Why Tunnels Could Build Tomorrow’s Cities, Admitting What Is Obvious, and More!

Everything we published this week

September 10, 2023

Hello and happy Sunday!

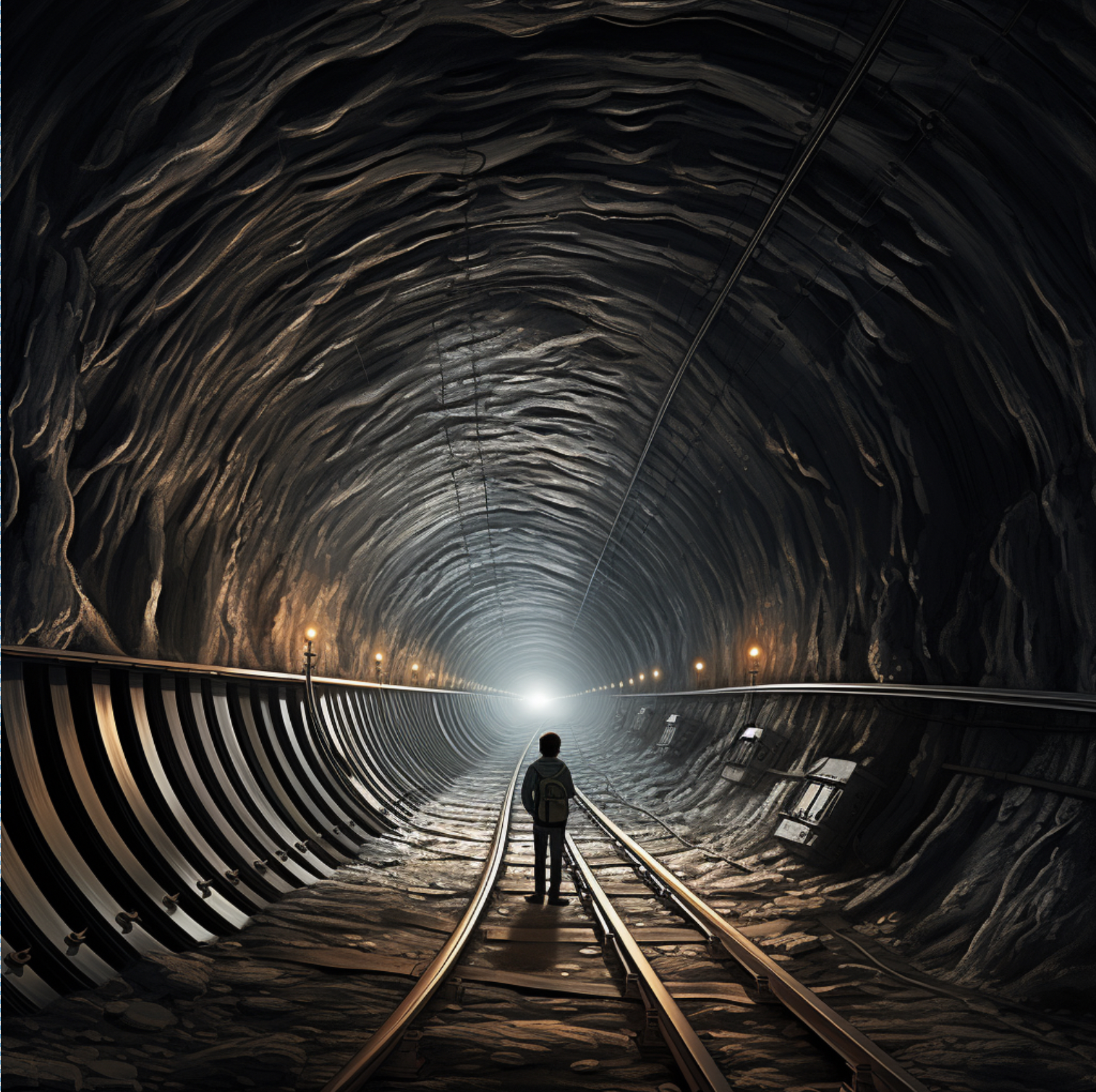

Why Tunnels Could Build Tomorrow’s Cities

Anna-Sofia LesivWhy continue to build up—when we could build down?

In the face of worsening traffic, a growing global population, and climate change, Elon Musk and other entrepreneurs have bet that the future of our cities lies in tunneling beneath the surface of the earth. Anna-Sofia Lesiv unpacks the history of tunneling, from construction in ancient Mesopotamia to the invention of modern tunnel-boring machines, and explains how tunnel boring works. While these machines have allowed for significant developments in infrastructure, they're plagued by inefficiencies and high costs—particularly in the U.S. She also examines Musk's The Boring Company and similar ventures, all of which aim to transform the laborious and expensive process of tunneling through technological innovation and automation.

Admitting What Is Obvious

Dan Shipper/Chain of ThoughtImagine suppressing what you truly are or want to do with your life, even though it's glaringly obvious.

Dan recently discovered the obvious about himself: that despite having established himself as a founder, what he truly loves—and has always loved—is writing. He grapples with the personal and societal costs to not pursuing what you really want to do, rather than what you think you should want to do. And he shares the benefits of admitting the obvious: you can perfect your craft and find examples to aspire to.

A Founder’s Guide to Liberation From Stress and Uncertainty

Casey Rosengren/No Small PlansStarting a company is filled with inherent stress and uncertainty—and if you don't learn to perform and live well under stress, your life can become driven by it.

As a founder himself, Casey Rosengren has experienced those pressures, and he offers insights on how to find liberation—the ability to perform well, think long term, and craft a life of meaning—amid them. He explains how founders can be driven by "aversive control," or a fear of bad outcomes, and shares practical strategies to navigate these pressures—like recognizing when you're running from stress, learning to make space for what's hard, and reorienting yourself toward doing things you enjoy.

You Need To Know What You Are Betting On

Evan Armstrong/Napkin MathConventional wisdom holds that startups are high-risk, high-reward investments, and public companies are safe and therefore less lucrative.

But as Evan uncovers, that's not exactly true—only a tiny percentage of both startups and public companies account for the majority of wealth creation. Instead, what matters in making investment decisions is the ability to time the sale of a stock, and forced constraints—like startup employees' inability to sell their shares. Evan explores the questions of exit liquidity, pricing forces, and risk category for investing in both public and private companies.

That's all for this week!

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!