How to Build a GPT-4 Chat Bot Course

We just re-launched our How To Build a GPT-4 Chatbot course taught by Dan Shipper!

It's an online cohort-based course that will teach you how to make your own GPT-4 based knowledge assistant in less than 30 days. It runs once a week for five weeks starting September 5th. It costs $2,000, but you can get a 15% discount if you are an Every paid subscriber. Want to learn to build in AI?

10-second summary:

- I worked on a search fund for a few months in 2021. I didn’t buy a business, but I learned a lot. People frequently ask me about it, too.

- A search fund offers a great way to be an entrepreneur, have a more interesting day-to-day life, and have a shot at a high personal payout.

- My investment theses: 1) apps building on top of software ecosystems, and 2) B2B media.

- I didn’t transact for three reasons: market (high multiples), capital (didn’t want to allocate more to runway and down payment), and business-operator fit (something you’re passionate enough about and have a skill set in).

- Lesson 1: finding good deals is the hardest part.

- Lesson 2: everything gets easier when you have expertise (industry, functional, etc.) that you can leverage. This is true both for convincing sellers you are a worthy buyer and actually operating and growing your business.

In 2021 I left my job as a newsletter writer to pursue entrepreneurship by acquisition. Instead of starting my own company from scratch, I wanted to search for and buy an existing business.

This approach to company ownership has exploded in popularity. A commonly cited driver of this trend is the so-called "silver tsunami”: Baby Boomers are aging, and with that comes retirement. Since many small businesses across the United States were started and are owned by baby boomers, now more than ever will there be a high volume of compelling businesses on the market for the first time.

There are a few options for funding a search. In a traditional search, you raise money solely from investors to pay your salary for 1-3 years while you search for the business and then use their capital to buy the company. You’re typically looking for larger businesses, and while you as the searcher own less at the end, you have more stability.

I took the self-funded approach, using a mix of my own money, investors’ money, and a Small Business Administration (SBA) loan. SBA loans—which are loans issued by small banks and backed by the government (similar to how many mortgages are issued) can be used to buy businesses. (The biggest benefit of SBA loans is that they can finance up to 90% of a transaction—yes, you read that right. On a $5 million deal, you could finance it with up to $4.5 million in SBA loans. The biggest drawback is that the loans are personally guaranteed. If the business defaults on the loan, your personal assets can be seized.) I intended to buy the right small company and run it myself for 4-7 years, growing the business and paying off the debt. At the end, I would be left with a cash-flowing business, of which I would own a good chunk.

I spent 3-4 months on my search. While most search funds target physical businesses (think HVAC, landscaping, or industrial manufacturing), I was primarily looking for a digital business, like a small software company or a niche digital media brand. I looked at thousands of businesses, looked more closely at hundreds of them, and actually spoke to a few dozen. But I didn’t ever close a deal.

I’ll explain why I pursued a search fund, my investing theses, why I didn’t transact, and the lessons you can take from my experience. Even though it’s basically a footnote on my resume, I get a lot of questions about the search fund concept. Maybe my experience can help some people who are on this path or want to pursue it.

Let’s start with the appeal of a search fund.

Unlock the power of AI and learn to create your personal AI chatbot in just 30 days with our cohort-based course.

Here's what you'll learn:

- Master AI fundamentals like GPT-4, ChatGPT, vector databases, and LLM libraries

- Learn to build, code, and ship a versatile AI chatbot

- Enhance your writing, decision-making, and ideation with your AI assistant

What's included:

- Weekly live sessions and expert mentorship

- Access to our thriving AI community

- Hands-on projects and in-depth lessons

- Live Q&A sessions with industry experts

- A step-by-step roadmap to launch your AI assistant

- The chance to launch your chatbot to Every's 85,000 person audience

There are limited seats so sign up now to take advantage. Learn to build in AI—with AI in just 30 days!

Why search funds?

Search funds came out of Stanford Business School in the 1980s, and today, most people who pursue this strategy are of a similar professional class. Most searchers have worked a few years in finance (investment banking or private equity), consulting, or big tech and want to try their hand at running a company.

Startup operators and serial founders are equally suited for the task, but historically they’ve been a much smaller percentage of searchers. Perhaps this is because startup operators have both the risk tolerance and skill set to start their own businesses from scratch. Or maybe it’s because the “search” stage of the process is functionally an M&A process, and startup operators don’t have that kind of experience. Whatever the reason, I’m going to spend a good part of this piece trying to persuade this group that this is an exciting career path for them.

The main appeal for search funds is that the “hard part” of entrepreneurship is already done: search fund acquisition targets are making a product or service, and selling that product or service for a profit (aka “product-market fit”). It’s much easier to take over a company that’s already working than to build a new one from scratch. So this approach can appeal to people who are interested in being their own boss but who might be more risk-averse than the traditional startup entrepreneur.

There are other benefits, too. If you buy a cash-flowing business, you can take a salary right away. And because you’re both the operator and the owner, if you do well, you’ll make a lot of money through your ownership.

I’ve framed the next section of this piece for the finance and corporate folks, since that’s the perspective I came with. If you’re a startup operator or serial founder, you’re welcome to jump ahead to the next relevant section for you.

Benefit 1: Be your own boss

The biggest benefit of running a search fund is that at the end of it, you operate your own business. The day-to-day work of doing so is different from other high horsepower career tracks like consulting, finance, and big tech. As founders and startup operators can attest, you get to:

- Set the strategy and act on it

- Hire team members

- Manage those team members

- Do sales yourself and then build a sales team

- Build internal systems and processes

- Complete other tasks related to your business and industry

In addition to the tasks themselves, you have a different kind of lifestyle. You’ll probably work fewer total hours, but feel a lot more pertinent stress and responsibility. The buck stops with you so you’re constantly putting out fires and dealing with different challenges. While you might have investors, you make the decisions and live with the consequences. Guesswork Investor (an SMB operator from the PE world) lays out the differences between deal work and operations well:

Think about sitting down at a poker table. In PE/SMB acquisitions, you only get to play one hand all the way to the river card, and when you do, you have to go all in. In that scenario, you’ll choose to sit and wait for the right hand, and then only bet all the way to the river if the perfect setup presents itself.

SMB operations feel more like sitting at a blackjack table with $5 minimums. Most hands have an optimal play of some sort, but nothing is guaranteed and you’re guessing at what the dealer has anyway. Losing a hand is annoying, but doesn’t kill you. You may even lose a few in a row, and it’s okay.

The decisions you make impact the kind of lifestyle you live.

Benefit 2: Compensation

Any career discussion wouldn’t be complete without talking about financial compensation. One of the big appeals of a search fund is the financial component: if it works out, there’s unlimited upside. Even if it just does “okay,” there’s still a great financial payoff.

The case I’m going to outline below is by no means guaranteed, but it’s realistic enough that you could plan for it. It also illustrates why this route is attractive:

- Say you find a business with $5 million in revenue and $1.25 million in EBITDA (20%).

- It takes you a year to find this business ($0 in income that year) but you’re able to transact at 8.0x EBITDA for a $10 million purchase price.

- You put $150,000 of your own money in, you pull $7 million from the SBA loan, and you raise the additional $2.85 million from search fund investors.

You have your business and you’re off to the races.

- As an operator, you’re able to conservatively grow the business by 15% per year while maintaining margins.

- You take a $150,000 annual salary, hire a salesperson, and use the rest of the excess free cash flow to pay off the debt (and eventually the preferred equity).

You do a good job and manage not to screw things up such that after five years, you still have a functioning business.

- Now the revenue is ~$8.7 million and the EBITDA has ~doubled.

- Assuming 1.0-1.5x multiple expansion (a conservative estimate), you sell the business to private equity for $20 million with an equity value slightly below that due to the last bit of debt.

- Depending on the terms you negotiated, you probably own 30-70% of the remaining equity value, leaving your personal proceeds between $5-$10 million.

Feel free to rip your own LBO model with your own assumptions, but chances are you’ll end up somewhere in that ballpark.

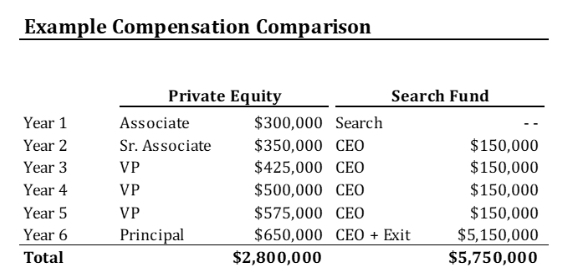

Let’s compare this hypothetical search fund route to the path of a private equity associate. The salary data for staying on this path is pretty well known.

The rule of private equity: everyone makes more in private equity, even when you account for the rule of private equity.

This chart is quite blunt and relies on many assumptions: if you’re at a large fund, you’ll have a higher comp; maybe you get promoted sooner or later; maybe you start with a smaller business but own more of it, etc. But it’s in the right zip code. The search fund is incredibly hard to do and very risky, but if you can make it work, it pays off exceedingly well financially.

Figure out your search fund focus

Once I decided to take the search fund route to entrepreneurship, I weighed several factors to decide where to focus my efforts. If you’re pursuing a search fund strategy, consider developing a few theses with questions like:

- Size: What is your target acquisition size? (Most people frame this as the amount of EBITDA or seller discretionary earnings [SDE] that a business generates per year. Targeting a $500,000 SDE business has a different set of concerns than a $2 million SDE business.)

- Market trends: What market tailwinds might you piggyback off of? Is there a compelling reason why this business will continue to exist and even grow?

- Industry: Are you taking a look at any business, or do you have a particular industry focus? Do you want to pursue digital or physical businesses?

- Geography: Are you searching for a digital or physical business? If you’re buying a physical business, are you searching for businesses located in a certain city, state or region?

- Skillset: What type of company or industry does your skill set and experience lend itself to?

I’m going to share a few theses that I brought to my search fund process. Having a thesis provides a few benefits. First, if you make your thesis public (via telling your network or writing about it) people will send you deals in that space. And second, if you evaluate a lot of the same kind of businesses, you get better at evaluating them because you can pattern-match across companies. (I’m also including my theses because I think these are still strong theses in 2023.)

Thesis 1: Building on a software ecosystem

A lot of the businesses I looked at were software businesses. One thesis I had at the time centered around “piggybacking” off of a big software company by buying plug-ins, themes, templates, and other products related to the bigger software company. Some canonical examples are WordPress plug-ins, Shopify App Store apps, and Salesforce Appexchange apps. Many big businesses have been built this way, too:

- WeCommerce, a portfolio of Shopify apps, went public at the end of 2020 valued at over $500 million.

- Appfire, a company that builds software for various ecosystems, started as an original partner in the Atlassian software ecosystem. In 2022, it reported over $150 million in ARR.

- Yoast SEO, one of the larger individual WordPress plugins, did $12 million in ARR in 2019.

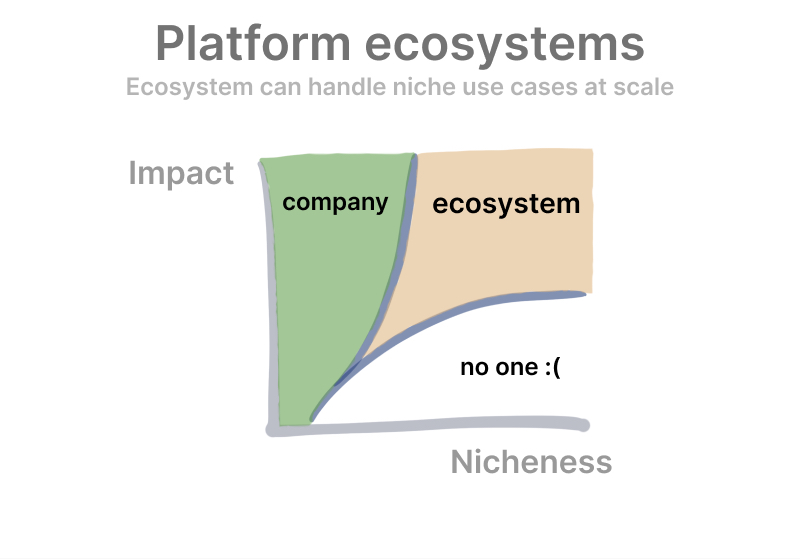

One of the reasons I was excited about this thesis was that it offered built-in distribution. Large high-growth software companies tend to evolve in a similar pattern: find product-market fit; scale the sales team to become a market leader; and build an ecosystem of third-party apps, developers, and advocates to create a moat.

Kevin Kwok wrote an excellent piece about this evolution. The platform software business enjoys network effects from the ecosystem: there are now hundreds or thousands of “nodes” that all rely on the underlying software for their business. It also makes the experience better: the ecosystem members make improvements to the core experience by building for edge cases.

Source: Kwokchain

This isn’t a new concept, and I didn’t think I had a ton of alpha just going around to any old ecosystem and picking out businesses. I did, however, have a thesis that “up-and-coming” software ecosystems would make the plugins a priority. Figma in particular caught my attention: the company had already scaled significantly and, in early 2021, had a small but growing ecosystem of plugins. I did some backchanneling and got word that their CEO did indeed have it as a personal priority to grow the ecosystem, which validated my thesis.

Thesis 2: Niche B2B media

In addition to software ecosystems, I looked at B2B media—trade publications, events, and the like. After writing my newsletter for a while (which focused on a tech/investor B2B audience), I felt like I knew the B2B media space as well as any other. It fit a lot of the dynamics I was targeting:

- Lots of small players ($500,000-$10 million in EBITDA) and a fragmented market

- Clear possibilities for growth. You can either grow the audience through more content or new channels, or you can try new monetization levers (ads, subscriptions, events, etc.).

- Sticky customer base. Many publications, newsletters, and trade shows have been running for several decades.

I focused my media search on industries that were growing, like the business of cannabis. I spoke to a number of investors and journalists, mapped the space, and looked at a large cannabis media company that was up for sale at the time.

Why I didn’t transact

I came across interesting opportunities in my search, but finding the right business wound up being harder than I expected. I hit three big roadblocks:

- Market timing. The time I was heads down on a search fund was February-June 2021, but I first got the idea for a self-funded search back in 2019. The increase in multiples for public software companies had trickled down to the lower-middle market. I talked to entrepreneurs with, say, $5 million in revenue growing 25% per year who wouldn’t settle for anything less than 10x. Looking back, it was good that I didn’t transact at this price.

- Capital. Since I worked on a self-funded search, I paid my operating costs in addition to putting some of my own capital into the deal. If I were to do it again, I’d still take the self-funded approach, but I’d set aside more money before starting the search—enough to cover two years of living expenses and a couple hundred thousand for the actual transaction. An alternative is to search on the side of a day job or part-time gig. Either way, jumping in the deep end with a shaky capital plan was a mistake.

- Business-operator fit. If you work in private equity, you need to find great businesses at fair prices. Then you buy them and hire an operator. If you run a search fund, you need to find a great business at a fair price, and then it needs to be a good fit for you personally. Do you know about the end market? Or at least are interested in it enough to work on it for a decade? Do you have a skill set that matches the biggest risk in the business? This combination means the venn diagram of “good business” and “good business for me” is quite small.

I also think I just wasn’t “ready.” I didn’t have the right combination of stability, experience, and drive to transact and run a business at the time. Maybe I'll be interested in doing it at another point in my life.

What did I learn from it?

Lesson 1: Finding and winning good deals is the (first) hard part

You’ve heard it before and I’ll say it again: a good deal will be able to attract capital. The excitement (and frustration) of deal-based work is that there are so many factors that can cause it to fall through.

Maybe you find a deal, but the seller isn’t ready to sell for another year or two. Or you get all the way through the diligence process, submit an LOI, and a private equity fund outbids you by a half a turn. Or perhaps the markets change and your lender reduces the amount they give you. Whatever the cause (I only listed a few), there are a million things that go wrong before a deal gets done.

In order to solve this problem, you need to get really good at sourcing deals. Finding and executing a good deal was the hardest part for me. As I wrote in my update after one month, if I were to do this again, I’d invest the most amount of time on first conversations with businesses that meet my target criteria. This is the best way to find great deals. (The channels and strategy for sourcing said deal flow are outside the scope of this post.)

Lesson 2: You need expertise, and you need to leverage it

I had the best success when I talked to businesses that were related to my background, and I had the least success when I talked to businesses that were unrelated to my background. Besides a strong sourcing engine, this is the most important consideration: have expertise and leverage it.

In the first phase of a search fund, you need to find a deal and convince the owner they should sell to you. Ideally, they sell it to you for a reason besides that you give them the most money (otherwise you have a lot more competition). This is a sales job.

With every step of the sales funnel, having industry experience will help. You get more referrals because you know more people. People on the fringes of your network send you deals because you have a brand. Owners respond to your emails because you worked at a brand they admire, or at least they know what you did. On the phone, you build rapport because you’ve already learned how the industry ticks.

For example, say you’re coming from the startup world. Maybe you’ve run business operations at two high-growth payments startups. If you approach small payments companies (or even small regional banks), you have a useful perspective to share with the owner. You can provide value even on that first call.

Then there’s the second phase of the search fund: operating the business. If you’ve worked in the industry, you have a much better chance of success. You know which processes matter. You know what red flags to pay attention to in hiring sales reps. You have some connections to open up new revenue. You’ve done it before.

It’s even more important that you choose something directly applicable to your experience if you’re coming from financial services, because you haven’t been an operator yet. If you’ve worked with $30-50-million-revenue commercial services businesses at your lower-middle market PE shop, those are the exact kinds of businesses you should look to buy. At least you know the right metrics to look at and key items to diligence. Maybe you know a CEO or two well from the deal who can help vouch for you.

It’s too hard to execute on a search fund if you don’t leverage your unique expertise.

When you should run a search fund

I’m writing this piece from an inexperienced vantage point—I spent all of four months doing a search fund full-time. I never closed a deal, operated a small business, or sold it.

But despite that, I still get asked a lot of questions about searching for a small business to purchase and run. It’s entrepreneurship, and it’s private equity. It’s a leap of faith without having to go through the low-status schlep work of working on your own failing projects for a while. If things go well, it checks the financial freedom box. And even on a risk-adjusted basis—taking into account the very real downside case of a bankrupt business—it’s still a compelling path.

My current point of view is this: if you have a story for why you are buying a business and why you can run it as well as anyone, you should search for a business to buy and run. The best personas are exited founders buying companies in their industry, or operators who have spent 5-10 years or more in a functional area and can use that experience to carve their own path. Other people—those with an M&A background, for example—can and have made it work, but it’s riskier without that direct experience. Build your advisory team accordingly.

Which is also why I’m no longer on the search fund path. If I get to the point where I have a best-in-class skillset or have worked in an industry long enough to know exactly where the opportunities are, then I’ll dive back in. Until then, I’ll support others who take the leap.

Adam Keesling currently helps funds and independent sponsors with diligence and financial modeling. If you want to discuss any of the ideas in his article (and/or have the kind of profile described herein), reach out to him on Twitter or email at adam [at] adamkeesling [dot] com.

Every needs your help. We're looking to talk to a few subscribers about your experience reading us. Why do you read Every? How can we make it better for you? Sign up for a time slot to talk to us (and get a free hat!).

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

LEARN TO BUILD A GPT-4 CHATBOT

Every is relaunching it's course on how to build your own chatbot in less than 30 days. It will run once a week for five weeks starting September 5th.

The course is available for $2,000 but you can get a 15% discount if you are an Every paid subscriber. Want to learn to build in AI?

Comments

Don't have an account? Sign up!

Naive question... Is it not possible to search for a business while also working full or part time? Why did you feel the need to quit your job and be fully dedicated to search?

Do you feel like you are on the path to a best-in-class skillet and/or specific industry experience right now? If not, what do you intend to do differently?

@tyler.a.gray Adam here. To answer your first question, yes it is. There’s not a gatekeeper or hurdle you have to cross to start searching. You can just… start. And many people do. It's a bit easier to stay focused if it's your full-time job, but if I did it over again I would either start searching from the stability of a full time job or save up more money (to me, two different solutions to the same problem).

For your second question, I’m getting closer. One path is to get in a spot where I’m driving value (selling to customers or building products) in an industry that I like that also is fragmented in a way that there are acquisition targets at a reasonable size. The other path I might go down is more the M&A route in which my role might eventually be closer to an “independent sponsor”. This is similar to a search fund except you hire an operator instead of doing it yourself. I still like the search fund idea a lot just want a bit more experience and financial stability before I take another shot.

@adamkeesling1996 Thanks Adam! This was a great post and I appreciate your thoughtful answers to my questions.

Any insight on how to search for a small business to acquire? Are there specific websites or other resources that you used to generate potential acquisition candidates?

Thanks for the great article, and even though you changed course, kudos to you for taking the leap.