Sponsored By: Laika

This essay is brought to you by Laika, the complete compliance platform for simpler, faster, and cost-effective SOC 2.

Everyone seemed to forget about Pinterest. Including the people running it. It should be one of the best businesses on the internet, but it has utterly failed to fulfill its promise. Look at all the things it has going for it:

- People explicitly go to the website with the intent to window-shop.

- Its product initially gained traction with the most valuable consumer demographic (women ages 20-60 who drive 70%+ of consumer spending).

- It boasts a wholly different engagement modality from other sites.

Despite all of these advantages, the business has been a dud. The stock price is down 8% since its public-market debut three years ago, the product has been fairly stagnant, and the company has churned many of the users that it gained during Covid.

Recently there have been signs of life. The company got a new CEO in June, its total monthly active users grew above its Q3 2021 mark of 445M, and a feed change generated a 6%+ increase in engagement. There may be a little bit of magic left. There may even be, dare I say it, an argument for optimism about the company.

However, it’s hard to be anything other than realistic about Pinterest. It should have been much bigger than it is, and while there are some encouraging signals, it is still a company that has failed to meet its potential. Is this latest improvement the last gasp of a dying unicorn, or the start of something new?

It’s funny to type, but this $15B company is an underdog. 435M users makes you a relatively minor player on the scale of the global internet. If they can figure it out, maybe other businesses can also figure out how to exist under the existential threat of Big Ad (Google, Meta, and Amazon). Pinterest has a chance to be a 100B company and they appear to finally be on the path to become one.

What is this product?

Analyst reports on Pinterest typically position it as a “social media company.” It’s better to think of it as a factory that takes in raw goods and outputs a finished product. Users—ranging from Mormon mommy bloggers in Utah to sleek ecommerce brands in Brooklyn—upload pictures of their products or interests as inputs. The factory interacts with this raw material in two ways: It labels the content with metadata that allows it to be sorted on its website and rank well on Google’s Image Search. It then distributes the inputs as Pins within its internal content discovery engine. Inside the factory stand its 435M users waiting to sort these inputs into the appropriate digital scrapbook. Pinterest calls this a board. Crucially to the model of the company, all of this user labor is free.

Your business needs SOC 2. But building compliance from scratch is complicated and time-consuming, and the cost can be crippling. Laika has you covered. Uncomplicate SOC 2 with our guide for growth-minded founders. In this guide by Laika you’ll learn:

- What SOC 2 compliance is and why it matters for your startup

- How to close more deals faster by becoming SOC 2 compliant

- How to prepare for SOC 2 compliance

- What to expect in terms of time and cost

- What to do after the report is in

What makes Laika the authority on SOC 2? They’re the only compliance automation solution that was built by compliance experts. Learn how to turn compliance from a pain point into a secret edge over your competitors.

The user experience is basically that of window shopping but transposed onto the internet. It is algorithmically optimized aesthetic browsing. For example, if I’m looking to build out a Lord of the Rings board (because it is the greatest fantasy series of all time) it would look something like this:

Within a board are both short-form videos and photos. There are native ads that are hypothetically tuned to me, but who are they kidding, serving an ad for “flexible financing for cosmetic care” on a LOTR board. I mean, I just started using a face wash for the first time at age 30.

People use the board mostly for browsing, but there is also a a job to be done of uploading content. Creators and brands are looking to sell additional goods and use Pinterest as a demand aggregator. Remember how the Pinterest Factory tags all of the images and videos with metadata? That’s how the company grows its users and, subsequently, usage. Whenever someone searches for something on Google, Pinterest’s goal is that their images appear at the top of the results. It’s a self-reinforcing growth loop.

Pinterest isn’t a platform exclusively designed for slack-jawed consumption like TikTok or Instagram. It’s meant to be a place where you seek out a specific idea, cultivate those ideas into a board, and then, for now, go elsewhere to purchase the goods related to that idea. It has a concrete and specific utility. It’s sort of like scrapbooking consumerism.

Over the last few years Pinterest hasn’t created anything truly novel; instead, it’s been responsive to other trends in social media. The company has released new content formats that are amalgamations of Twitter’s short-form video and Snapchat’s Stories which have done OK. Last year it spent about $22M on creator economy projects that it recently admitted were a failure. All in all, I find myself uninspired. None of this screams a compelling growth story.

The temptation when analyzing a company that relies on user-generated content is to ascribe form factor as the determining factor of what a company is: Instagram is for photos, Twitter is for text, etc. The second, more advanced, level is to analyze it based on what type of graph the feed is determined. Is it a social graph based on who you follow, like Facebook? Or is it determined by what your interests are, like Reddit? The third, and most interesting of opportunities, is to analyze a company by the utility that it provides. Does it provide joy? (Tinder.) Does it provide crippling loneliness and depression? (Also Tinder.)

Pinterest is in the rare category of having a crystal-clear value proposition that it is clearly delivering for lots of people. This is a double-edged sword: it makes it far harder to add additional products (because it dilutes the use case), but it should theoretically make achieving business results easier. Why aren’t the business results following that utility?

Why can’t Pinterest build a winning ad product?

A technology company has three ways to make money:

- Charge for access (SaaS)

- Charge for usage (Amazon Web Services)

- Charge for eyeballs (Facebook, TikTok, Pinterest)

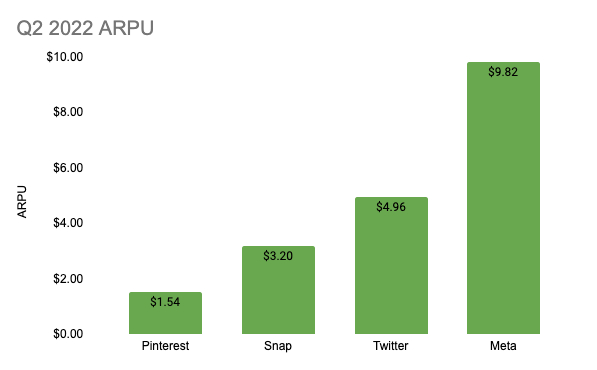

Of the three, number three is the best if you can make it work. Great ads make you scroll for longer, make the rest of the service free, and are high-margin products. Pinterest should be the perfect platform for ads since people are on there explicitly to find goods. Despite that theoretical fit, Pinterest’s monetization has been abysmal.

If a website can achieve monopoly status over a certain modality of engagement or market vertical, those ads become a margin tax on all transactions flowing through the system. On Amazon, merchants now have to pay to get their products to the top of search results (a business line that did $9.5B last quarter). On Google, you can pay to have your website appear above your competitors, even when a user directly searches for a competitor’s company.

The most lucrative/performative ad to sell is one that appears right when a user has the intent to buy. Think of going shopping: you are much more likely to be open to a food ad while in the grocery store.

But Pinterest isn’t in the best spot for this value proposition. Their specific use case is discovery, not purchasing. Imagine a CPG company that makes cashmere sweaters. A Pinterest user searches for “gray sweater.” The CPG company can (and does) pay Pinterest to show up as one of the first Pins in that search result, and it'll get average conversions. But the more likely result is that the user will think, “Hmm, that’s cute”, and never come back to it. Pinterest isn’t a shopping destination––it’s a window-shopping experience. The difference between doing this flow and doing it with a broader search bar like Google is the engagement modality. Pinterest encourages you to curate multiple options and then return to a board where those options are stored. Google’s design wants you to just click a link and go to another website.

As always in the ad market, it would be better if Pinterest could build a direct response ad engine similar to Meta’s. This would require them building out attribution technology to understand when a click on a Pin converted into a sale. And, just like Twitter, the company was slowly getting there with its product stack. Unfortunately, it was kneecapped by Apple’s ATT rules just like everyone else, so building a direct response business is pretty much out of the question.

ATT’s big issue is that it doesn’t allow for cross-app user tracking. So if you click on an ad on the Pinterest app and go to another app to make the purchase, the two companies struggle to conclude that you were the same person who saw the ad and made the purchase. To try and get around that, you can build an in-app shopping experience that allows for purchase attribution to occur because it all happens in one place. This is, once again, not a novel idea. Instagram has tried it several different ways, Twitter tried it all the way back in 2015. There hasn’t been an app in the west that has solved this problem. In all honesty, I can't determine an answer for why these efforts have failed. When you interview people who have built this the most common answer is the cultural differences make it impossible. That feels handwavy to me, but it is what my expert interviews consistently said.

Maybe Pinterest will be the one to crack it. The company launched an integration with Shopify in August to try. It is more obviously a place for a shopping cart, which is what I would do if I were in charge of the product. In my consumer interview for this piece, I consistently found people saying some variation of “using Pinterest feels different than other social media websites.” It was described as positive, uplifting, or blissful. Perhaps this product culture will be the one to get it right versus Instagram’s escapism or Twitter’s intellectual battle.

What are the primary risks?

In season 2 of HBO’s Succession, Kendall Roy is talking to his dad, CEO and media magnate Logan, about whether he would’ve ever had the top job. After hemming and hawing, Logan finally answers.

Kendall: Hey, Dad, just out of interest, um, did you ever think I could do it?

Logan: Do what? The top job? Oh, I don't know. Maybe.

Kendall: You can say.

Logan: I, well, you know, I just. You're smart, you're good, but I just don't know.

Kendall: What? Come on.

Logan: You're not a killer. You have to be a killer.

We are firmly in a tech recession—potentially entering into a wider economic recession—and the more frivolous cultures of the bull market are less likely to work. It will take flinty-eyed, hard-nosed leaders to win in the digital ad market. It remains unclear if Pinterest has that killer instinct.

I chatted with more than 10 former senior employees from different departments within Pinterest for this piece. When I asked them why Pinterest hadn’t made it, they would cite slightly different product decisions, but there was one answer they always came back to:

“Management felt disconnected.”

The company hired a new CEO in June who seems to have more of the right stuff. I’ve listened to a few public discussions that had the new CEO and felt that he spoke the right language, but if you were to ask me why Pinterest would fail, it would be its culture. Do they know what it takes to win?

Pinterest is also likely over-exposed to macroeconomic effects. On the advertiser side, its brand ad business will be the first budget marketing departments cut. During a recession, money always gets funneled into measurable ROI-positive marketing efforts, like direct response ads. Other social platforms could theoretically benefit from consumer weakness because people will be looking for free escapism. Pinterest has that! But a lot of the business is built around consumption. An extended recession would probably hurt both of their most important constituents—advertisers and consumer purchasers.

Plus, what if click-to-buy just doesn’t work? The feeling in the industry has always been that in-app shopping should work, but what if that’s wrong? Purchasing behavior is one part analysis, one part sociological conditioning. What if western consumers flat-out refuse to do this? Even if Pinterest perfectly executes, it may lose.

How does this company fix itself?

If you made me CEO today (mistake) I would show up ready to sell. The best bet to build this into a $100B business is for the C-suite to fall prostrate before Jeff Bezos and pray for Amazon to acquire them.

An acquisition by Amazon would allow the company to plug into a direct intent, high-attribution ad backend. It would also simultaneously be hooked into every third-party Amazon merchant’s product catalog for automatic image upload onto the platform. The transaction makes a ton of sense for Amazon, too. The browsing experience on the Amazon store is terrible and, because of legacy design choices, is unlikely to ever be fixed. Pinterest would bring a high-quality audience of 450M people at the top of the funnel for Amazon to model its browsing behavior.

The rumored Paypal-Pinterest merger of last year is another version of this same play. However, Amazon could digest Pinterest with hardly any financial concerns while Paypal would likely have to take on additional debt to service the transaction. Note: I highly doubt the FTC would allow this but who knows anymore.

If that transaction didn’t work, Pinterest would be left with the option to go full stack shopping app on their own. It’s aware of this, as a spokesman noted on its most recent earnings call:

“Our API for shopping makes it easier for merchants to upload their catalogs and metadata while also sending real-time data on SKU-level pricing and inventory. On the discoverability side, we're leveraging both machine learning and the first-party signals we get from the unique human curation on Pinterest. If you're looking for a mid-century modern couch, we should be able to show you tables, rugs, and lamps to complete that room based on how millions of users have saved and organized home decor content. I think this is a superpower for us as we become the home for digital taste base shopping.

Finally, we have an opportunity to become an even more trusted partner to retailers by helping send more traffic, attributable conversions, and customers to their businesses. We can deliver high-quality shopping experiences in partnership with retailers by creating frictionless handoffs with the merchant for things that people want to buy. For example, we're piloting a hosted checkout program with Shopify that allows users to check out directly with the merchant while on Pinterest. We are also testing mobile deep linking that takes users straight to the retailer's app and checkout page.”

Absent an acquisition by a strategic, these are the right moves by Pinterest’s management team. The company has $2.7B in cash and has good cash flow to finance these investments. All of these moves will likely allow the company to have a stronger financial profile with profitability possible in the near future. I don’t think we’ll see strong user growth, but increasing ARPU while keeping non-investment costs steady would be a win. This ARPU increase would be driven by better ad performance, which itself is powered by in-app transactions. The company has all the right press releases, is saying all the right things, and is well-positioned. So for the first time in a year of analyzing consumer social internet stocks, I’m bullish. Keep an eye on Pinterest.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Thanks to our Sponsor: Laika

Thanks again to our sponsor Laika, the all-in-one compliance solution. Check out their comprehensive guide to learn all about SOC 2 compliance and why it matters.

Comments

Don't have an account? Sign up!