Finding Power

An introduction to Clay Christensen’s most underrated idea: “The Conservation of Modularity”

May 4, 2020

🔓 This is a free preview of a Premium Members only post! 🔓

People think strategy is about profit, but really, it’s about power. Profit is just the prize.

And if you want to understand the nature of power in business — where it comes from, how to create it, how to sustain it — probably the best place to start is Clay Christensen’s “Law of Conservation of Modularity,” a massively underrated idea from his second book, The Innovator’s Solution.

It’s pretty obscure compared to Christensen’s other hit theories, like “disruptive innovation” and “jobs to be done.” I think this is because the theory can be somewhat abstract and technical, making it hard to understand. (Don’t worry — in this article I do my best to make it engaging and intuitive! 😅)

Another reason the idea is obscure is it suffers from branding issues. Confusingly, it was originally called “The Law of Conservation of Attractive Profits” and some people still refer to it by that name.

But, despite all the challenges, this is not an idea you want to overlook. In my view, it’s actually the most powerful theory in Christensen’s entire oeuvre. I love it because it gives us a unique lens we can use to answer the most important question in strategy: why are some companies so much more powerful than others?

So let’s dive in :) 🔮

⎼⎼⎼⎼⎼⎼⎼⎼

Every industry — the entire economy, in fact — is essentially a chain of interlocking activities that work together to transform raw resources into completed products. These “value chains” have evolved to serve the most common needs that arise in our lives.

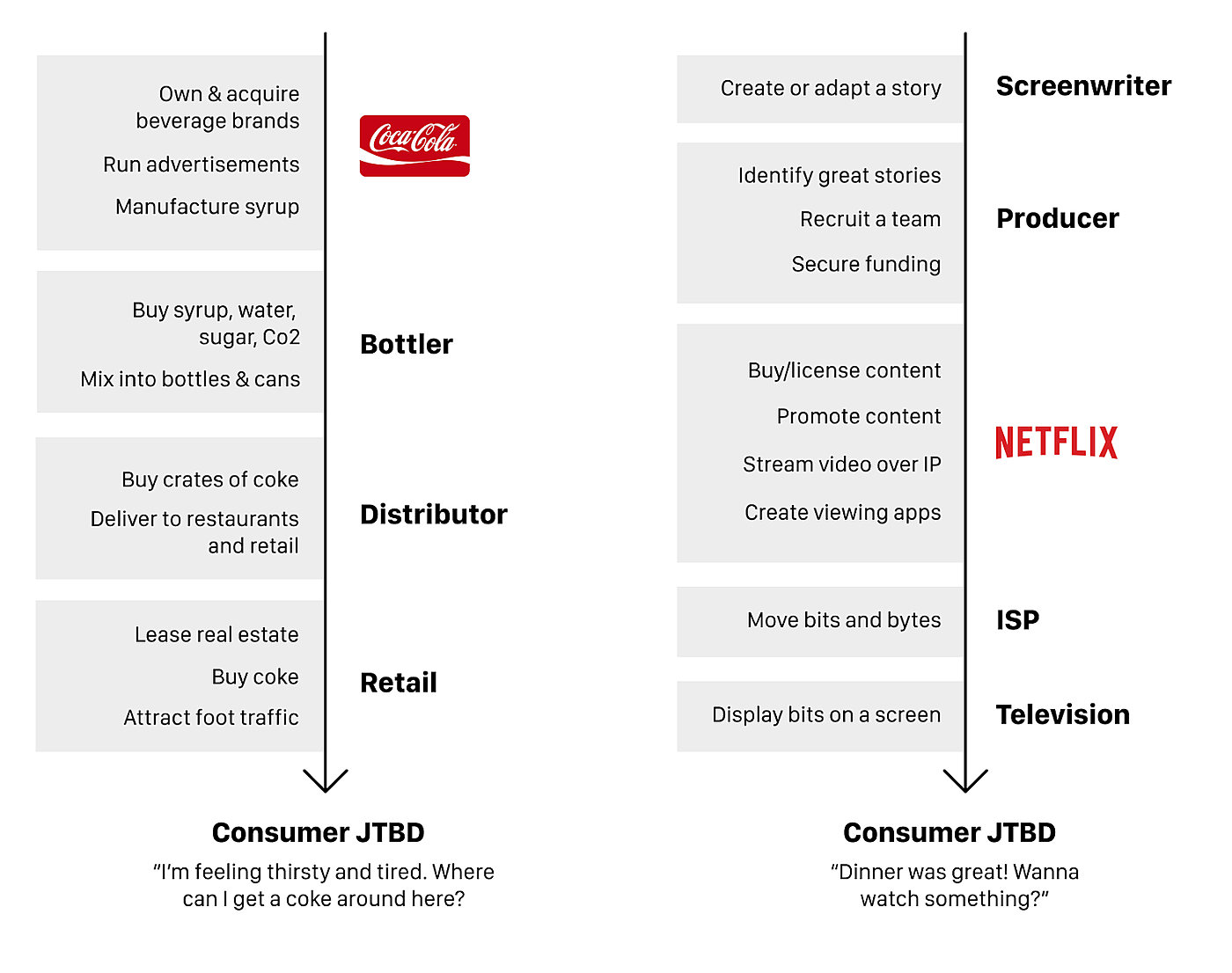

For example, here are two value chains, built on two different consumer needs: refreshment and entertainment.

(JTBD = “job to be done,” which is Christensonian parlance for “need”.)

Of course, all these activities aren’t being performed solely to serve consumer needs. At every step in the process, businesses are trying to make as much money as possible. But they will not all succeed. Some positions in the value chain are destined to generate unimaginable wealth for the businesses that occupy them, while other positions are doomed to subsistence profitability.

This is a fact that we often take for granted. But really, stop to think about it: why do some companies make so much more money than others?

In my previous posts covering Michael Porter’s work, I covered the Five Forces framework, which is a good tool to measure how powerful a company is. The basic idea is that there are five forces that act on every company to limit power and profits. But it doesn’t explain why some companies experience so much more force than others. Obviously this is important information to know when you’re crafting a business’s strategy.

Lucky for us, it’s the exact question Clay Christensen aimed to answer with his “Theory of Conservation of Modularity.”

Comments

Don't have an account? Sign up!