This post is a walkthrough of how you can earn “passive income” in DeFi, inspired by a panel I am speaking on at Consensus 2022. For regular readers, it may be more intro-level than usual, though maybe you know someone who could benefit from this!

For Consensus newcomers, welcome! I publish a crypto article almost every Friday, often focused on tokenomics, DeFi, or gaming.

Let’s start with the important caveat: there is very little “passive income” in DeFi. Passive income suggests you have built some product or business which can generate profit for you with minimal or zero continuing effort on your part.

Unless you write a smart contract that charges fees that are paid to you, or sell an NFT with royalties that keep accruing to you, most returns in DeFi are not really passive income. They’re better understood as “yield.” Returns on your assets that you are putting to work in the DeFi ecosystem, either to help another platform function better or to simply take advantage of free tokens that are being kicked off.

The core difference is that passive income is something you could accrue without an existing amount of capital. But if you want “passive income” in DeFi, you almost always need some amount of crypto assets you’re willing to put at risk. Those assets are what earn you your yield.

As I explained in “How are DeFi Yields so High?” The sources of yield vary. Some are dividends of profitable crypto businesses. Some are the fees you’re earning for helping provide a service. Others are completely unsustainable free money faucets, the amped-up crypto equivalent of VC-subsidized Uber rides.

But regardless of where they’re coming from, there is free money out there for those who want to claim it. You just have to know where to look, and how much risk you’re willing to take.

Through the rest of this post, I’ll explain some of the safer easier ways you can earn passive yield on your crypto assets. At the end, I’ll go over assessing whether or not it’s worth it, and where some of the hidden risks are.

How to Earn Passive Yield in DeFi

There are five broad sources of passive yield in DeFi:

- Lending

- Trading fees

- Staking

- Platform incentives

- Aggregation

Each can allow you to earn some passive return on your capital at various APRs and risks, depending on your tolerance and how much time you want to spend managing it.

Lending (low risk, low maintenance, low yield)

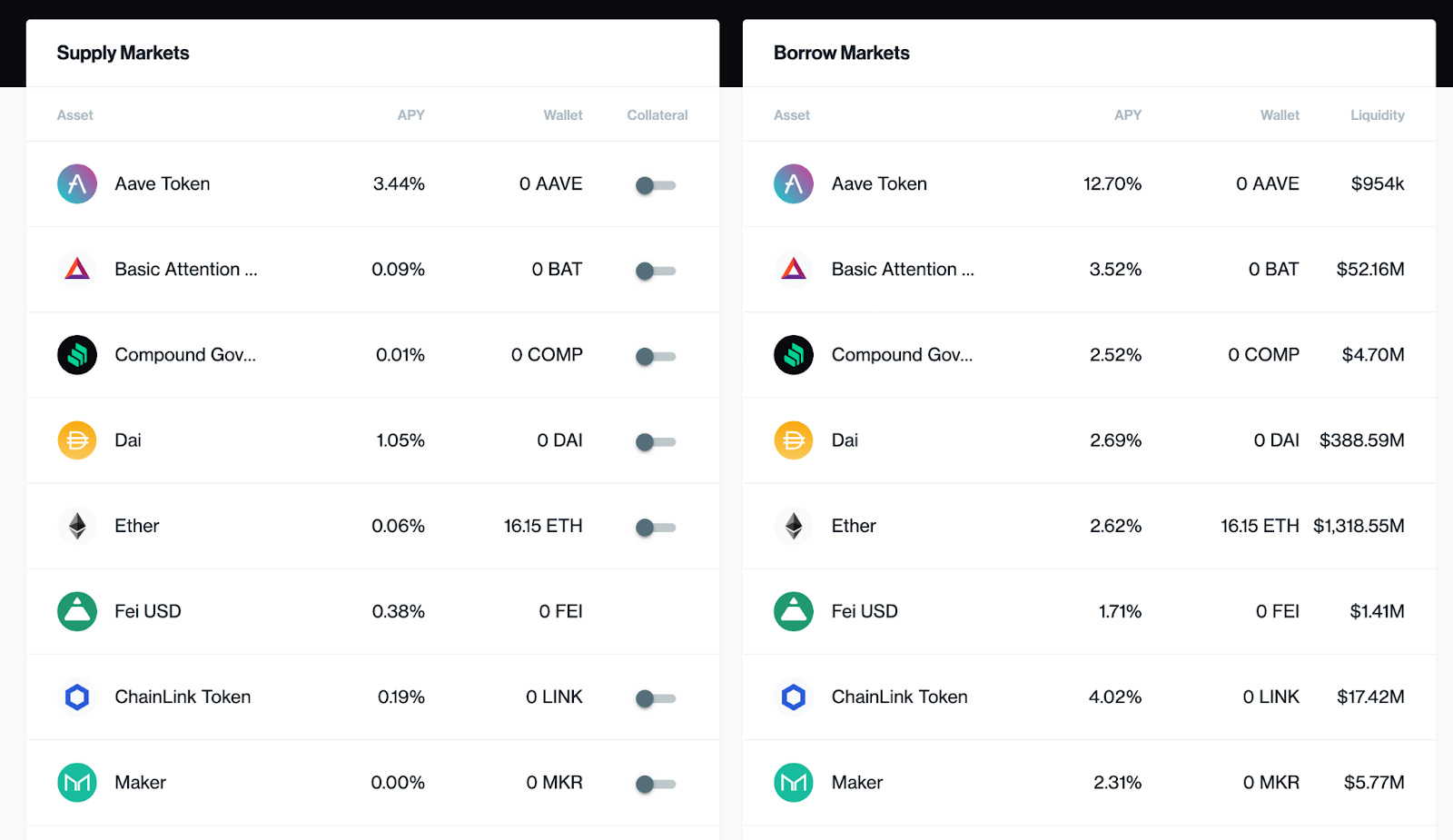

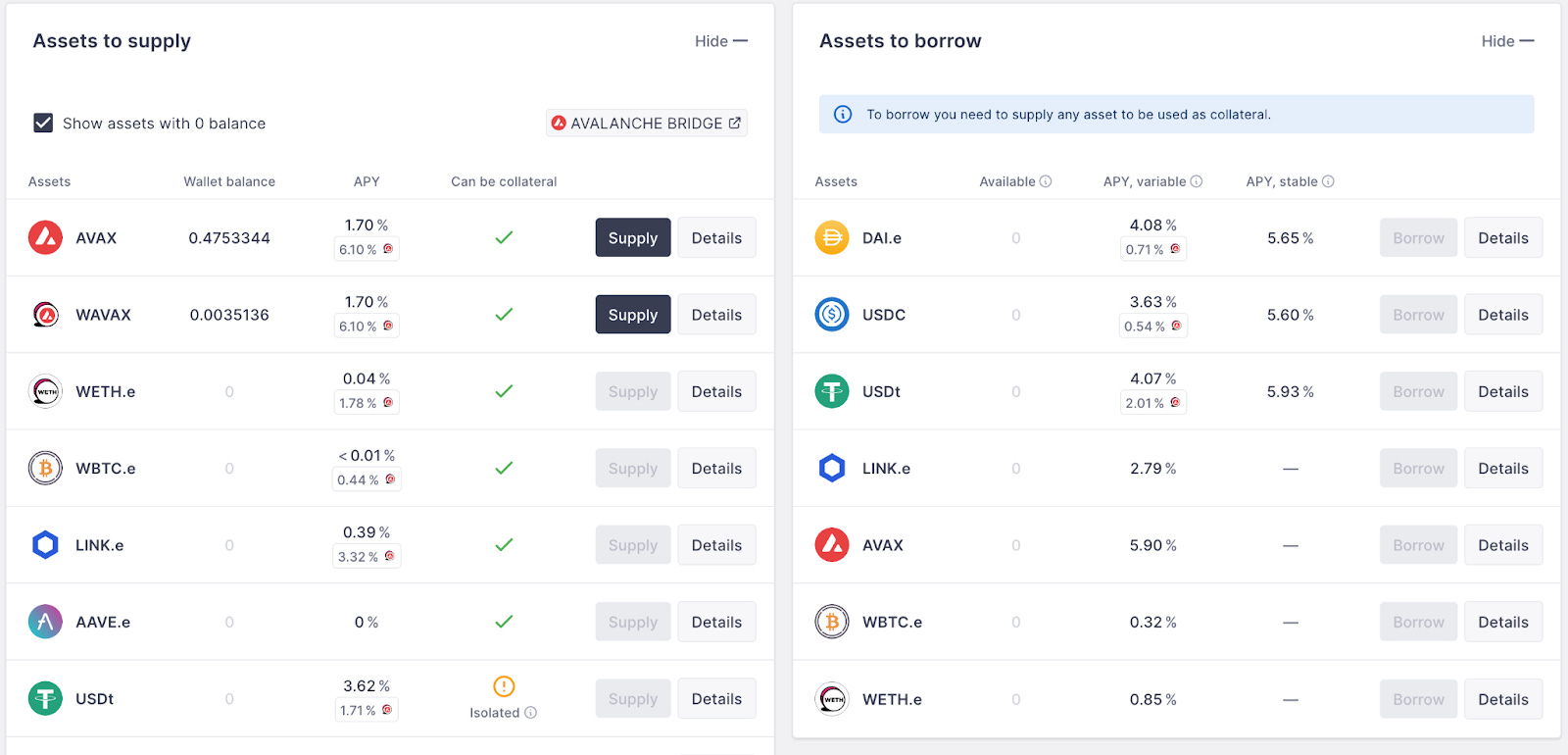

The simplest way to earn yield in DeFi is to supply assets to a borrowing platform like AAVE or Compound, and get paid a small amount of interest from the people borrowing that same currency from the platform.

When you deposit assets into AAVE, Compound, Rari, or other lending protocols, you are then able to borrow other assets against them. Deposit somet ETH, and you can borrow USDC against it.

When you borrow USDC, you have to pay interest on it. That interest rate varies based on the demand for borrowing USDC, is compounded by the second, and has to be paid whenever you pay off your debt. If you don’t pay it off or the debt gets too high, the platform can take your collateral to pay your debt.

When you pay interest on the USDC you’re borrowing, some of that interest goes to the platform itself, but most of it goes to the other users who supplied the USDC that you’re able to borrow. So when you deposit some of your funds into these platforms, you’ll earn a bit of interest from the other people paying interest on borrowing those funds from the platform.

If those people default on their debt, you’re protected, because the platform will seize their collateral and sell it to protect your assets. And despite the many catastrophic meltdowns in DeFi, the major lending platforms Compound and AAVE have never had any issues for depositors.

So this is very safe, and requires no maintenance, but the yield is very low. You’ll typically only make 2-4% on stablecoins, and next to nothing on ETH or wBTC. You can also read more about this strategy here.

Trading Fees

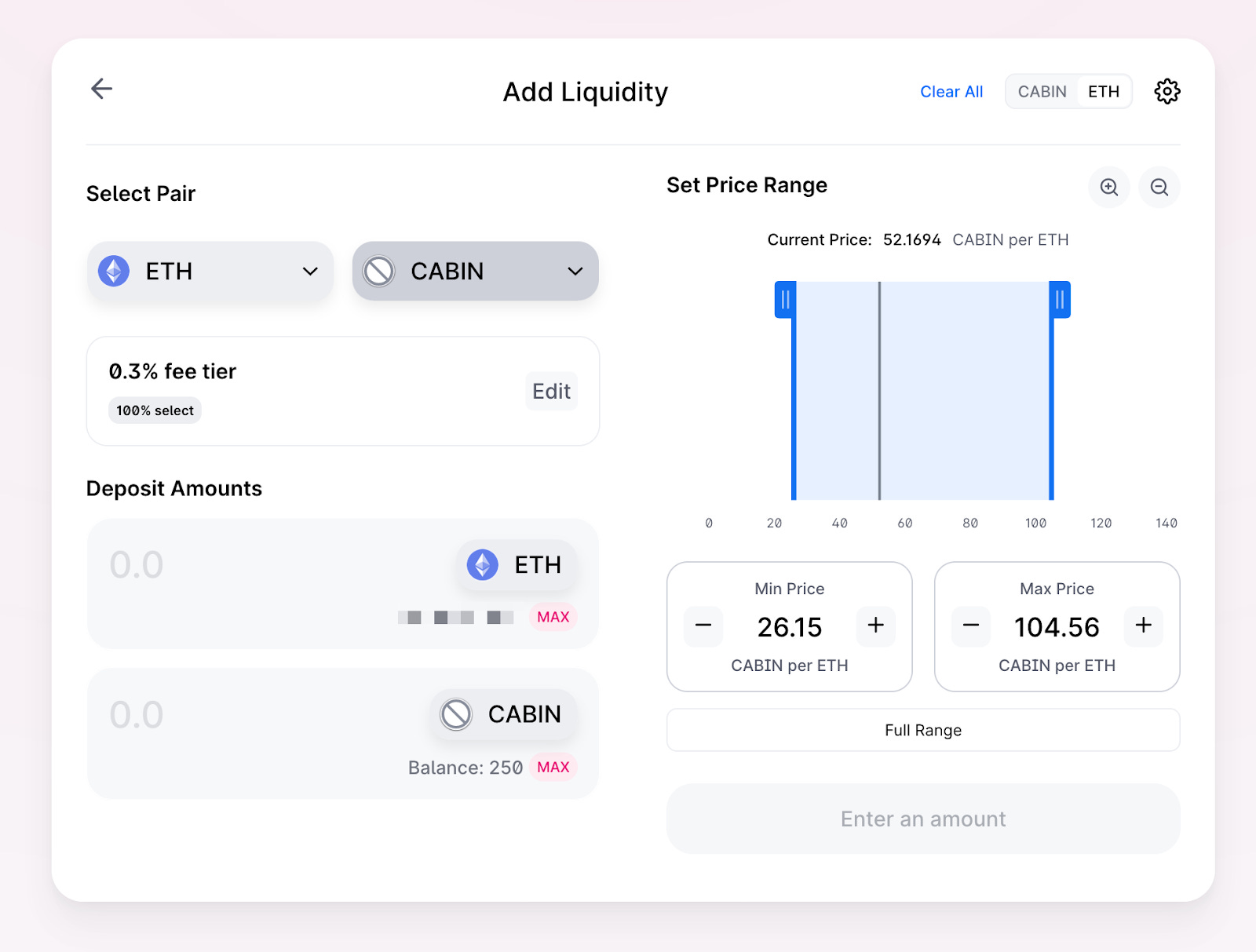

Your next option for earning some passive yield on your assets is to supply your assets to decentralized exchanges, so other people can trade between them and pay you a small fee.

Think of this like lending money to the currency booth at the airport. People want to trade between Dollars and Euros, so you give the booth 100 USD and 100 EUR. At the end of the day you come back, and they give you back 120 USD, 80 EUR, and an extra $4 in trading fees generated from people swapping between the two.

You can do the same by depositing your crypto assets into decentralized exchanges like Uniswap, Sushiswap, and Curve. You supply the assets, people trade between them, and every time they trade, they pay a small fee. When you withdraw your assets, you get your share of the fees generated, based on what percentage of the total trading pool you contributed.

While your funds are very secure using this strategy, you do open yourself up to impermanent loss. If you’re supplying tokens with prices that fluctuate a lot against each other, like ETH and USDC, you might lose money if their prices change significantly. Thankfully the yield on supplying volatile assets is also higher, so it can be worth it. It’s just a risk you have to decide if you want to take.

This is reasonably safe, has minimal maintenance, and has a highly variable yield. Typically the riskier the pair is, the more your yield will be. You can read more about this strategy and how it works here.

Staking

There are two kinds of staking. Real staking is when you contribute some of your crypto assets to help secure a crypto network, like staking your SOL to secure the Solana network, and soon staking your ETH to secure the Ethereum network.

In return for doing this, you earn a share of the new tokens that are being emitted plus some share of the gas fees being charged on the network. So it’s kind of like earning a dividend for helping secure the network with additional collateral and processing power.

Many projects will have “staking” but it’s just a way to get you to lock up your tokens and not sell them by giving you free tokens. You’re not securing a network or doing anything particularly useful besides not selling your tokens. This is a way to get free tokens, but you’re not really earning yield, you’re just protecting yourself from dilution.

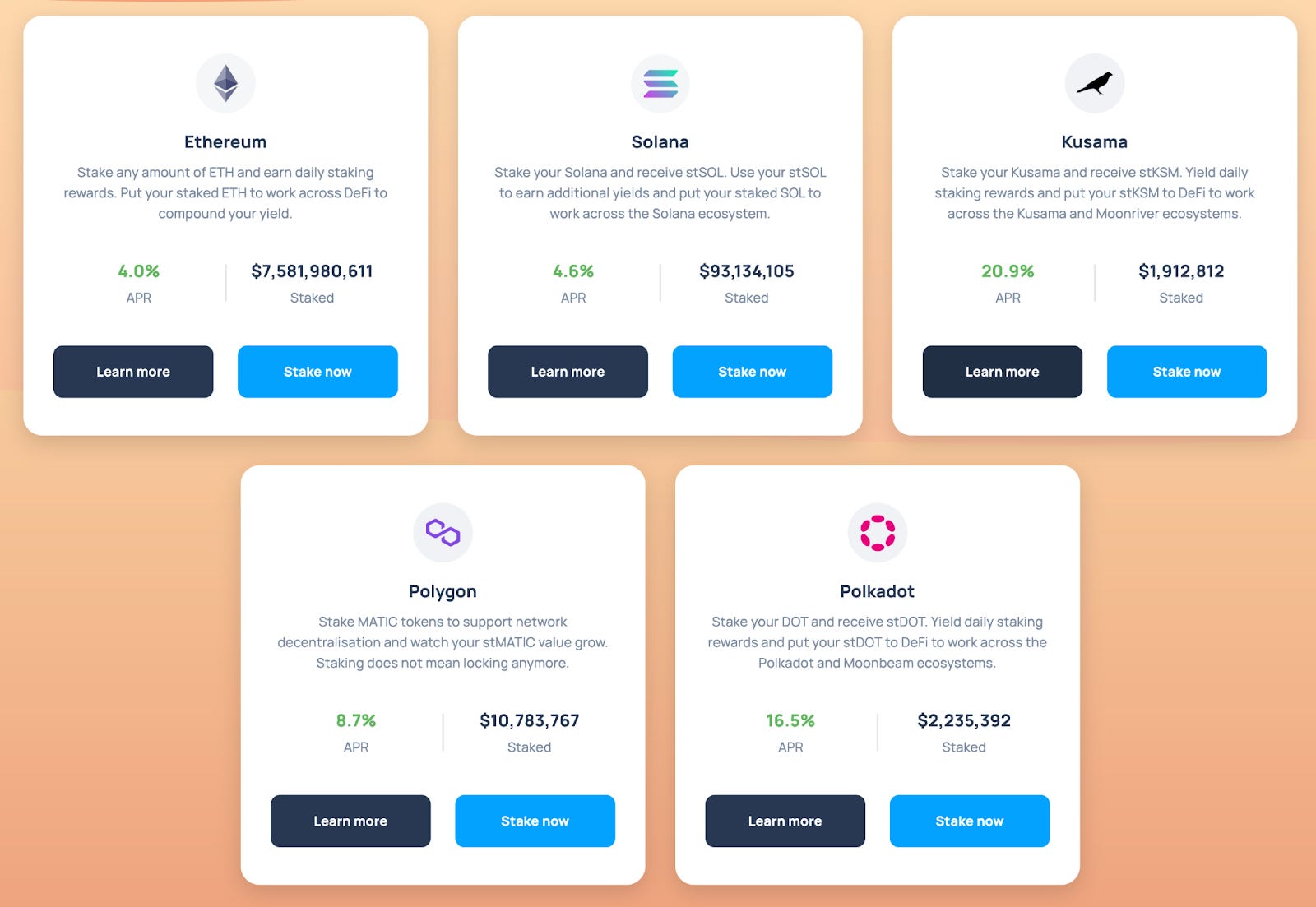

For real staking, you have two options. You can set up a validating node yourself depending on what network you want to stake tokens on, or you can just buy liquid staking tokens from a service like Lido. By going to Lido you can exchange your ETH for stETH, a token which earns about 4% APR in ETH while sitting in your wallet.

It’s among the safest options, has no maintenance, and has a low but very predictable yield. This doesn’t really require a blog post, you can just check out Lido, Rocket Pool, or look for other liquid staking solutions if you want to get started.

Platform Incentives

Platform incentives are where you can see the insane APRs start to appear, as protocols gives away their tokens to incentivize more people to use their products.

I mentioned AAVE above, and if you use AAVE on Ethereum you are getting low predictable yield. But if you use AAVE on Avalanche, your yields are higher, because Avalanche has given AAVE free AVAX tokens to give away to incentivize people to migrate funds to the Avalanche chain.

These platform incentives can often be worth moving your funds around to different platforms to find the best yields, a process called “yield farming.” For example, let’s say you want to earn the highest yield on your USDC. You could pair it with DAI and deposit the two into the Uniswap DAI/USDC pool to earn trading fees. But Curve pays you extra CRV tokens to deposit your stablecoins there, so it might be worth it to deposit your funds on Curve instead.

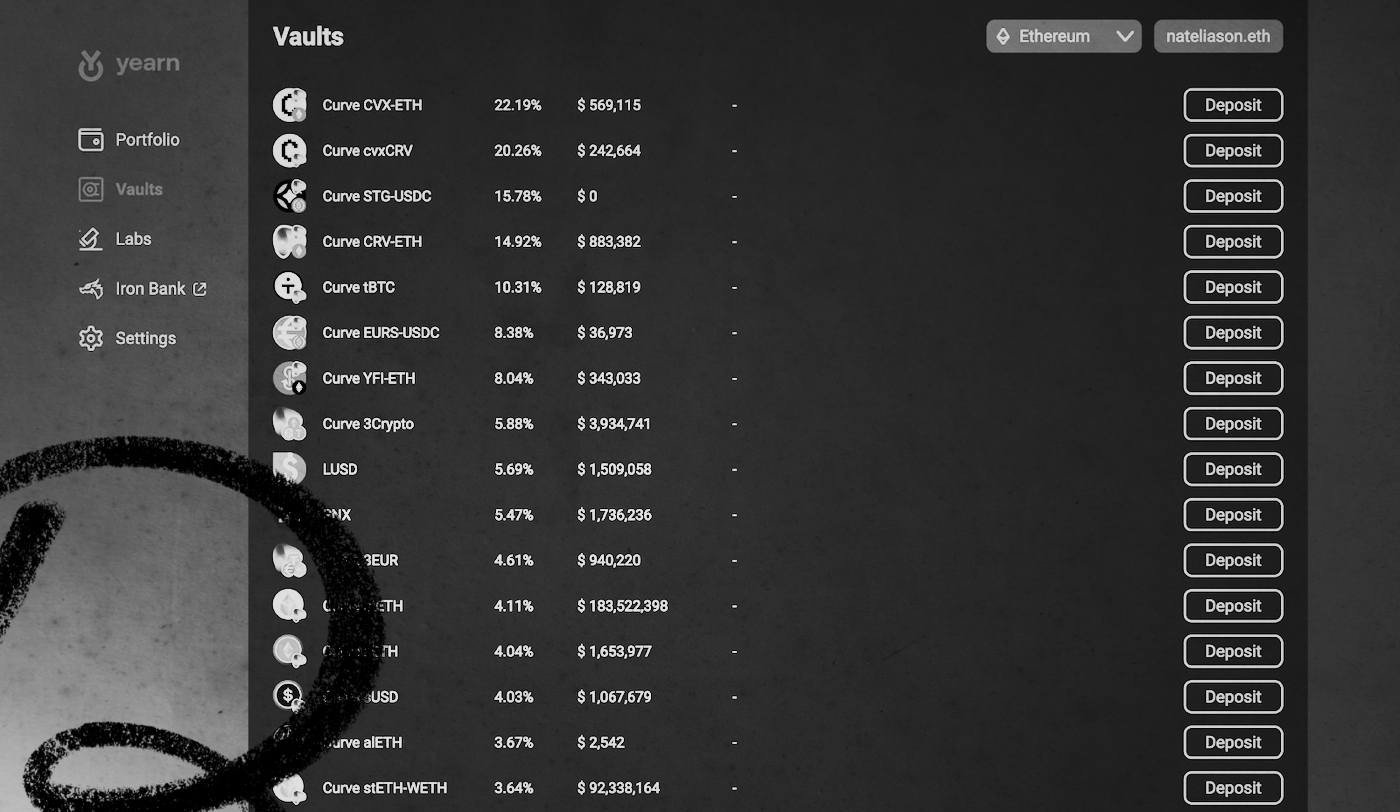

Then even within Curve, there are different pools that will pay you more or less CRV tokens for the same amount of USDC. So you could rotate your funds within different pools to maximize your yields.

Platform incentives are where you can get into an insane amount of optimization, earn the highest yields, spend the most time micromanaging it, and also have the highest risk of blowup. If you want more, I have an in-depth guide to farming with stablecoins that covers finding these opportunities. And if you want the super degenerate yield farms that pay out 1,000%+ APR and will probably lose you all your money, you can go shopping on VFAT.

Aggregation

Finally, there’s aggregation, which is essentially a metalayer on top of these other methods. Yield aggregators tap into these other sources of yield and do the farming for you, so you can just deposit your investment and let the aggregator take care of the farming for you.

There are two main types of aggreagors. Autocompounders will focus on a specific source of yield, harvest the rewards, sell those rewards for more of the underlying tokens, then reinvest those tokens for you. This is a process you would otherwise have to do yourself and could incur a significant amount of gas fees in the process, so they’re able to save you quite a bit of time and energy.

Then the “true” aggregators collect yield from a variety of sources to give you a blended APR that should reduce your risk exposure while balancing out your earnings over time. Yearn’s token vaults like for USDC and ETH take a variety of strategies to earn yield on the assets, so you don’t have to keep hunting for the best returns.

These aggregators are almost like democratized hedge funds that you can deposit and withdraw funds from any time, at any amount, and which anyone can access. They require no maintenance, are relatively low risk, and can sometimes have good yield. Though since they’re using the strategies already laid out and taking a fee off the top, they will typically pay slightly less than doing the strategies yourself.

You can read more about how they work here, and definitely check out Yearn if you want to try using one. You can also look for good farms to autocompound on Beefy.

Getting Started

If you want to get started with these simpler, safer methods, here’s the easiest way. I’ll assume you have some ETH on Coinbase or another exchange already.

- Install MetaMask

- Send in your ETH from Coinbase to your new Metamask wallet

- Go to any of the sites linked above (you’ll have the easiest time with the AAVE or Yearn strategies)

- Deposit your funds

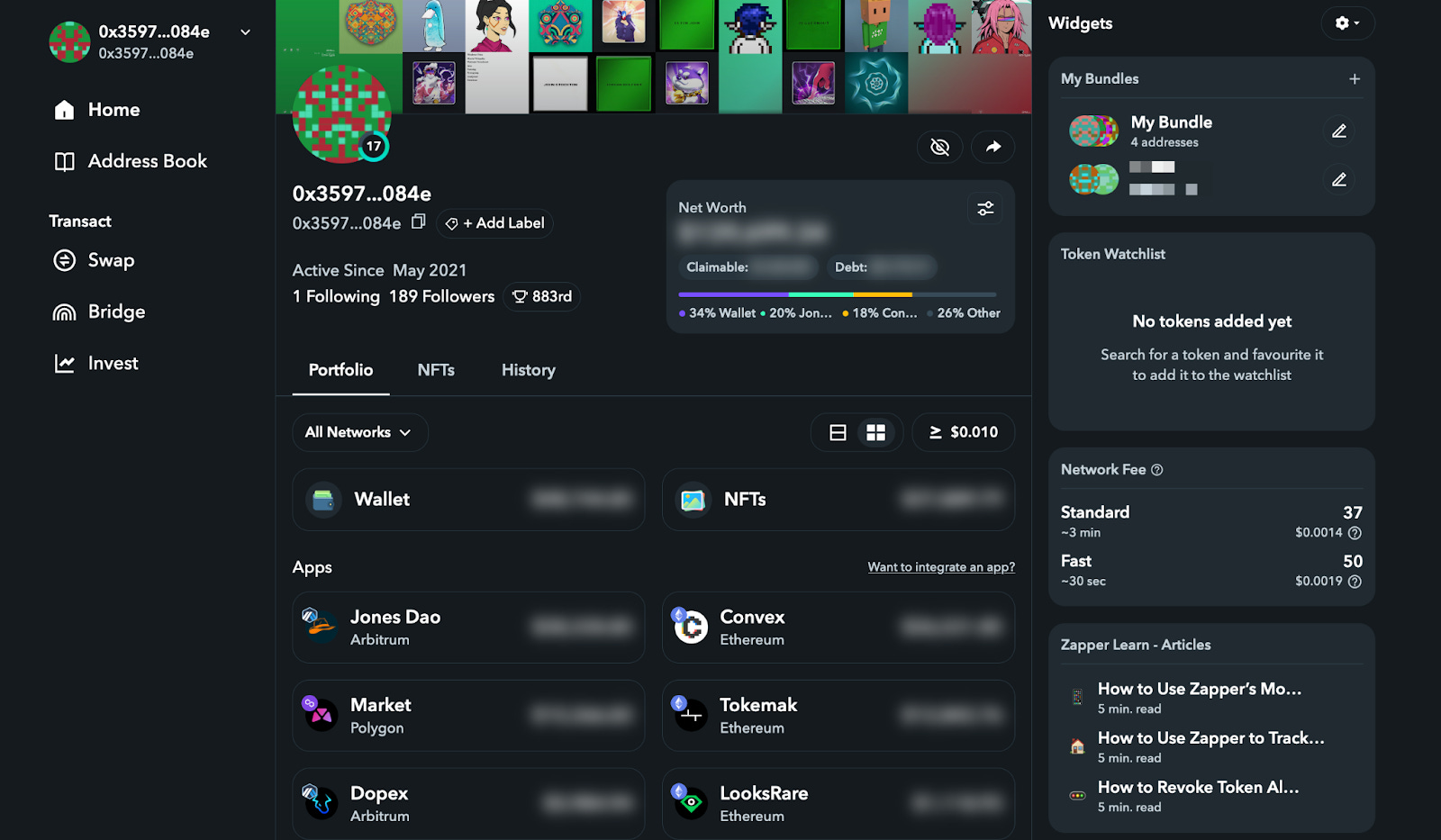

- Watch your portfolio on Zapper!

And that’s it! You’re earning passive yield. If you want to find more platforms to experiment with, the easiest way is to go to DefiLlama and scroll through the top projects on every chain sorted by Total Value Locked. TVL is a decent proxy for legitimacy, since the more money in a project the more battle-tested it is. It’s not perfect, though. Luna had billions in TVL.

Speaking of, let’s talk about risks quickly.

Is Passive Yield in DeFi Worth It?

When you hear “passive income” or “passive yield” you assume it should be fairly, well, passive, right?

Most stuff in crypto fails that test. It could blow up, you have to move things somewhat often, there are tons of risks that go unacknowledged, and you can’t really leave it for a few years without touching it. Except for maybe a couple of things.

So you aren’t really getting passive yield the way you might from holding a bunch of dividend-paying stocks in your brokerage. It still requires more maintenance, and the downside is much higher.

For example, if you put your life savings into Anchor Protocol to earn 20% APR, you might have lost 50% of it or more when Luna broke down. Was earning 20% worth the risk of losing everything? Definitely not.

Despite writing about stablecoin farming in the past, I don’t do any of it now. Even if I can get 10% on my USDC, I’d rather have those dollars sitting in a fiat bank account because I think that risk-adjusted rate might be higher. This is a privilege I have by living in a country with a secure banking system though. That calculus might be different for someone in a developing nation.

That said, I keep a lot of my ETH in Lido’s stETH. I consider it extremely low risk, and since I’m going to hold all that ETH anyway, I may as well earn 4% on it. The nice thing about stETH too is it’s extremely low maintenance. I don’t have to do anything, it just sits in my wallet. If you want more than 4% on your ETH, there are other ways to get it.

But, you should play around yourself and decide what makes sense for you. I’ve had plenty of fun on the more degenerate side of DeFi as well, though I think it’s mostly lost me money. If nothing else, experimenting and putting your money in a few different places is a great way to get your feet wet and see how everything works. I’d check out my Tokenomics series too if you want help evaluating projects, and you should also make sure they aren’t ponzis.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!