Tokenomics 103: Utility

Even if a token has a great supply model, it still needs a good reason to exist and for people to hold it.

April 11, 2022

In the first part of this Tokenomics series, I covered the high-level concepts you need to consider when evaluating a project or company’s token.

In the second part of the series, I covered how to think about a token’s supply. The emissions rate, market cap vs. FDV, total supply, distribution, etc.

In this third part, I’m going to cover utility. Utility is a subsection of the demand side of the tokenomics equation. Even if a token has a great supply model, it still needs a good reason to exist and for people to hold it. Without those, there will be no demand for it, and no one will buy or hold it.

So let’s dig into utility. We’re going to cover:

- Spending vs Holding

- Cash flows

- Governance

- Collateral

Spending vs. Holding

The first question we have to ask when looking at a token is: are you supposed to hold this token as an investment? Or is it a token you’re supposed to spend?

If it’s a token you’re supposed to spend, then it doesn’t make any sense to hold onto it long term. You can just buy it in small batches as you need it, if ever. So figuring out which of these buckets a token fits into is one of the first things you really need to drill in on.

For example, let’s look at Chainlink. Chainlink is one of the most important services in all of crypto. It is absolutely core infrastructure for keeping our various DAPPS running.

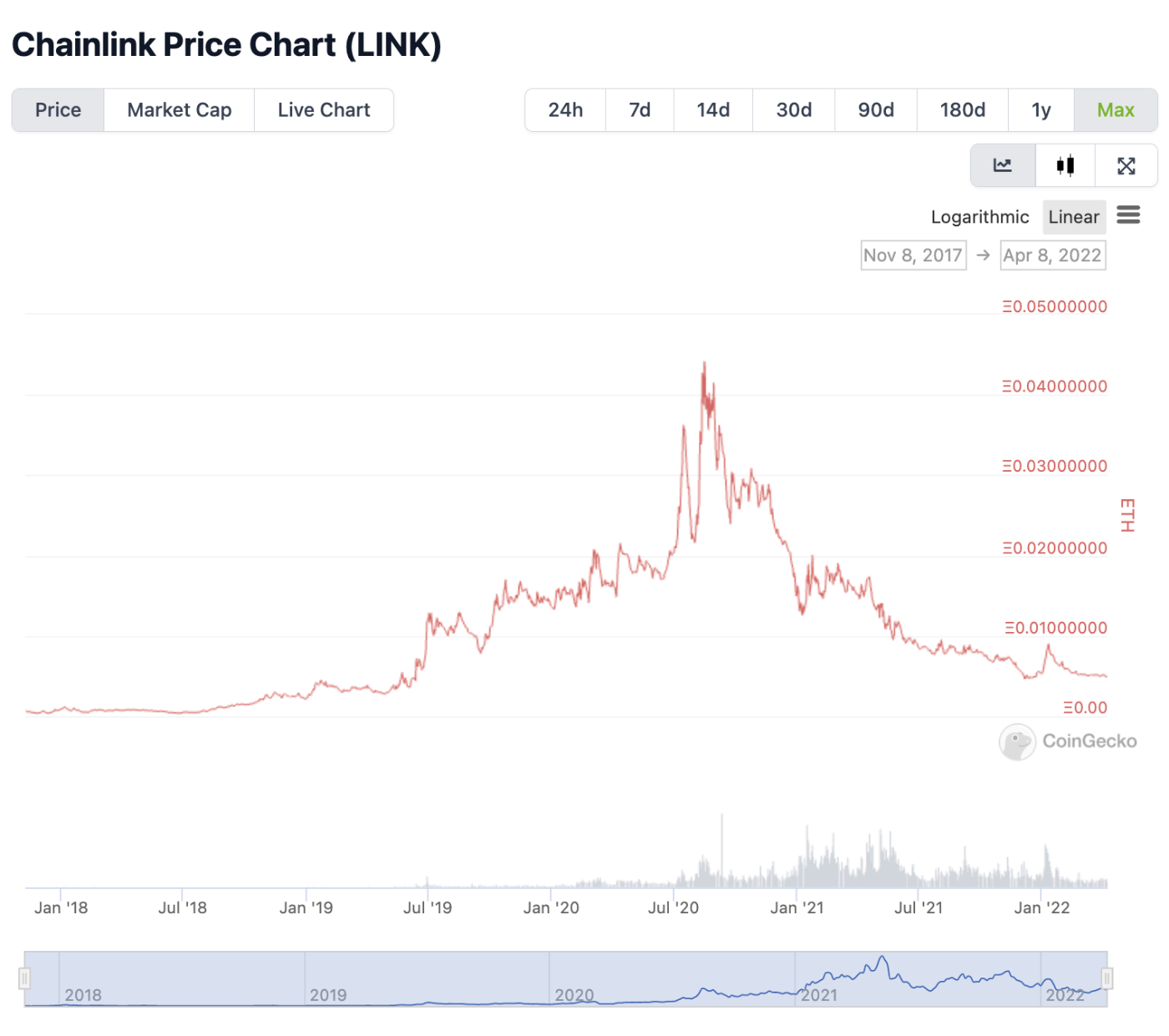

So buying LINK should be a good investment, right? Well, unless you bought it before mid-2019, that hasn’t been the case. Check out the chart against ETH:

If you bought LINK after July 2019 and held it, you’ve lost 50-90% of your value against ETH. Why is that?

On first glance, LINK seems like it should be a great investment. Finite supply, valuable infrastructure, everything looks good. But the problem is the utility. The LINK token is primarily used to pay for Chainlink services, so it’s a spending token. Not an investing token.

If you hold LINK, all you can do with it right now is pay for Chainlink services. They’re really important services, but you don’t need to buy the token in advance. You can just buy it as needed.

Chainlink is releasing staking for revenue sharing this year, but we don’t know what the details of that will be, or when it will release, so right now, the only use of LINK is spending it.

The other issue with spending tokens as investments is the parent platform has a disincentive to let the price go parabolic. If LINK appreciates dramatically, all Chainlink services get more expensive, and people might look for other platforms to use. It would make more sense for Chainlink to have two tokens: one for spending, one for staking, but that’s a separate topic.

The issue with LINK as an investment right now is:

- The only use is to be spent

- Chainlink doesn’t want its services getting crazy expensive

- No cash flows or other utilities from holding LINK

Again, Chainlink is one of the most important projects in the space. But that doesn’t mean its token is necessarily a good investment!

Another good example of this is in-game tokens for P2E games, like SLP for Axie Infinity, or AURUM for Crypto Raiders.

When you earn AURUM in Crypto Raiders, it’s primarily meant to be spent on things like Recruiting or dungeon keys. It’s not meant to be held long term, since it has a variable supply and changing inflation rate. It also has no cash flow, no governance, or any utility besides being spent. The same goes for SLP: it could fluctuate in price, but it’s not meant to be an investment. For Axie, the investment token is AXS, and for Crypto Raiders, it’s RAIDER.

So when you’re looking at a token, the first question should be whether this token is for spending and using in the application, or if it provides some compelling long-term investment beyond just being spent.

Cash Flows

If a token is one that you hold vs. just spend, then the next question is: why hold it? The most common compelling form of utility that makes a token worth holding is cash flows. If there is some mechanism where you get paid for holding and using a token, then it might be worth buying even if it doesn’t completely hold its price against majors like ETH and BTC.

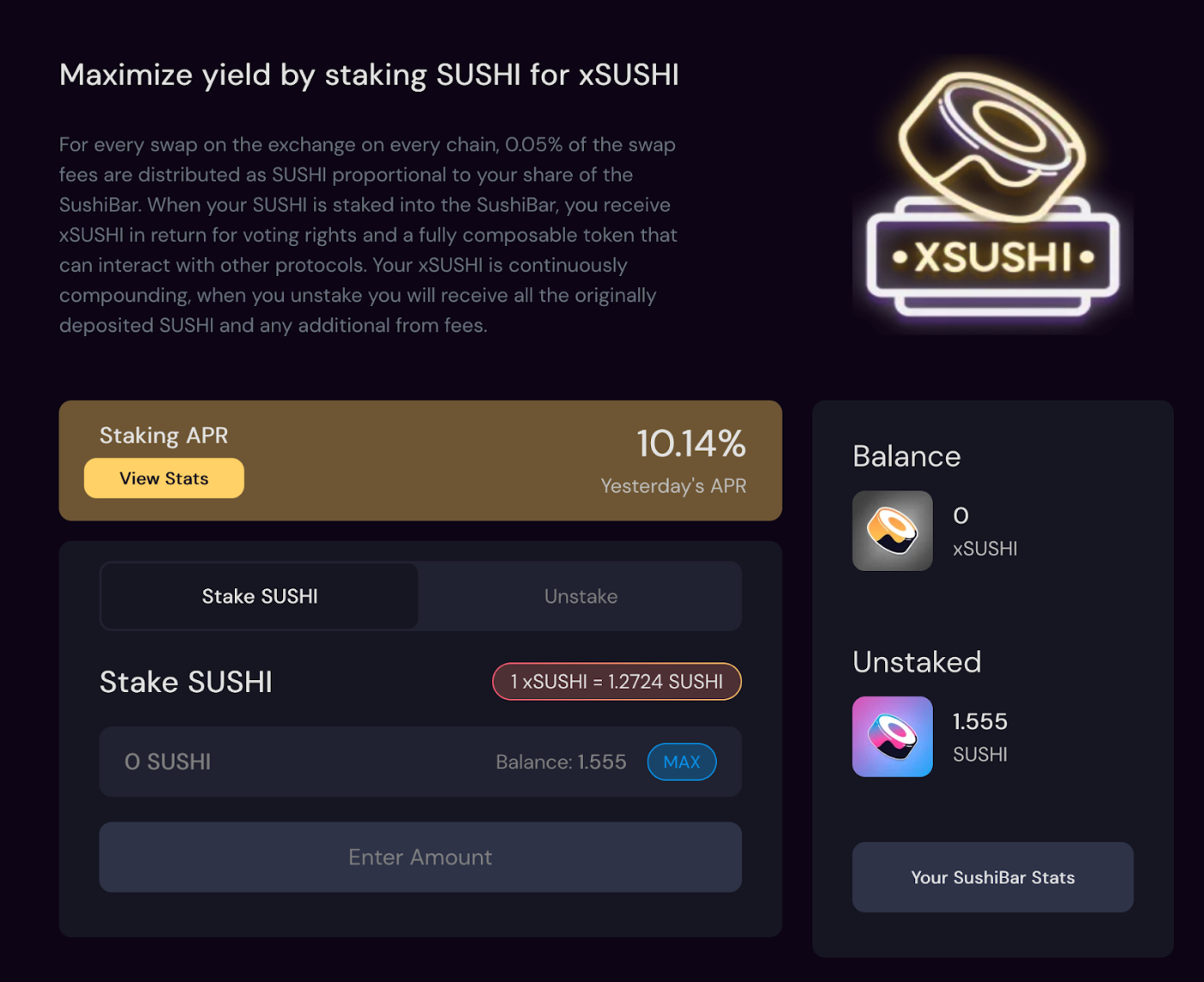

Fee sharing is one way a token does this. If you buy SUSHI, you can just hold it to speculate on the long term value of SushiSwap. Or, you can stake it for xSUSHI, which will earn you a share of all the fees generated by the platform:

xSUSHI is a “liquid staking token.” You have staked your Sushi and you’re earning fees, but the way you earn fees is by the trade-in value of xSUSHI increasing over time. This lets you take your xSUSHI elsewhere, in case you want to deposit it in AAVE or elsewhere as collateral to borrow again.

Getting 10% APR is much better than getting 0% from holding regular SUSHI, but you still have to ask if that APR offsets any depreciation against ETH or whatever your base asset is. And unless you bought Sushi in November 2020, you got a bad deal:

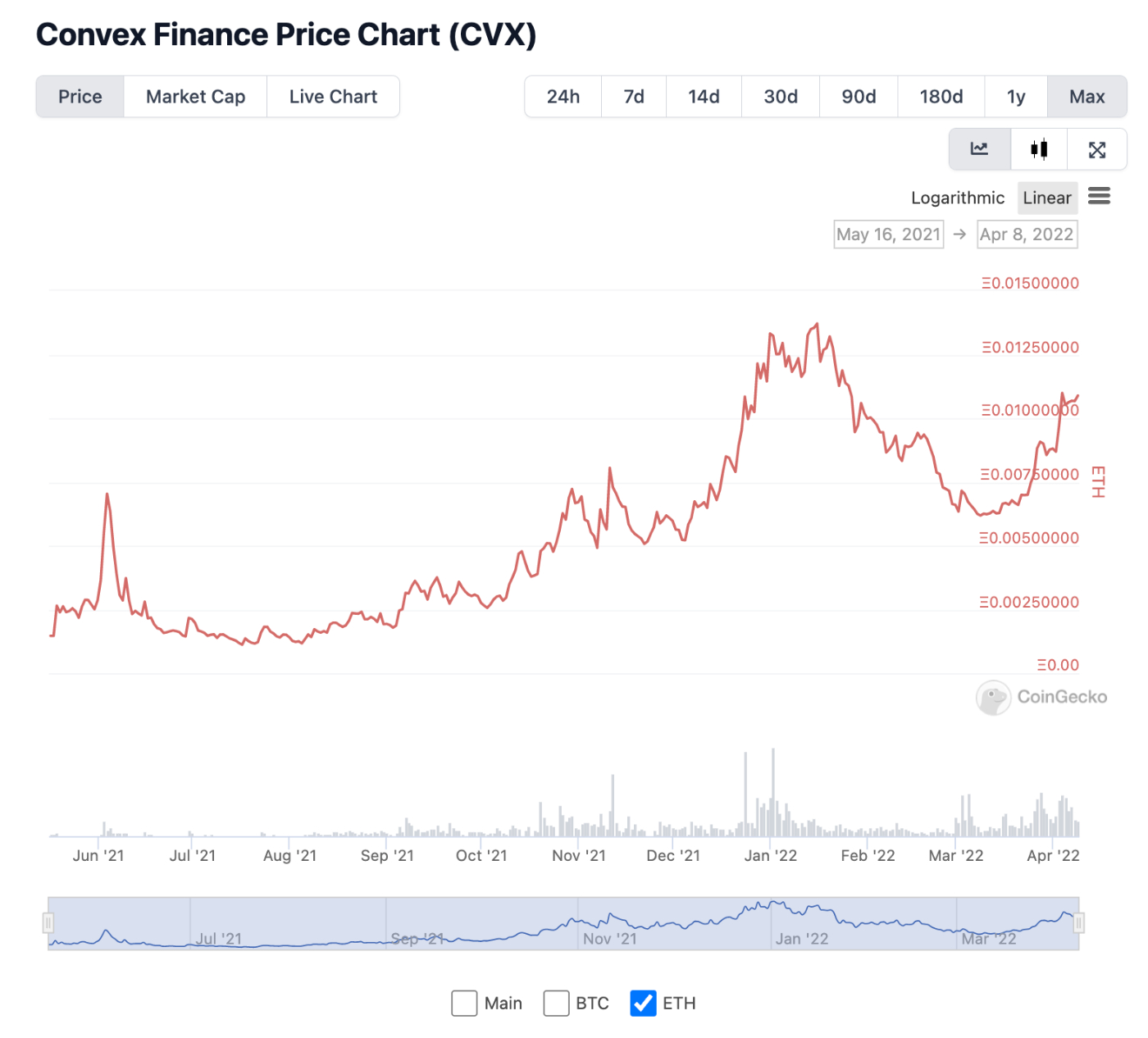

Another cash flow token I talk about a lot is Convex. According to Llama Airforce Union (all of this explained in the Curve Wars article), the current APR on locked Convex is 44%:

And if you look at Convex against ETH, it has held up much better:

So this is a token which has so far appreciated well against ETH and is paying a 44% dividend. That’s a huge win-win. Even if you bought the top of CVX in January, three months of yield (about 10% ROI) makes up for a lot of the drop between then and now.

The last thing you want to make sure of with cash flows is how those cash flows are being generated. If staking the token is just earning you more of that same token, and that’s how they’re releasing their token into the wild, then you’re not really earning anything. You’re just saving yourself from being diluted.

You want to look for projects where the cash flows are based on actual revenue, and ideally not paid in the token you’re staking. Convex pays you based on bribes, and you get paid in a variety of tokens. With staked RAIDER, you earn AURUM based on the amount of AURUM spent in the game.

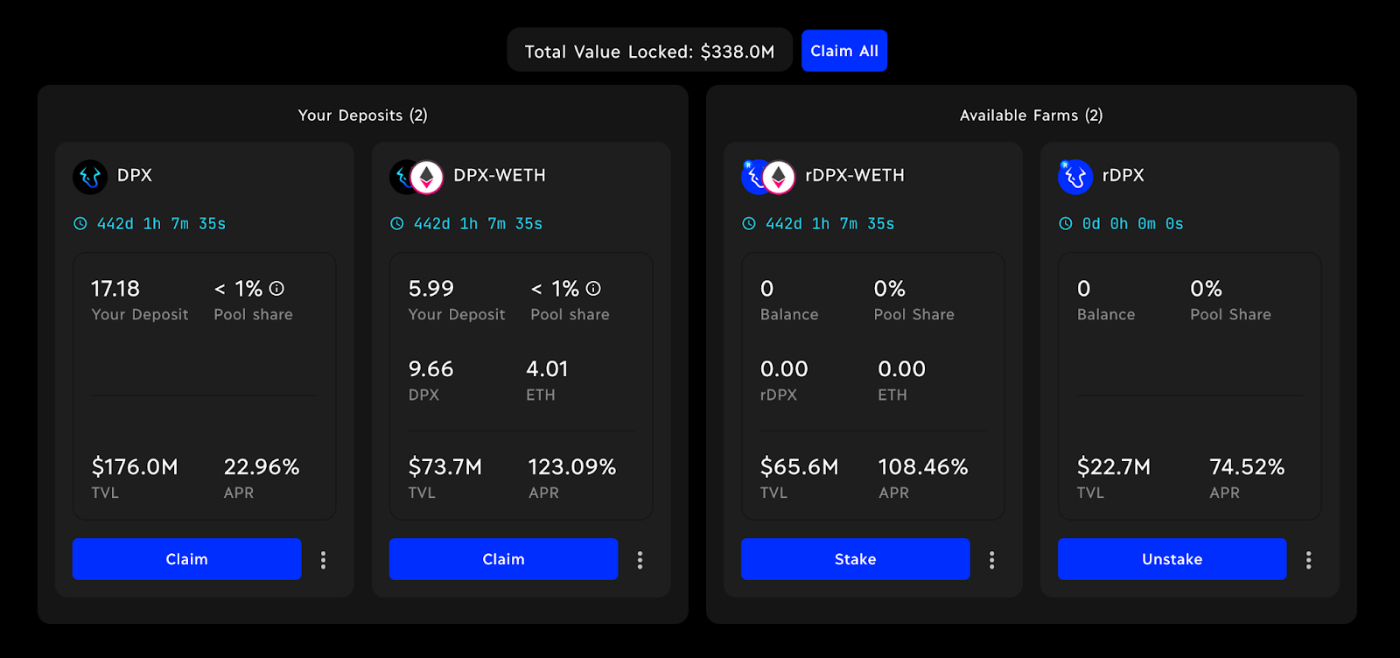

But for Dopex, the staking revenue is currently paid in DPX and rDPX as a way to release the tokens until they have revenue sharing turned on. So it’s not quite as good of a cash flow system as Convex yet, but it’s at least reducing how much your share of the protocol is diluted. And they’re switching this over to a true revenue sharing system sometime in the near future.

To me, cash flows are the most interesting form of utility for a token to have. If it’s a token you’re meant to hold, then it needs to be more worthwhile to hold than just holding ETH. Aside from speculating on future price increases, cash flows are a good way to justify that.

There are a couple other considerations still though, the next one being governance.

Governance

If you love a protocol and you want to be involved in shaping its decisions, then governance is the another utility that could make you invest in it even if it doesn’t pass some of the checks above.

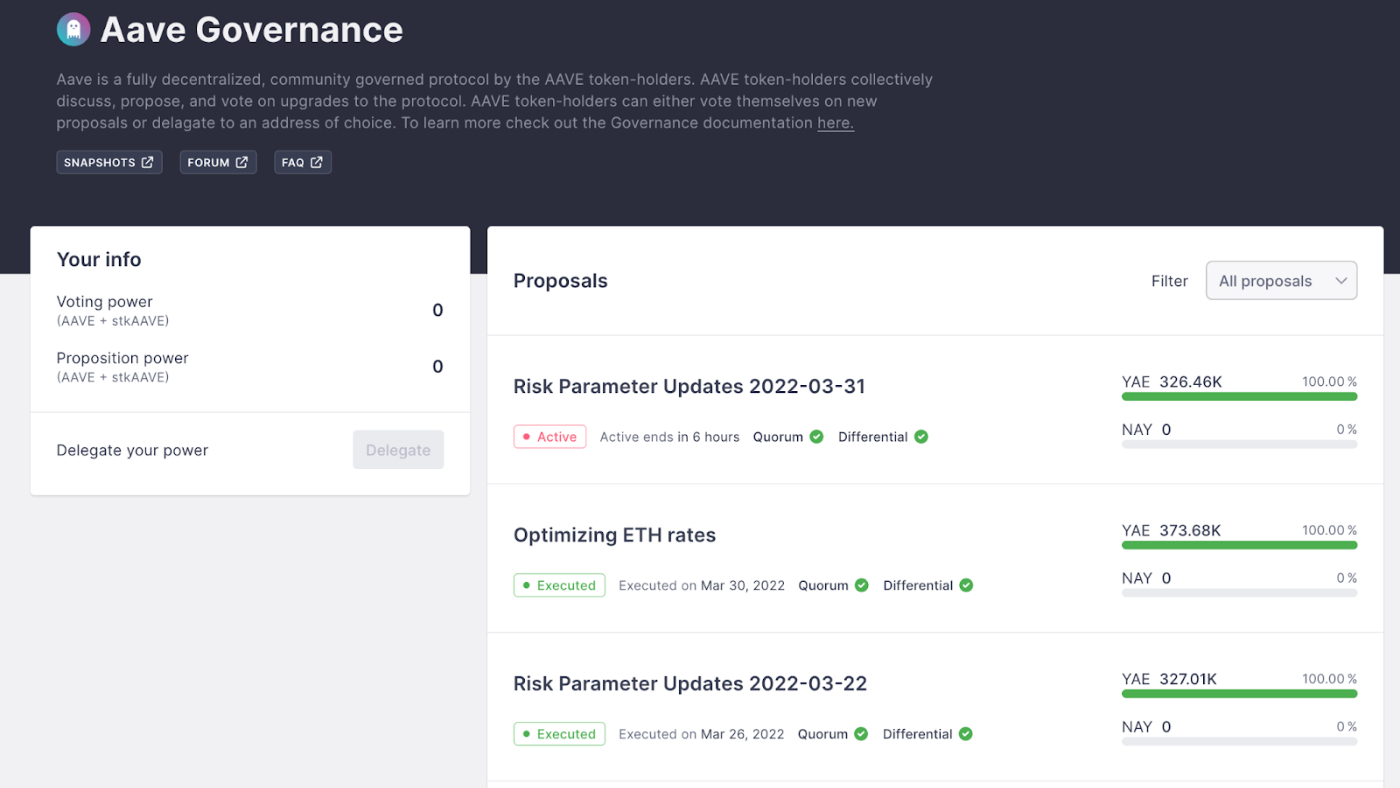

AAVE, for example, has a rough chart compared to ETH:

But the AAVE governance forum is extremely active, with most votes attracting 250,000 - 400,000 votes:

So if you’re another DeFi protocol, a VC firm, a whale, or just anyone who wants to have some sway over future AAVE decisions, it might be worth holding some AAVE tokens to vote on these proposals.

I’ve personally never felt this benefit to be super compelling. I’d rather trust AAVE to make the best decisions for their platform. But in some cases it can be lucrative. Convex’s cash flow is technically through bribing governance votes, so if a protocol has particularly impactful governance votes, owning a say in those decisions can be lucrative.

If you’re holding DAO tokens this is also one of the big benefits. The more CabinDAO tokens you hold, the more say you have on how Cabin funds are used, and on who gets to attend the fellowships. The same goes for other popular DAOs like FWB.

So if your goal is participating in a community, governance is a great perk for a token. If you just want to maximize the ROI of things you’re invested in, it’s rarely enough on its own.

Then the last thing you might consider before holding a token is whether or not you can use it as collateral.

Collateral

If you’re buying into a project and you want to hold it long term, the last thing you want to have to do is sell that token if you suddenly need liquidity.

Maybe your tax bill comes in unexpectedly high, or you want to make a downpayment on a car, whatever it is, being able to access some liquidity for your investments helps significantly with being able to hold them long term.

So the last question you might ask is whether you can use this token as collateral to borrow against, using one of the major lending platforms.

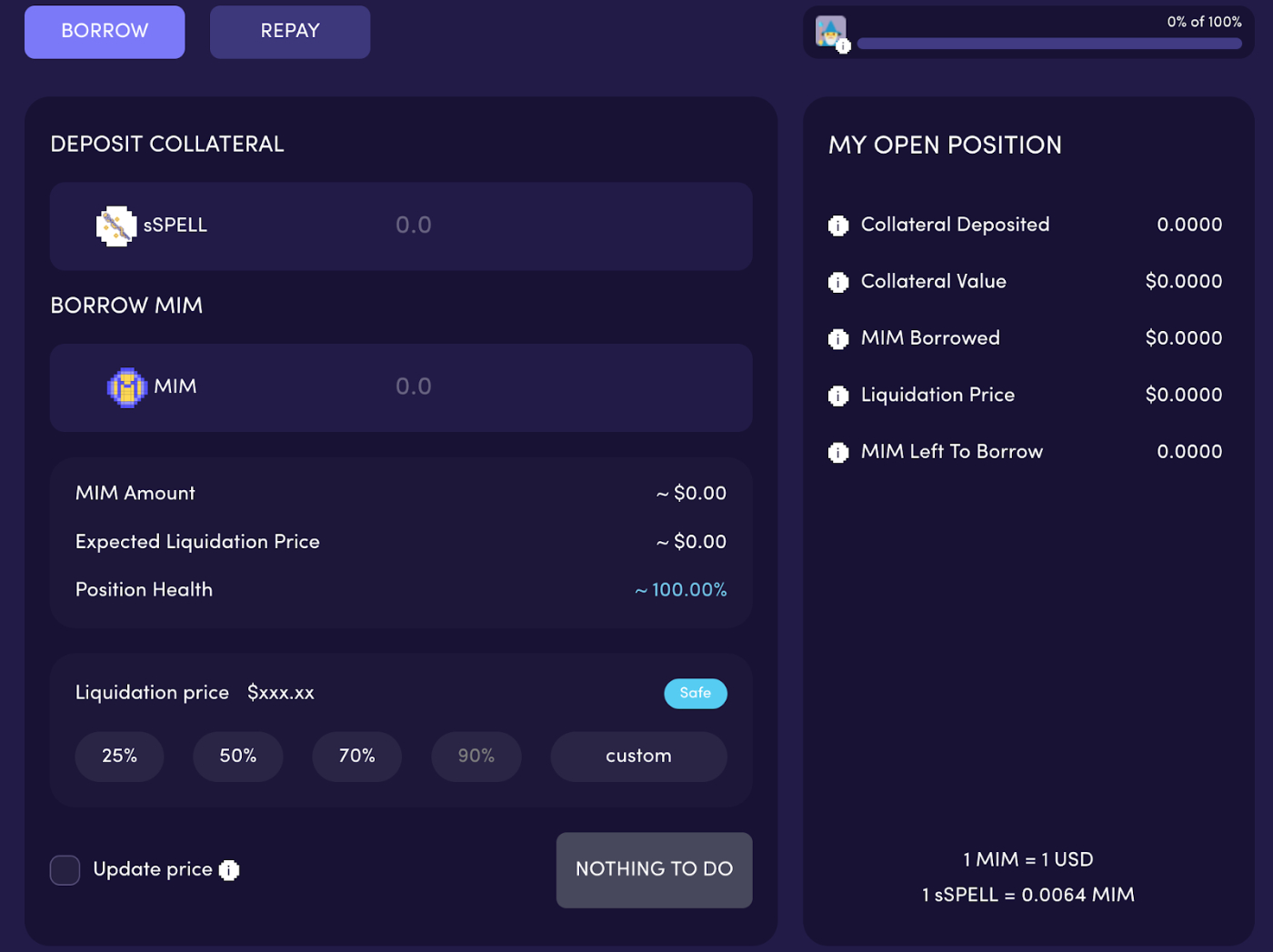

The xSUSHI example above is a good one, since you can deposit xSUSHI on AAVE to borrow against. It doesn’t pay much interest, but you’re still earning 10% while it’s deposited, and you can borrow up to 50% of the value in any other asset on AAVE like ETH or USDC. You can do a similar thing on Abracadabra, where you can borrow against your staked SPELL tokens:

This is probably the least significant of the utility factors, but it’s still worth considering. Being able to borrow against an investment makes it much easier to hold on to.

Starting to Tie it Together

We’ve now covered two of the more in-depth topics: supply, and utility.

I’ve done it in this order since I usually look at how the supply is structured first, and if it passes the tests laid out in that article, then I think about the utility of the token.

If it passes these considerations as well, then it’s getting closer to feeling like a good investment to me.

But there are still more factors, like game theory, growth, and adoption, which will be covered in future posts in this series.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!