Sponsor Every

I am in the fortunate position of getting to sling words for a living. These words are sponsored by advertisements. Like this one!

But this is a special ad because it is an ad letting you know that Every is accepting some new sponsors for the fall. We have great ad performance, a best-in-class audience of 50,000 investors/founders/executives, and you also get to feel fuzzy because you are helping me make rent. Win, win, win.

Learn more about rates and performance here.

We’re at the fun part of the market where crypto has lost trillions of dollars in value and people are scrambling to make up reasons why it’s useful.

Many of these reasons are painfully cringe attempts to copy the new technology onto old paradigms in a masochistic sort of skeuomorphism that would only be envisioned by marketers and influencers who have never built the kind of technology they’re LARPing as innovators of. “Facebook could give everyone a META token and you earn more of it when you get Likes and you can cash that out for ETH and…”

Crypto is EARLY. Painfully early. If you’ve ever used any of the types of applications I talk about in this newsletter then you know the user experience is usually terrible. If you make a careless error you might lose all your money. If you pick a token at random it’s more likely a scam or shitcoin than anything legitimate. And we’re still five to ten years out from anything close to mass adoption of anything besides HODL and speculative gambling.

That doesn’t mean there’s nothing there, though. Crypto and the blockchain technology it’s built on do have the potential to create a new wave of the Internet, it’s just going to take some time. And to understand that potential, it’s helpful to look at some of the past major paradigm shifts in technology and see what we can learn from them.

Let’s start with mobile. The mobile revolution enabled:

- A new physical form of interacting with computers (small touch screens)

- New sensory forms of interacting with computers (audio, kinetic, visual w/ cameras)

- Mobility, you weren’t tethered to an office anymore

From those few things, we got an incredible amount of innovation. An amount that would have been hard to predict if you just had that list as your starting point. Uber needed mobile computers. Snapchat and Instagram wouldn’t exist without the cameras. Fitness apps needed kinetic sensors. Podcasts and Audiobooks needed computers with audio on the go. But none of those applications are obvious from the basic set of innovations.

The Internet is even simpler. What did it do, really? You could sum it up at the foundational level with: Computers can now talk to each other. You don’t need to be physically in front of some computer to utilize a process that’s living on it. And from that simple innovation, we got all of this.

If you were hanging around when they first started wiring computers together and you said, “One day this simple innovation is going to let people make millions of dollars selling pictures of their feet to strangers,” Al Gore would say, “please put on some shoes and get out of my office.” But that’s what the Internet did!

Okay, now let’s talk about crypto. We’ll start with what the blockchain, crypto, and web3 tech actually enable.

Then once we understand that, we can look at what it might let us do in the future while recognizing that there will be many things on the order of feet pics and Postmates that we probably can’t predict.

Sponsor Every

50,000 of the top operators, founders, and investors in tech read Every, every day. You can reach them and grow your business by running a sponsorship with us.

What Crypto Technology Actually Does

Keeping with the ultimate simplicity theme from above, what does crypto technology enable?

Crypto and “Web3” are really all about blockchain tech. And what a blockchain lets you do is run perpetual decentralized applications.

They’re perpetual because they will always run forever if the blockchain is running. You don’t have to keep “hosting” the application like you do for a Web2 app. And they’re decentralized because they’re running everywhere all at once.

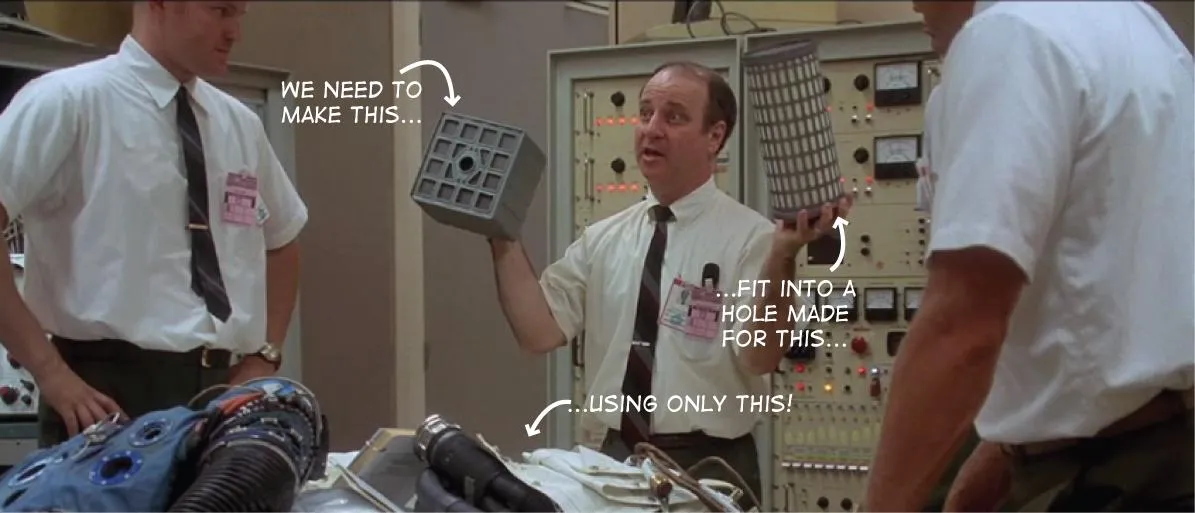

It's important to highlight that crypto is a backend innovation, akin to the first Internet innovation, and very different from mobile, which was a user experience innovation. Just as the first web pages looked a lot like newspaper or magazine pages translated onto a computer screen, we’re still in the early skeuomorphic phase of crypto applications. The front end has not caught up to the backend.

There are other benefits from blockchain technology, like legibility of activity and potential for democratized access, but those aren’t the core new tech offering. They’re consequences and uses of it. The core new technology really reduces to perpetual decentralized applications. That’s the thing that we couldn’t do before.

So, what can we do with that?

Current Uses of Perpetual Decentralized Applications (PDAs)

I try to keep a relatively level head about crypto, and at least 90% of it is nonsense right now. Maybe more like 95-99%.

But there are some real use cases right now that are quite good and provide a legitimate case for the value of blockchain tech.

I should emphasize, though, that if you live in the US, or another more developed country, some of these will seem silly to you. I’d encourage you to spend some time exploring what is like to live in a country without a robust banking system and with rampant inflation and/or corruption, and then look at these benefits through that lens.

Though, I guess the U.S. has decent inflation, and corrupt politicians getting rich off insider information too, so maybe you don’t have to think too hard.

Digital Gold

Bitcoin is the first innovative use of blockchain technology. Before blockchain, there was no way to have a global, digital, trustless, hard monetary asset.

If you live in the US or many other countries you could buy Gold ETFs and that kinda gets you close. But you’re still trusting some other institution to redeem that ETF, and the government or bank could easily seize it or restrict your access to it.

With Bitcoin, anyone in the world can buy it. It’s completely digital, so you don’t need to store it. It’s trustless because the network is designed in such a way that you don’t have to trust a third party to honor your bitcoin the way you do in the ETF situation (the whitepaper is worth a read to understand this), and it’s a hard monetary asset based on the fixed supply cap.

It was technologically impossible to create something like Bitcoin before blockchain tech existed. But it’s also one of the most obvious and simplest versions of applying blockchain tech. It’s akin to the instant messaging layer of the Internet. And it’s kinda boring. Who gets excited about gold besides your grandparents and that one guy you went to college with who bought a 100-acre ranch in Texas to prepare for the total societal collapse that’s definitely coming next year just you wait.

So, what else exists right now?

Digital Currency

People don’t like spending their Bitcoin, and with the transaction fees, it’s unlikely to ever actually be a “peer-to-peer electronic cash system” like Satoshi originally suggested.

Luckily, other blockchains are providing a digital cash system through stablecoins. Stablecoins like USDC and Tether as a way for anyone in the world to send US Dollars around are a massive improvement on the existing banking system in most of the world. And even in the US, sending $25,000 of USDC on a Saturday makes wiring money look like cave paintings.

Yes, you can’t use your stablecoins to buy much in the real world (unless you use a Junodebit card). And yes, you still need to convert it into local money in most places, and that might be expensive.

It is still very early, but despite the earliness, the global digital currency innovation is quite impressive.

Digital Ownership & “Property Rights”

Before perpetual decentralized applications, there was no way to make a thing online and guarantee someone could “own” it forever.

Domain names can be taken away by ICANN. This blog could get taken down by Substack. Your Twitter account could be taken down. Your Instagram photos could get wiped out.

You can only rent on the pre-blockchain Internet. But with code that can live everywhere forever, without needing a trusted third party to support it, you can own things in a way that’s arguably even better than Title rights in a developed nation. You do still rent your real estate from the government, after all.

Right now, digital ownership is focused on art, pictures of monkeys, and ENS domains. But if you looked at the Lightsaber and Beer-pouring apps on the 2009 iPhone and said, “see, apps are all silly!” then you would have been missing the point. We don’t really know what all will get done with digital property rights, but the fact that we have them for the first time is pretty exciting.

Decentralized Lending & Borrowing

In the span of about 5 minutes, I could borrow USDC against my ETH, transfer it to my Juno bank account, and buy a car with it.

I wouldn’t need to sign any loan docs or go through any kind of underwriting, no one needs to check my credit score, and my interest rate would be about 2 to 3%.

That’s super fucking cool. Yes, it’s somewhat inefficient since you can’t use the item itself as collateral as you can in a car or home loan. And yes, you need quite a bit of crypto for this to make sense for big purchases. But the fact that I can take out a huge loan like that, send it to my bank account, and buy something, is incredible. I could literally do that on my phone in the bathroom at the dealership.

And again, if you’re a wealthy person in the US, you might be thinking, “okay, I can get a portfolio line of credit with my bank too, so what?” but remember, most people are not in the US or living with a robust financial sector. And remember, the bank could take that money away, they could mess with your interest rate, they would care about your credit score, it’s much less convenient.

Right now, you can only use other cryptos as collateral, but we’re still in the early days. Lightsabers and beer pouring. MakerDAO is already working on bringing real-world assetson-chain as collateral. Multiple projects are creating on-chain versions of public company stocks. As more assets get moved or mirrored on-chain, the number of things you’ll be able to leverage will expand significantly.

Single Sign-On

Web2 companies like Facebook and Google have tried to make single-sign-on a thing for years. It started to get popular maybe five or six years ago, then everyone realized that if they shut down their Facebook or Google account, they would lose access to everything, and it started to wane.

But crypto applications are natively single-sign-on since you don’t typically create an account, you just connect your wallet. This is such a different experience that you’ll need to just try it to understand it, but it is a much nicer way of having an account on a website without having to give them a way to spam you.

Other Decentralized Financial Activities

There are also DEXes, Options trading, Perpetuals, and other financial tools and primitives being built as PDAs, but it’s kinda nerdy financial stuff and rather speculation heavy so I’m going to leave it out since it’s less attractive to the general interest in “why does crypto matter.” The other stuff above is more compelling.

Anyway, it’s a short list, right? Well, this is why crypto critics aren’t wrong when they talk about how “useless” crypto is. It doesn’t do very much right now, but these few things do show some hints at what might be coming later. So, let’s explore that next.

Future Uses and Benefits of PDAs

These all build on the aforementioned technology and benefits. I’m going to limit it to uses which either:

- Could not be done without blockchain tech

- Would be much shittier without blockchain tech (akin to Postmates on a phone vs. IBM mainframe)

Here’s a hodgepodge, feel free to toss any other ideas in the comments.

Cashing Out Value Locked in Various Silos

Video games are one form of this, and I’ve written about crypto gaming extensively (and critically). But any digital economy or ecosystem with a form of internal value could use crypto to make that value extractable to other currencies. This is one area where decentralized exchanges with permissionless token listings are particularly powerful.

Other versions of this besides video games might be hotel, airline, and other loyalty points, gift cards, or even coupons.

Subverting the Credit Card / Stripe Tax

This is a subtle one that you might not be aware of unless you’ve started a business, but every company that accepts credit cards ends up paying a 2-4% tax to Stripe or their credit card processor.

The payment processors can extract this tax because it’s the only way to accept digital payments in your store, online or offline.

With the digital currency innovation, companies can start taking digital payments without fees. Considering many businesses margins are less than 10%, getting back 2-4% of each purchase is massive. Solana Pay is already offering this and there will likely be many more tools for it in the future.

Streaming Payments & Paychecks

Being able to move very small amounts of money continuously using code is starting to create some interesting use cases. The idea of a biweekly paycheck can quickly become a thing of the past, with people instead getting their salary or hourly payments streamed to them while they’re working.

This introduces quite a few other potential work setups, like being able to charge continuously for consulting work vs. needing to deal with invoicing before and after work is done. It also opens the door to true micropayments for activities like reading a blog, but I’m extremely skeptical of that use case. I don’t think it’ll ever catch on.

Transferable Status & Reputation

If you build a reputation on Twitter, it’s very hard to migrate that reputation to YouTube or Instagram. Most social networks will reduce the spread of media from other social networks because they don’t want you taking your audience elsewhere.

Due to the single-sign-on mentioned earlier, social media in a Web3 world will likely center around following addresses instead of accounts siloed in one service. Since you’ll follow wallets, it won’t matter where they’re posting material. You’ll automatically be following them there.

And even if there is a siloed reputation system, you’ll likely be able to record your status in one area on your wallet and use it to establish a reputation in another domain. Basically, imagine if you could prove when signing up for StackOverflow that you had earned 10,000 Reddit Karma for your posts in /r/Javascript. That should give you some initial starting reputation, and that’s much easier with the wallet-based identities and single-sign-on that come with Web3.

The downside of a centralized account is that if you develop a bad reputation in one place, it will also be easy to punish you in other places. This could be good in general for weeding out bad actors, but you can imagine how it could be used maliciously too.

New Ways to Experience the Same Desires

The last type of innovation I’ll mention is a general assumption that as we use the technology more, we’ll find new ways to apply it to old desires and problems.

Mobile created new ways to make money, and blockchain will probably bring new ones with it as well. It’s already created a few, like selling digital art and democratizing access to owning shares of media like music.

Web and Mobile created new types of media, and I suspect there will be some new kind of media that develops that’s blockchain native. I can imagine, for example, a much more robust version of Wikipedia than we’re able to do on Web2 rails today.

Web and Mobile introduced new communication technology, so we’ll probably come up with some new form of that. It won’t necessarily be better, of course. Tinder is a much shittier version of talking to people at a bar.

Web and Mobile created new ways to accrue and struggle over power. That’ll happen again.

They created new kinds of games and entertainment. We already have some of that, and much more will be coming.

They created new ways to signal status and flex. That’s already here and there will be more of it.

At root, humans are simple creatures. We like entertainment, mating, status, and desperately scrambling to find meaning before we die. Every new tool gets purposed towards seeking those ends in some new way that may or may not be better than the old ones. I see no reason to assume that won’t happen again, especially since there’s money to be made.

But we’re still very early. Many of the uses are silly, and many of the people evangelizing it are cringey.

It’s a very simple, core innovation: perpetual decentralized applications.

I’m excited to see what else we do with it.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Sponsor Every

Here’s what one of our sponsors had to say about their experience working with Every:

The Every team has been the best group to work with! They are so well organized, communicative, and transparent from beginning to end. Their writers are top-notch and helped us create excellent ad copy. Our first placement worked so well with their audience that we decided to redirect our social ad spend towards additional placements.

- Susie from INDX

Comments

Don't have an account? Sign up!