The Best Ways to Earn Yield on Your ETH

Staking, farming, LPs, understanding risk, and what I'm doing

March 25, 2022

Sponsored By: Branch

Today’s newsletter is brought to you by Branch, a furniture brand dedicated to helping you work in comfort.

There’s a reason their flagship Ergonomic Chair has sold out over 10x, and why their Standing Desk was recently rated #1 by CNN. Branch designs and sells premium office furniture with the industry’s top manufacturers but sells direct to customers to pass along the savings. What’s more, if you’re a team, they offer free design services, bulk discounts, and white-glove installation.

Upgrade the way you work and feel the effects of what an ergonomic workstation can do for you. To shop their bestsellers, click below.

A couple of weeks ago I shared an in-depth guide on stablecoin farming. How to maximize your APR on dollar-based stablecoins, so you can far exceed the interest rates you get in fiat savings accounts.

But you can find a way to earn yield on almost any asset in crypto, and after stablecoins, the next most common question is: what about ETH?

You've probably heard you can stake your ETH and earn 4% on it. But what's the best way to do that? Should you do it at all? And what if you want to earn more than 4%?

That's what we'll cover in this article. The best ways to earn yield on your ETH through a variety of strategies, and how I'm using those strategies with my ETH stack.

We'll cover:

- Staking

- Lending

- Yield Aggregators

- Stable ETH Liquidity Pools

- Riskier ETH Liquidity Pools

- Leveraged Plays

- What I'm Doing

- How to Find More Opportunities on Your Own

Let's dive in.

Staking Your ETH

Staking is the base rate for earning yield on your ETH. It's the easiest way to get a return, it's arguably the safest, and it requires the least maintenance.

When you stake your ETH, you're contributing it to securing the Proof of Stake Network launching on Ethereum later this year. In the new PoS model, the network will be secured by all the participants who are staking their ETH instead of by the energy-intensive Proof of Work process the network currently uses.

By staking your ETH, you're putting some of your own funds at risk as proof that you'll be an honest validator for the network. If you try to submit false transactions, your stake could be slashed as punishment. But so long as you make honest contributions, you'll earn new ETH emissions as well as transaction tips in perpetuity.

The amount of staked ETH determines the interest rate. The more ETH that's staked, the more secure the network is, but the lower the interest rate will be. It's currently at 4%, though some estimates suggest that after the merge it could reach 10-15%.

For now though, staking your ETH will earn you around 4% on the amount you've locked up, so this is our base case for ETH yield. Then the question is, what's the best way to get it?

Lido stETH

The most popular way to stake your ETH is to use Lido's staking service. Instead of having to manage setting up a validator on your own, you can deposit your ETH to Lido's staking network and still earn 90% of the yield.

In addition, Lido gives you a "liquid staking token" stETH. You get 1 stETH per ETH you deposit, and your stETH balance in your wallet goes up every day to reflect the yield you've accrued via staking. This makes it extremely easy to see how much interest you're earning from staking, and gives you a token you can use in other defi activities like staking it as collateral in AAVE.

The downside of Lido is that you do give up that 10% of your yield, and since Lido operates all of their own nodes, they're slightly more centralized than some alternatives. There's also some argument that since your stETH balance increases in your wallet, it might be taxed as income instead of long-term capital gains, though this debate is still ongoing.

Rocket Pool rETH

A new contender for the best way to stake your ETH is Rocket Pool's rETH. Rocket Pool operates similarly to Lido: you deposit your ETH, you get rETH in return, and then Rocket Pool handles getting your ETH staked on their end.

The two big differences between Lido and Rocket Pool is the degree of decentralization, and how the staking tokens work. Lido handles all of the staking on their own, so their $8b worth of ETH is centralized in 21 validators they control. The LDO token will allow for governance on their decision-making, but it is still a somewhat centralized service.

Rocket Pool lets anyone create a validating node on the Rocket network, and it only takes 16 ETH instead of the normal 32. Creating your own node lets you earn a higher yield than you would via Lido (currently up to 6.36% vs. 3.8%), and it makes the Rocket Pool network more decentralized. Despite only having 1/6 as much ETH staked as Lido, Rocket Pool has 953 node operators, 45x as many as Lido.

rETH also doesn't rebase the way stETH does. Instead of your rETH balance going up, the amount of ETH you can trade your rETH for increases over time. This means the rETH tokens in your wallet are getting more valuable, instead of the balance increasing, which means there's no chance of your staking rewards being counted as income. Granted, you can also do this with Lido by wrapping your stETH for wstETH.

So if you're interested in setting up your own node with some extra guardrails so you can earn a higher yield, or avoiding the "is this income" question, Rocket Pool is a great option.

Staking On Your Own

If you want to have the maximum amount of control over your ETH, you can set up a staking node on your own. You'll need 32 ETH and some decent technical proficiency, so I'm not going to go too much into this option here. You can read more about how to do it here if you want. The benefits are that you'll earn slightly more yield, and you won't have the risk of a protocol like Lido or Rocket Pool failing on you.

Again, staking should be considered your base case. It's the lowest risk, still has a solid ROI, and it's what we'll compare everything else against.

With that in mind, let's look at the other options for earning ETH yield.

Lending ETH for Yield

Similar to how you can lend out your stablecoins to earn yield, you can also lend out your ETH.

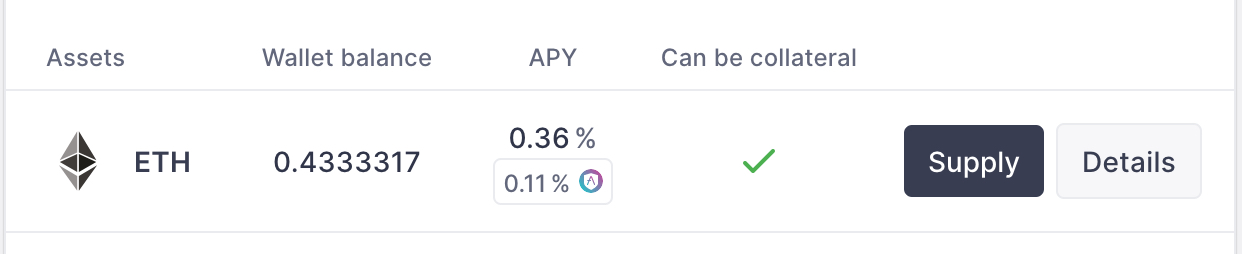

I'll say upfront though that this rarely earns you more than 1-2% APR and is generally a terrible deal compared to staking. So why do people put their ETH in lending platforms like AAVE? Mostly to borrow against it.

We can check the same lending protocols as the stablecoin article:

Sure enough, the APR on depositing ETH is only 0.47% on AAVE:

It's 0.06% on Compound, and most of the Rari and Market pools are paying less than 1% as well.

You'll almost never see the ETH APR on lending platforms higher than this, so if you want a sustained yield from your ETH, I definitely recommend looking elsewhere.

So let's move on to yield aggregators.

Yield Aggregators

A yield aggregator is any service that takes your assets and puts them to work using a variety of strategies to earn you the best yield possible.

The main ones we want to look at are:

Unfortunately, these are often going to be equal to or lower than the staking yields as well.

Yearn's ETH vault often hangs out between 1-2%. Tesseract is somehow at 0%. Tokemak is a little better at 4%, but that's barely higher than Lido's 3.8% and you'll have to spend gas to claim rewards.

So yield aggregators are rarely a good option here either. I've actually never seen one of these sources beat the staking yield, so I doubt they'll ofter a sustained higher yield in the future.

Let's move on to stable ETH liquidity pools.

Stable ETH Liquidity Pools

This is where things get more interesting. Just like stablecoins are pegged to a fiat currency, there are a number of ETH-pegged assets that serve as artificial ETH tokens.

One example is Alchemix's alETH (more on Alchemix here). This is a synthetic ETH they mint to ETH depositors who want to borrow against their future yield. It's not the same as normal ETH, but it's always redeemable 1:1 for ETH, so the price is always the same. Barring any massive peg-break event, of course.

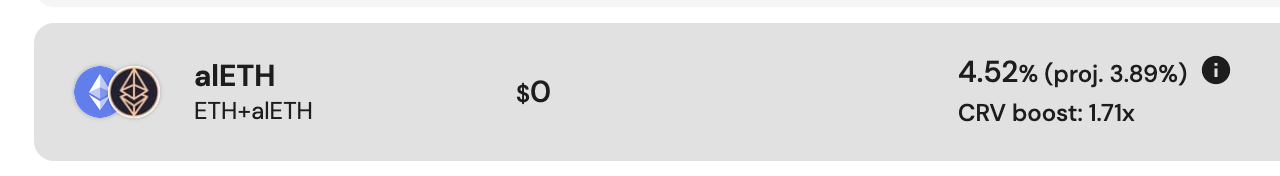

Part of how this peg is maintained is the ETH:alETH Curve pool. If you farm this pools rewards on Convex (this farming stack is described in the Curve Wars article) you can currently earn 4.5%:

The benefit of these pools is that since the assets are supposed to be 1:1, you'll never have any impermanent loss. If you put in 5 ETH, you should get 5 ETH back. You do always have the risk of these synthetic assets breaking peg though (like what happened to IRON) so that's the additional risk you're taking on.

To find these pools, you can browse through the ones listed on yield aggregators and autocompounders like Convex, Beefy, and Yield Yak.

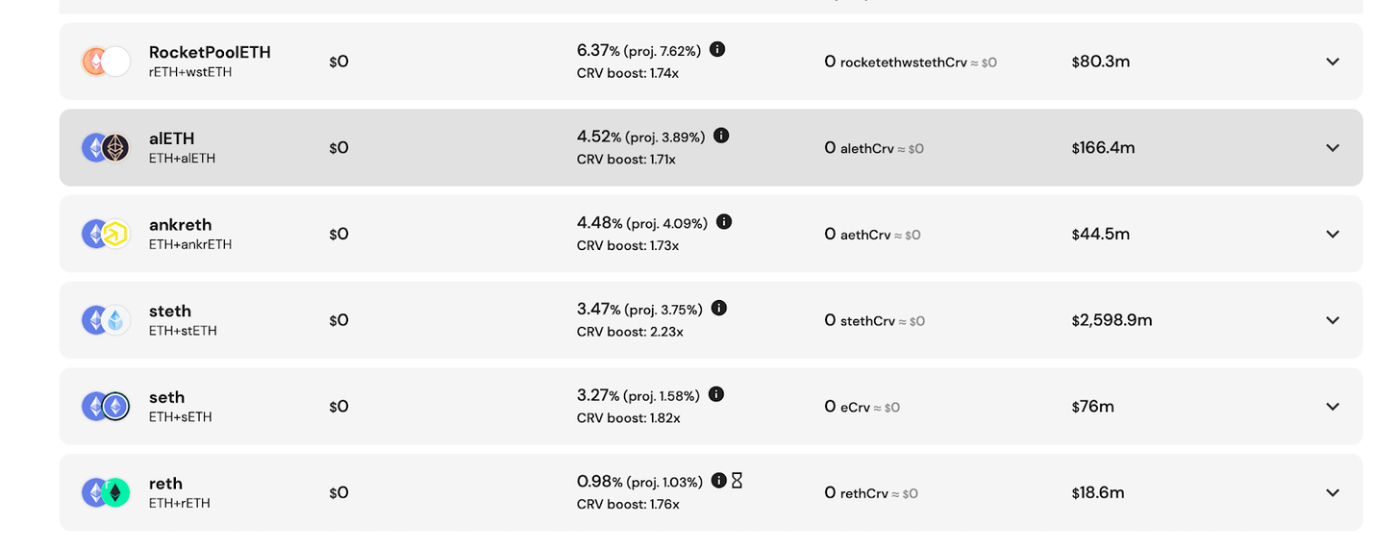

There are few other ones on Convex that beat the 3.8% from Lido:

Particularly interesting is the RocketPoolETH option. This is paying 6.37% on top of the ~5% you're earning on the rETH you deposit into the pool, which means your total yield is around 11.37%. That's one of the best options by far.

The main "gotcha" to watch out for is how the assets are pegged to ETH. We could farm the jETH-ETH liquidity pool on Arbitrum for example, you just have to be aware that jETH is not pegged to ETH. Its value fluctuates based on the success of JonesDAO's strategies. So while it should stay close to ETH, it's not pegged.

It's rare to see a stable ETH liquidity pool pay more than 5-10%. So if you want higher yields than that, you'll have to start looking at riskier liquidity pools.

Riskier ETH Liquidity Pools

There are plenty of liquidity pools for tokens paired with ETH that pay much higher than 5-10%.

But, to take advantage of those, you have to be willing to open yourself up to impermanent loss. If the other token appreciates or depreciates significantly against ETH, you could end up with less than you started with, even when you factor in the rewards.

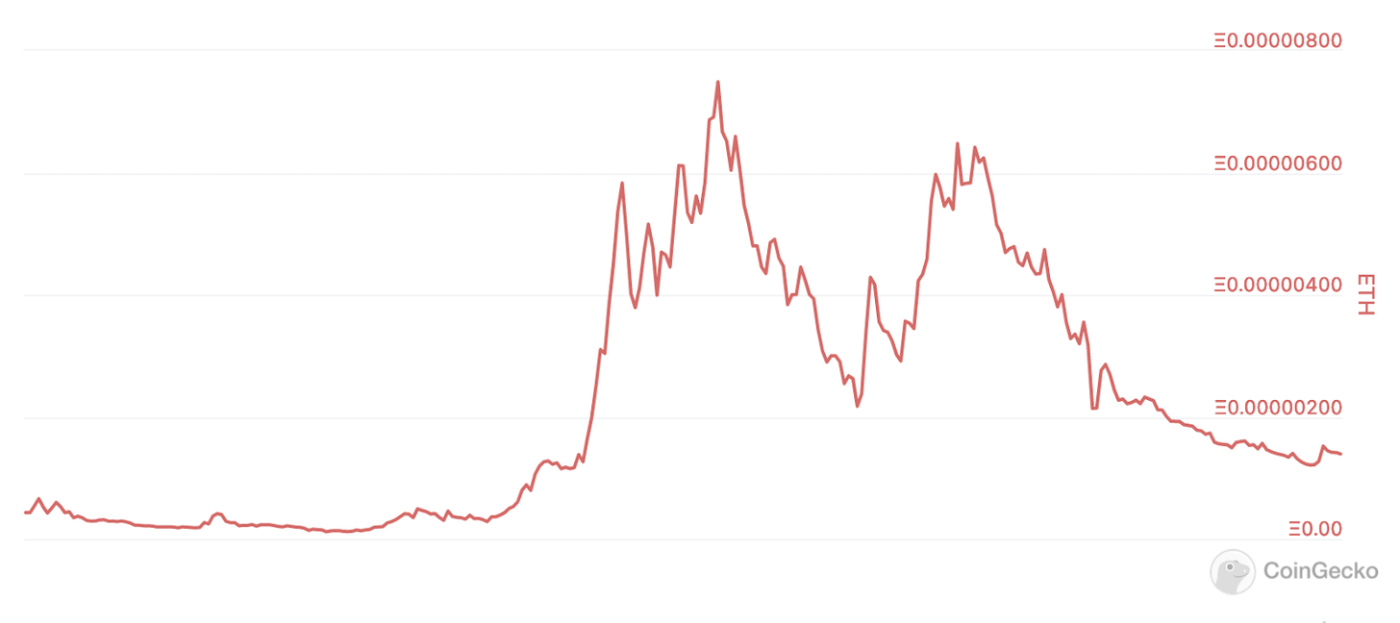

For example, the SPELL/ETH pool pays 47% APR right now:

But with how volatile SPELL's price has been in ETH terms, you could still lose money on this pool.

If you added liquidity at the top, and pulled it out now, SPELL has dropped 75% against ETH. It's been about 6 months, so you made 23%.

But a 75% drop creates a 20% impermanent loss, so you only made 3% more compared to if you just held ETH and SPELL. Not really a good deal (you can play with the numbers here):

There are hundreds of these pools to explore, so you just want to make sure that whatever the APR is, it is good enough to justify taking on that impermanent loss risk. Typically the higher the APR, the more acceptable the potential volatility will be.

Leveraged Strategies

Most of these strategies can be juiced up with leverage depending on your risk tolerance. Especially when combined with some of the ideas from the stablecoin farming article.

For example, you can now deposit your stETH from Lido into AAVE as collateral. It will keep growing just like it would in your wallet, which means you can both earn your 3.8% APR and borrow against it.

So you could put all your stETH in AAVE where it's earning 3.8%. Then you could borrow 1/2 of it, and put that into a stablecoin pool earning 20%. So now your total APR is 3.8% + 1/2 * 20% which gets you to 13.8%.

Or you could borrow ETH against your stETH, convert that ETH into more stETH, deposit that, and repeat a couple more times. Assuming you borrowed 70% each time (which is probably safe since stETH is pegged to ETH) and did it 4 times, you'd have a total of 2.75x your initial stETH amount earning 3.8%, so a net of 10.45%. Or if you don't want to do this yourself, you can use a tokenized version called ETHMAXY.

Obviously we're getting into kinda risky territory just to squeeze a few extra percentage points of yield out, so you'll have to decide if the juice is worth the squeeze.

What I'm Doing

I'm using a blend of safer and more aggressive ETH yield farming strategies, including one that pays higher than the RocketPoolETH Convex pool with (in my opinion at least) a comparable level of risk.

You can see what I'm doing in the paid addendum to this post.

How to Find Opportunities on Your Own

Assessing ETH farming opportunities is a little easier than stablecoin ones. The main questions you should be asking are:

- Does this beat the yield I can earn from regular staking?

- If it does, is the additional risk worth it?

For example, the Yearn Curve Rocket Pool vault will autocompound your RocketPoolETH position that you would take on Convex. So your APY will probably be around ~11-12% when you factor in the staking yield that rETH and wstETH have.

But now you're adding platform risk from Curve, Convex, and Yearn, on top of the risks of rETH and stETH. If any of those protocols fail, you could lose everything. So is it worth layering on that additional risk for a few extra percentage points? Maybe!

With those questions in mind though, the most helpful places I've found to check are:

- Convex

- Yearn

- Beefy

- Rari

- Market

You can certainly get more in the weeds from there, but that list will give you a good start. Be careful when you see new, insanely high APRs in ETH denominated terms. If they’re legitimate, they rarely last long, and you can easily spend tons of gas trying to move your ETH around chasing the highest return.

It’s often better to pick one strategy you could stick with for months at a time, sit back, and enjoy your yield.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!