Make a Billion, Give It a Grade, or Disrupt It—AI Edition

Should we invent a tech saint? St. Patrick < St. Pixel

Happy St. Patrick’s Day! For our non-American readers, this is a day where everyone says they’re Irish, gets hammered, and wears green. If you, like us, are staying inside to hide from this nonsense, please use our stories as a form of safe harbor.

One other thing—we’ve been making some changes to the Digest. More analysis, more jokes, more news, and more images. Mind letting us know what you think? Just rating it at the bottom is enormously helpful. If you have more in-depth feedback, send us an email at hello@every.to.

Our stories

🎧 “How to Run a Profitable One-person Internet Business Using AI” by Dan Shipper/Chain of Thought: We doth have a simple dream. A lakeside cottage. A dog by the hearth. A billion-dollar company that we have to share with no one. Ben Tossell is well on his way to achieving this by running a solo—and profitable—internet business. To do so, he uses AI, and in this interview with Dan on How Do You Use ChatGPT?, he shows us how. Watch this to figure out how to do the same. 🔏 Paid subscribers have access to the episode transcript.

🔏 “How to Grade AI (and Why You Should)” by Michael Taylor: Don’t let Evan’s lack of academic success fool you (dropped out of his Master’s program two semesters in)—we think grades matter. They also matter for AI. You need some way to rigorously compare systems, and so far, evals are the best tool we’ve got. Read this if you are trying to figure out what AI tool is for you.

“Can a Startup Kill ChatGPT?” by Dan Shipper/Chain of Thought: ChatGPT has tens of billions in funding, 100 million users, and Sam Altman. Startups have Zyn, Diet Coke, and more than a handful of gumption. In this piece, Dan makes the counterintuitive case that startups have a better chance than you think to take down the AI giants of today. Read this if you want to use AI to challenge the incumbents of your industry.

The backchannel

Dan’s piece about Google’s AI model, Gemini Pro 1.5, and the subsequent feedback continued to generate conversation:

“I don’t think [the Google Gemini photo mishap] will be the downfall of Google, but it’s not a bump in the road. Google has a larger problem about bleeding talent and being unable to do acquisitions, and the layoffs changed the culture a lot. It’ll probably get worse before it gets better…When founders get acquired by Google, they have a lot of moral authority to take risks on projects. That’s why there’s been maybe one blockbuster (Chrome) to come out of Google that wasn’t from an acquisition. The only other recently is their Photos app, which, if you read into, was done by an acquired founder and had a lot of resistance. It also tends to be acquisitions that make up for the internally produced failures. Biggest example is YouTube being a successful social product where Google+ failed...Doing something new, that’s not attached to an existing project—that’s just not what Google does well.” —A former Google employee

Evan’s piece about ads in the age of AI also garnered more feedback:

“Overall, I’m not too worried. The ad industry will adapt. People will always want free content, businesses will always want to advertise, and advertisers will always want money. So new methods will replace the old. We’re already seeing big brands make more full-length feature films (Marvel, Barbie, Lego, etc.) and as the cost of content creation drops to $0, smaller brands will be able to compete in the high-quality content game, too. Might be a great outcome for all if ads become enjoyable content. And I’d bet that’s what AIO [AI optimization] looks like, too: generating top-quality products and deep information for the AI algorithms to train on.” —A former AI adtech executive

Want to chat? DM Dan or Evan on X.

Chain of links

Google made AI good at Goats. One of the key challenges in AI is making the system generalizable—one that can easily transfer its skills to a new set of problems. Google made an AI agent that was able to play multiple video games, including a favorite of ours called Goat Simulator 3. This milestone, while silly, is still significant. First step goats, next step world domination.

First AI startups came for the developers, and I said nothing. Cognition Labs launched a spooky-good AI software engineer demo and announced a $21 million funding round. X freaked out about how this could “take an engineer's job.” Two things: The real breakthrough wasn’t the coding—it was the planning. We’ve heard the company used GPT-4, a model not explicitly designed for agents. That Cognition could get such good results with duct tape and spit is what is amazing, not the AI writing code. Second, it is easy to dismiss this demo, but the breakthrough should neatly transfer to GPT-5, 6, etc. Agents are the next big thing.

Everyone is building Mighty Morphin Power Robots. Over the last few weeks, multiple startups have raised funding to pursue adjacent approaches to robots. Essentially, they train their robots the same way OpenAI trains language models: Dump a whole bunch of text, images, and video into a training run, and the robot learns what to do in an “end-to-end neural net.” There will be similar problems to hallucinations in text prediction models like GPT4, but in this case, the robot will make a physical error. Does this approach require making the hardware yourself (such as Tesla and Figure, the latter of which raised $675 million, are doing), or can you do it with software alone (like Covariant and Physical Intelligence, which raised $70 million). If they can get the costs below those of minimum wage employees, we’ll be surprised.

It’s alive! The robot car is driving and alive! Sure, the car can’t really work in the rain or the snow or when it is foggy or when it is really smoky, but boy, does it work when it is sunny! Waymo is now charging for rides in San Francisco and is operating in Los Angeles. Slowly, slowly, this industry moves toward saving lives. For more, see Evan’s coverage of autonomous vehicles. —Dan Shipper and Evan Armstrong

The napkin math

Adobe is unable to Photoshop AI profits. The company’s share price tanked 10 percent last week as weak guidance showed no significant uplift from its AI services, like Firefly. Two possibilities: First, the products aren’t good enough yet. Or second, and most likely, incumbent distribution advantage may be overstated. If this is true, oh, boy, there are many startups to be made bb.

900 million users, 50 employees, 1 owner. Telegram is one of our favorite companies that remains chronically under-discussed in the U.S. The founder recently conducted his first public interview since 2017. This business, which is based in Dubai, matters because it offers a legitimate threat to the social media dominance of American companies while being ferociously in the favor of free speech. My bet is that this interview was granted as he gears up for a fundraise or IPO.

$50 billion in memes. Crypto is a funny industry that demands to be taken seriously as a revolutionary force on the internet, while people are making millions on tokens called dogwifhat or U SELL U GAY (I promise that these are real). Anyhoo, the market capitalization of these memecoins are currently north of $50 billion.

You know what’s cool? A trillion dollars. Stripe released its annual letter, in which it said that the company processed $1 trillion, or 1 percent of GDP. Very impressive! Also not mentioned: its margin. As more of GDP goes online, it is reasonable to expect Stripe to capture some of that value. However, when you use the entire economy of the planet as your TAM, it is easy to ignore margin for too long. I anxiously await an audited financial document from this company. —EA

For the love of charts

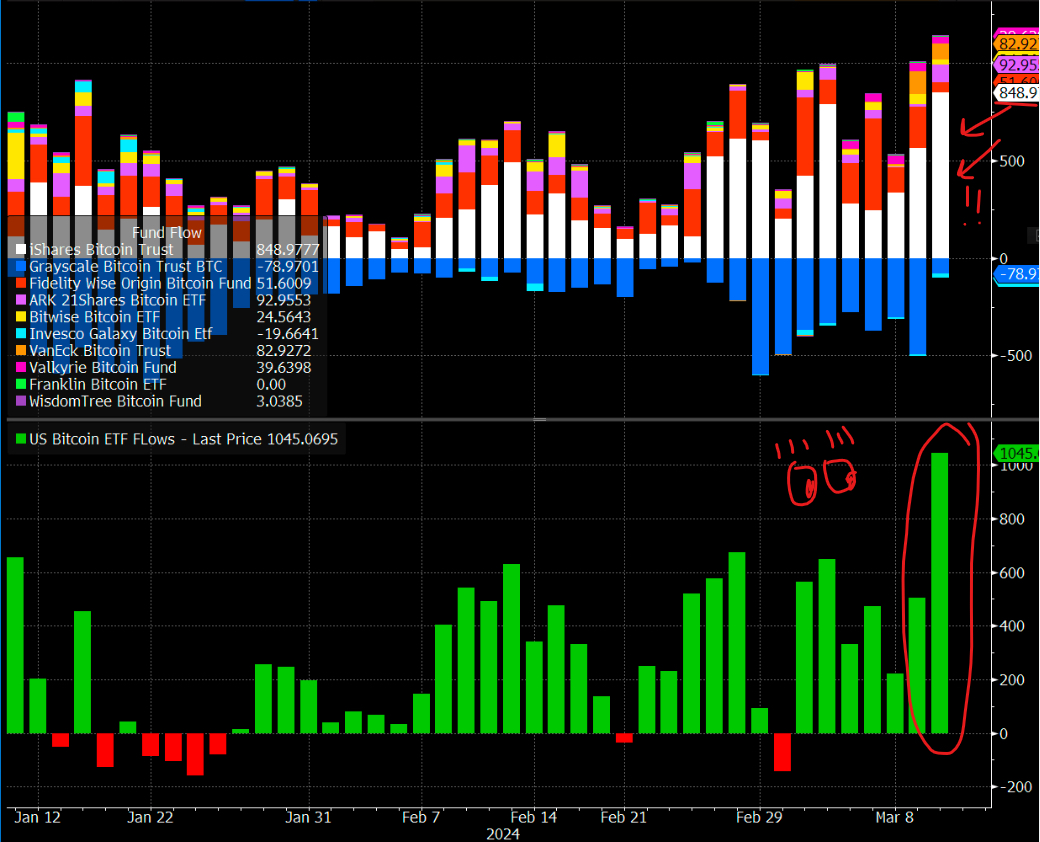

BlackRock is buying all the Bitcoins. Well, not exactly, but investors are pouring tons of money into the BlackRock Bitcoin ETF ($IBIT) so that BlackRock can buy Bitcoin on their behalf. Investors sent more than $1 billion in a single day to Bitcoin ETFs this past week, with about $850 million of that heading to BlackRock’s:

Source: X/Eric Bulchunas.Blackrock’s Bitcoin ETF (the white bar) has now raised more than $11 billion in the two months since it went live, and it holds $15 billion in BTC.

For comparison’s sake, U.S. venture capital funds cumulatively raised about $67 billion in 2023. In other words, the BlackRock Bitcoin ETF—which is just one of 10 Bitcoin ETFs that exist—is on pace to raise as much money this year as all U.S. VCs did last year. Obviously, “on pace” is doing a lot of work there, and a lot can change between March and the future, but as of now, investors are signaling an increased appetite for risk. If it holds up, it should start bringing some light to the fundraising and exit tunnel soon enough. —Moses Sternstein

The examined life

Maybe the real self-reliance was the friends we made along the way. I reread Emerson’s famous essay "Self-Reliance" this week and found something totally unexpected. It’s not actually about going off the grid and living like Bear Grylls so that you never have to interact with or depend on anyone else again. It’s about thinking and feeling for yourself instead of quashing your instincts in favor of conformity. A refreshing read. —DS

Eye candy

What if software companies made hardware? Google WayPoint: if Google built public infrastructure. —Lucas Crespo

Source: X/Lucas Crespo.That’s all for this week! Be sure to follow Every on X at @every and on LinkedIn. Was this newsletter forwarded to you? Sign up to get it in your inbox.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!

This Sunday Digest is a fantastic collection of articles. You keep me in the know without gobbledygook.