The Jet.com Obituary

The brand couldn’t compete against Amazon, but the acquihire was worth it for Walmart

May 29, 2020

Due to continued strength of the Walmart.com brand, the company will discontinue Jet.com. The acquisition of Jet.com nearly four years ago was critical to accelerating our omni strategy.

What can we take away from this passing?

Jet’s Early Days

Say you want to compete with Amazon. How would you do it?

Marc Lore, who previously founded Quidsi (aka Diapers.com) and sold it for $535 million, had an idea. Amazon competed on price and convenience. What if a company competed only on price? With this in mind, he began working on the company that would become Jet.com.

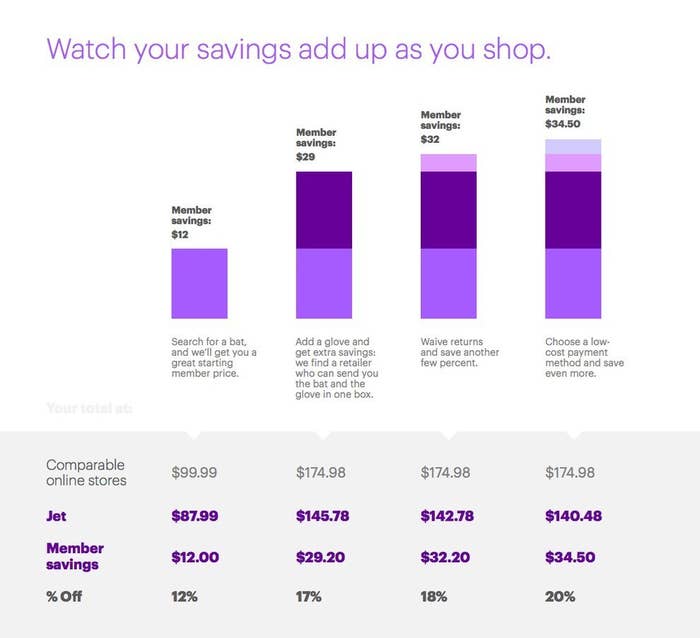

Jet’s innovation was their “Smart Cart”. It utilized a concept called price scheming. Price scheming dynamically updated the prices of goods as customers added them to their cart to give them lower prices.

See, shipping and fulfillment costs are lower when you ship from the same distribution center. So if you added something from a warehouse in Texas, other items in that warehouse would be cheaper on Jet.com because the distributor could package them together. Additionally, customers could get further savings on Jet.com by using a cheaper payment method (such as debit) or agreeing to not return an item.

(Source)

The first few months after launch, Jet actually exceeded sales expectations. However, revenue wasn’t the main issue for Jet.

Zero LTV?

The main issue with Jet was unit economics. Investors focus on LTV to CAC in the early days of a startup because if a company has a positive LTV to CAC ratio, it can acquire new customers even if it means burning cash. When that happens, it means the cash is coming in a future time period.

However, it seemed Jet wasn’t making very much gross profit at all. At their launch, Jet fulfilled its orders in three ways.

One-third of customer orders Jet fulfilled itself: it purchased goods from manufacturers at wholesale prices.

Another third was fulfilled by partner merchants. For these items, Jet bought from other merchants at retail prices.

The remaining third was purchased by Jet’s “concierge service”: Jet would list an item on it’s website that it didn’t own, then Jet employees would actually search other websites for that product and order on behalf of the customer. Jet would pay whatever price it took.

As you might imagine, this last third wasn’t so profitable. The Wall Street Journal reported purchasing 12 items for $275.55 on Jet.com, but then calculating that Jet’s concierge employees had spent $518.46 on the transaction (resulting in a loss of $242.91). Obviously, means the gross margin is negative for the items that were sourced this way.

While these negative gross margins only applied to a fraction of the products Jet sold, discount eCommerce is not a very profitable industry to begin with. It wouldn’t surprise me if they had near-zero gross margins across all their products.

Making the LTV to CAC ratio work when you don’t have any LTV is pretty tough. However, if Marc Lore asks to paint a masterpiece, you give him a brush. His vision was that Jet could achieve profitability once they reached $20 billion in annual sales. At that level, Jet could leverage their market power as the gatekeeper of consumer demand to get better terms on their inventory. So, investors made the bet.

Jet Didn’t Build a Brand

Despite their unit economics, Jet’s problems really stemmed from one main issue. They tried to buy a brand instead of building an audience.

Brand is more than the colors of your logo and copy on your website. It’s the sum of the interactions you have with your customers. The more positive interactions, the more trust you build. That’s a brand, and it takes time to build.

The bottleneck to build a brand is the number of times a company interacts with a customer. It takes 6-8 interactions before that customer trusts you enough to buy something.

Buying advertisements artificially scrunches down this process. Not only is it more expensive to buy ads than to spread through recommendations, but consumers are increasingly immune to aggressive marketing tactics. Jet took this approach and I imagine they had a high acquisition cost to pay for it.

Amazon, however, did the opposite. They have spent years building one of the most powerful discount brands in the world. So powerful, in fact, that we don’t even remember the products themselves; only that they came from Amazon. From my piece on Shopify:

To explain this risk, all I have to do is look at my personal Amazon order history. In the past few months, I’ve purchased a spiral-bound notebook, a baking sheet, and a 24x32 picture frame. And where did I buy them? I would say "from Amazon," even though each one came from a different retailer.

Thus, the Amazon platform risk: stores that are built on Amazon have better initial distribution, but consumers don’t recognize the brand. Consumers don’t often repurchase unless through Amazon, and Amazon has the power to change their algorithms or merchant terms at any time. There’s zero loyalty, except to the big A, which means there’s zero pricing power for merchants.

This quote referenced the platform risk for small brands. But one company’s platform risk is another company’s network effect. To consumers, cheap + convenient = Amazon.

To make matters worse, just a few years later Jet.com moved their brand upscale. Instead of being the cheapest, Jet targeted high-income demographics like urban millennials. They purchased Bonobos and Modcloth and integrated them into Jet’s existing site. They piloted JetBlack, quite the opposite of discount retail.

There are valuable premium brands. There are valuable discount brands. Jet didn’t build either.

Facing Amazon LLC

As a final nail in the coffin, even if Jet did find a way to have positive unit economics and a brand that consumers loved, they competed with Amazon on the wrong strategic vector. See, Amazon’s retail segment isn’t in the money-making business. It’s in the customer acquisition business. Jet shut down because they tried to compete with Amazon.com instead of Amazon LLC.

Instead of thinking about the margins of Amazon selling a product, think of the blended margins of selling a product and also advertising other products. Amazon has become the largest product search engine on the internet. Their advertising business is growing 40%+ and has higher margins than the retail business. Amazon might only break even on the products, but they more than make it up with advertising.

This isn’t even mentioning the lock-in with Amazon Prime, or Amazon Web Services, or the flurry of other businesses Amazon owns.

And not only could Amazon subsidize break even prices with profits from other divisions, but they also could subsidize them with margin from long-tail products. Online retailers often make the most margin on long-tail items because you can’t find them anywhere else. Even if it’s not a discount item, if an item doesn’t have a direct replacement, it has more pricing power.

Amazon has over 12 million products. Jet had several million as well, but selling long-tail items for Jet was unprofitable. They didn’t have the buying power or third-party seller infrastructure set up to make it profitable.

So not only can Amazon play “eCommerce as CAC”, they can also play “high margin long-tail pays for low margin short-tail”. Jet could do neither.

But Walmart needed eCommerce help

Despite all these issues, Walmart purchased Jet because they needed eCommerce help.

When Walmart bought Jet, the narrative was quite different. Even though Walmart.com officially launched in the early 2000’s, by 2016 Walmart’s eCommerce sales only accounted for 3% of their revenue.

As an example, take a glance at the first line of a Quartz piece from July 2015, when Amazon first passed Walmart in market cap: The retail king has lost its crown. While Amazon today is praised for its creative acquisitions and unstoppable growth, five years ago they were a Walmart killer.

So Walmart was on their heels and needed some energy, and Marc Lore and the team from Jet was the perfect spark. By the time Walmart shut down Jet last week, most of the Jet team has already transitioned to work on Walmart.com. And it seemed to have helped: Walmart eCommerce is now nearly 15% of Walmart’s total sales.

And thus the story of Jet concludes. It will be remembered for expensive customer acquisition and expensive talent acquisition. We won’t ever know if Walmart needed Marc Lore and his team, but there’s no doubt that they helped.

If you enjoyed this, tell your friends what you are reading by retweeting the thread below. Cheers!

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!