people in it, he is able to interview various CEOs and legendary investors, while it’s much harder for me to do so. This creates a flywheel where good content leads to good audiences which leads to better content. Of course, this isn’t Ben Thompson’s main advantage, but it helps.

Broadly speaking, most businesses can be evaluated across seven dimensions of power. The more their product experience is derived from one of these sources of power, the better position they are in. Of course, the 7 powers I’m talking about are those identified by Hamilton Helmer. I will briefly list and describe them here, but if you want a full explanation you should read his book (or at least a summary).

- Scale economies - when your cost structure benefits from scale

- Network economies - when your value proposition benefits from scale

- Counter-positioning - when your competitors are disincentivized to copy you

- Switching costs - when your customers are disincentivized to leave you

- Branding - when quality is hard to discern, or signaling is important

- Cornered resource - when nobody can access a key ingredient you control

- Process power - when you evolve a complex process that nobody can copy

As a really simple example, price is always an important consideration for customers and a basis of competition, so if you have scale then you can have a lower price or keep the same price but earn higher profits, or use the savings to make the product better in other ways.

Want to do this yourself, with some help?

This post is already getting long and there is so much more detail to cover! I am guessing a lot of you reading this might be interested in conducting market research yourself, but you’re worried:

- You might not actually make time for it

- You might get stuck or confused

- You might not learn as deeply on your own, and would benefit from a group that will push you to go deeper

As someone who started working with a personal trainer in the past year and for the first time in my life am working out regularly, I can definitely attest to the power of social pressure!

So I want to try something new with this. For anyone who is interested in doing their own market research on any industry they want, I’m putting together a workshop that will convene at the beginning of September. We’re going to do a five-week sprint, where each week we will go through one of the steps in the process outlined above. By the end of it you will not only have completed the market analysis you wanted to do, but you’ll also have a new skill you can use anytime, a much deeper understanding of how markets function, and hopefully a bunch of new friends.

I’m limiting it to 30 seats because I want to make sure it’s good and I am not sure if this can scale. I will be teaching the course personally and want to make sure I get to know everybody.

Next week I’ll email out more information (curriculum, guest speakers, pricing, etc). If you want to get that email, you can sign up by clicking the button below.

If you have any questions just email me (nathan@every.to) or reply to this email!

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Thanks to our Sponsor: Tal&Dev

Tal&Dev can help your company attract and select talent that fits for a fraction of the cost of a headhunter. Join today for a speedy, low-risk way to grow your business with the right talent.

Comments

Don't have an account? Sign up!