DeFriday 2: Polygon’s Surge & Ethereum’s Future

Plus: Interest-Earning Lottery Tickets and Crypto Sharks

Happy Friday!

I’m back with another edition of DeFriday, the weekly newsletter covering the world of Decentralized Finance.

If you’re new to DeFi, be sure to check out the intro articles:

- Creating a high yield crypto-based savings account

- Putting your asset allocation on autopilot for 15-20% APY

And if you missed last week’s DeFriday, here’s the link.

The Deep Dive: Polygon

When the market crashed last week, Ethereum transactions were taking 5-10 minutes to settle and gas fees shot to over $1,000 for token exchanges. For most traders, that meant it was impossible to rebalance your portfolio or buy in to take advantage of tokens that were on sale without spending ungodly amounts of money.

But not for me. I logged into AAVE, withdrew some liquidity, and bought more ETH. The transactions settled in sections, and I paid less than a cent in transaction fees.

How? I used Polygon. It's an exciting sidechain that bypasses many of Ethereum's scaling problems and allows traders to transact with extremely low friction. It's currently growing in popularity—and it really came in handy for me this week during the crash.

So let's explore what Polgyon is, why it might be growing in popularity so much, and how it could fit into Ethereum's future.

How Polygon Solves Ethereum's Scaling Challenges

If you tried to follow the advice in either of my previous articles, you likely ran up against the painful reality of Ethereum gas fees.

Given the current demand on the Ethereum network, it can often cost $50 to $200 and take five to ten minutes to complete basic transactions. That's fine if you have a significant amount of money to move around and are patient, but for newer DeFi entrants or people looking to be more active it's a huge barrier.

Different solutions have started popping up over the last few years to help fix this. Some are completely new blockchains, like Solana or Binance Smart Chain. Some are "Layer 2" solutions which will sit on top of Ethereum to speed things up, like Arbitrum or Optimism.

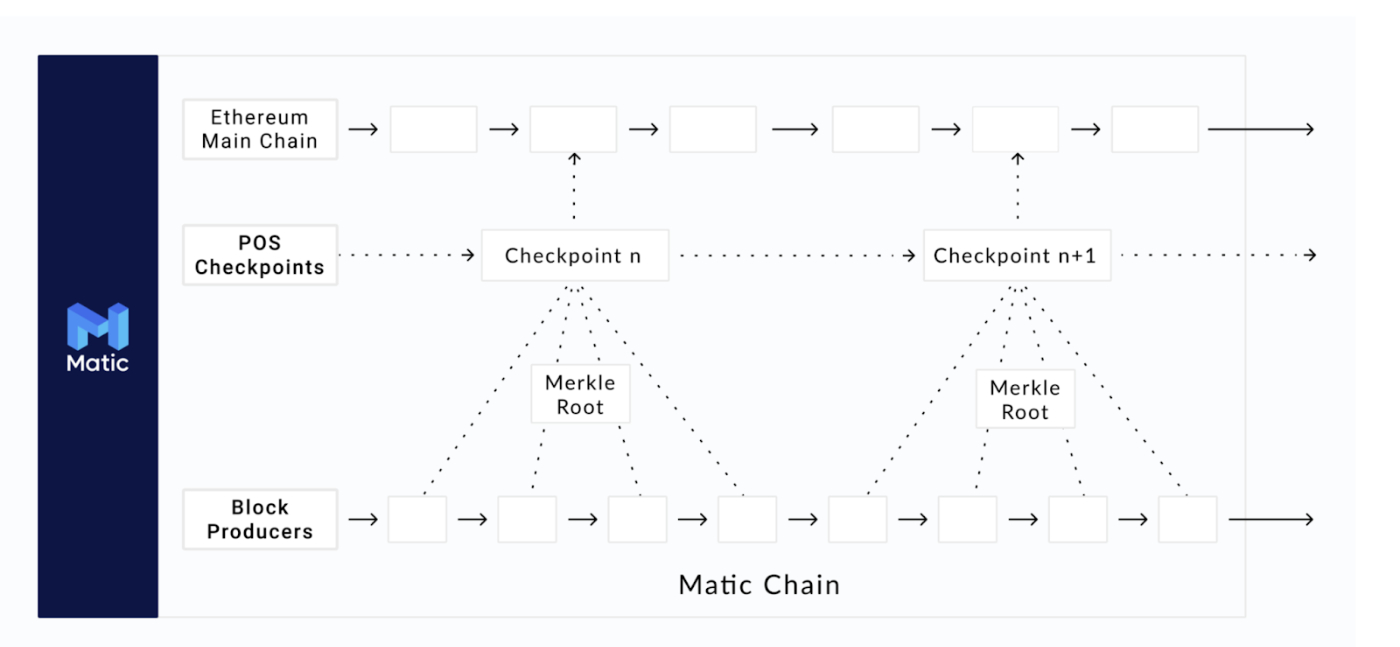

Polygon (formerly called Matic) takes a different approach. It's considered a sidechain: a separate blockchain that runs its own transactions, but still resolves summaries of those transactions to the main Ethereum blockchain.

It doesn’t get all of Etheruem’s security features, but by handling validation through its own Proof of Stake system, it can resolve transactions faster and cheaper. Each Block on Ethereum takes about 13 seconds, but on Polygon, the block time is less than 1 second. Those blocks are then rolled up into checkpoints, which occasionally get committed to the Ethereum blockchain.

(source)

A simple analogy might be Splitwise. Instead of having to use Venmo for every transaction between you and your friends, you can track how much you owe each other on Splitwise and then occasionally resolve the net of those transactions through Venmo.

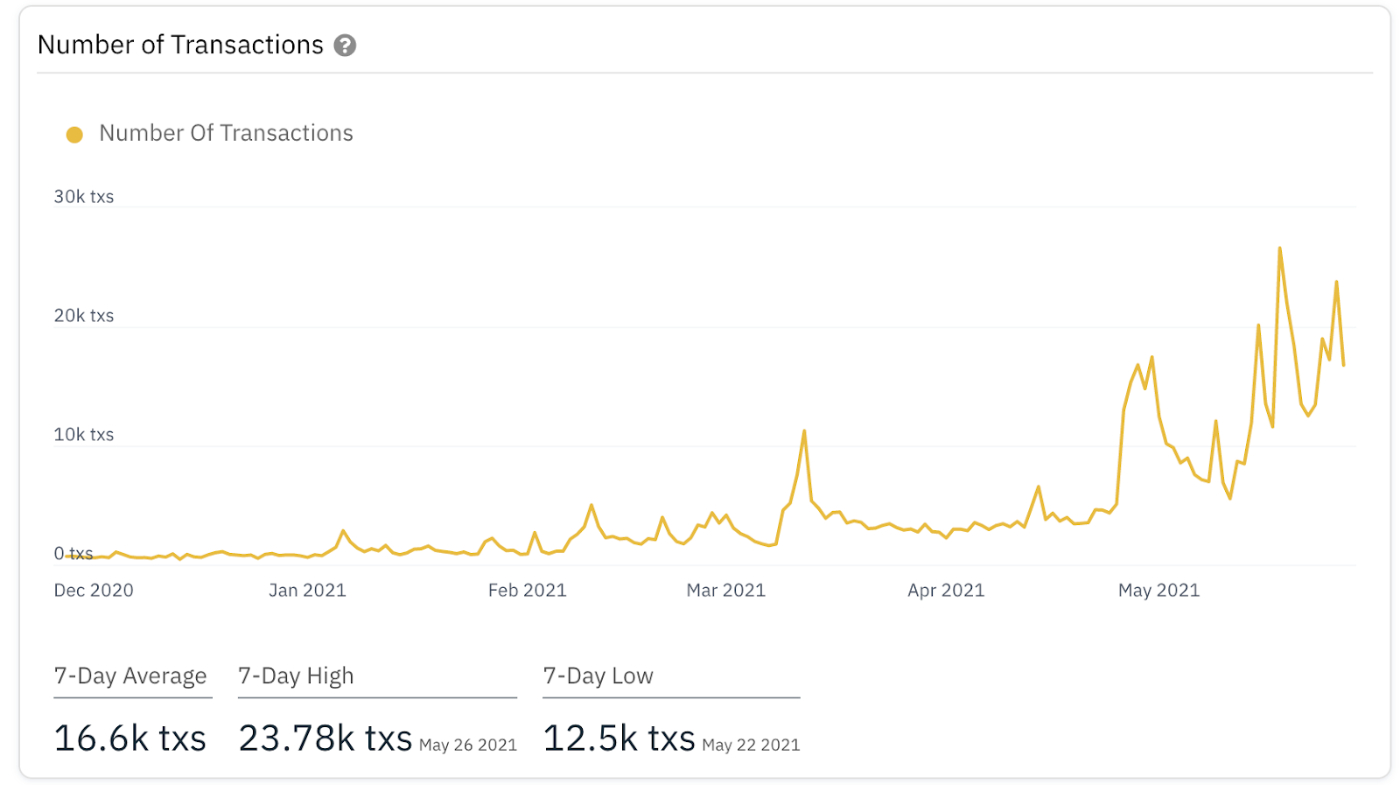

This allows it to process transactions in seconds for fractions of a penny, but without requiring you to leave the Ethereum ecosystem completely like Solana or Binance do. And people are starting to take note, with the number of transactions growing dramatically:

And the price reaching record highs:

What's Driving Polygon's Growth

Aside from riding out the recent downturn particularly well, Polygon's token has appreciated 300% in the last month, and almost 8,000% in the last year. What's driving that growth?

A big factor is likely that Polygon is the most active, and one of the few Ethereum scaling solutions currently available. Of course, Layer 2 solutions and ETH 2.0 advancements like sharding, are also trying to solve the same problems as Polygon but it's unclear when many of those will become available.

In the meantime, Polygon is the closest thing we have to low-cost high-speed transactions on Ethereum. And the pace of adoption, plus excitement around DeFi projects launching on Polygon raises a lot of interesting questions about its future.

Will It Last?

Polygon bears will argue though that once Ethereum has Layer 2 options available, applications will prefer to use those instead of a sidechain like Polygon since the rollups will retain more of Ethereum's security, and make it easier for applications to interface with one another without having to use a separate chain.

On the other side, Polygon launched quickly and has already scooped up a significant amount of activity from the Ethereum mainnet. If people have already sent DeFi funds over there, there's no rush to bring them back, and if Polygon continues to improve their product and attract new applications they could provide a thriving DeFi ecosystem alongside Ethereum's mainnet.

Polygon Criticisms

One common concern that comes up around Polygon is that it is not a completely decentralized system, as it has admin controls built into it for upgrading the smart contracts. This is not entirely uncommon for new crypto projects, though, and Polygon has responded to it publicly on Twitter here.

Another concern is that four wallets alone hold more than 50% of all Polygon (MATIC) tokens. It's not clear who these wallets belong to, though it's most likely the developers or exchanges. If it is individuals, it's possible those individuals could dump their holdings at any time tanking the price of Polygon.

Using Polygon

If you're curious to try Polygon out, using it is simple enough. You'll need some Ethereum, Polygon, or a stable coin like DAI to start, all of which you can buy on Coinbase.

Then, transfer those funds to a MetaMask wallet, and go to the Matic (Polygon) Bridge. The bridge will let you move your funds off of the Ethereum network and onto the Matic network, using the exact same wallet address.

Once you deposit your funds into the bridge and send them on their way, all you need to do is add the Polygon network to your MetaMask, and you'll be able to interface with Polygon apps just like you would Ethereum ones.

Neat App of the Week

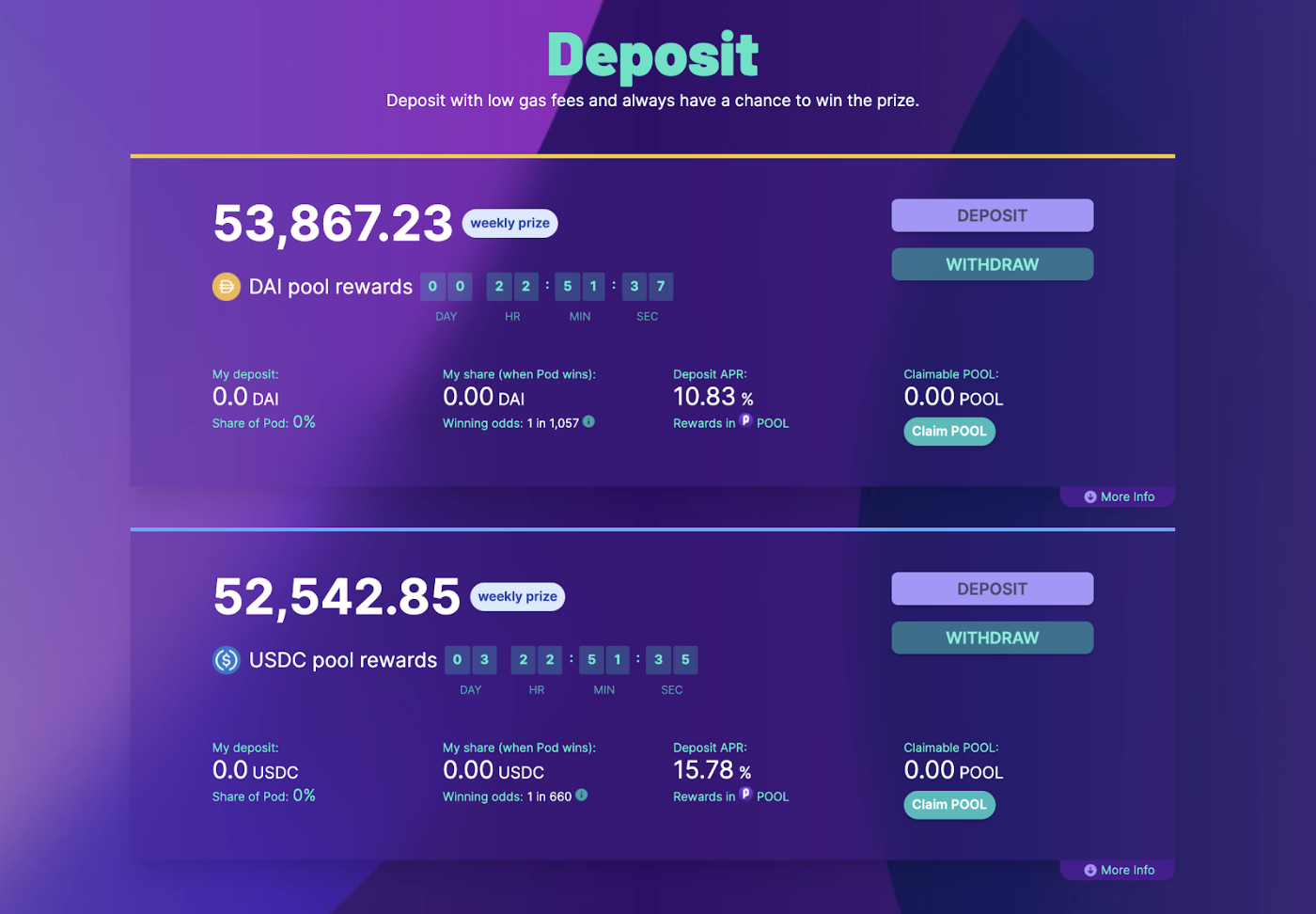

If you want a bit more gamified way to earn interest on your stable coins, PoolTogether is a cool program on Ethereum and Polygon in which you can earn 10-15% APY, while also having a chance to win a lottery prize each week.

This week they launched their new "pods," which dramatically reduce the price to deposit funds on Ethereum, and allow more people to share in the lottery winnings!

Other News

Kevin O'Leary, "Mr. Wonderful" on Shark Tank, is investing in DeFi through his new DeFi Ventures fund.

The Wall Street Journal did a profile on Uniswap and its founder, Hayden Adams.

It appears Carl Icahn is also eyeing a 9-figure investment in crypto in the near future.

Alchemix shared some stats from the crash last week, showing alUSD, the stable coin they use for their self-repaying loans, was the 2nd most stable currency during the crash.

PancakeBunny on Binance Smart Chain suffered a massive $45 million exploit, tanking the value of their token over 90%. Ouch! Flash Loan exploits like these are some of the more common ways these protocols get taken advantage of, and goes to show the importance of building on (and using) more secure battle-tested protocols.

Wrap Up

That's all for this week, be sure to subscribe to get future editions!

And if you sign up for the paid membership, you'll also get access to a private Discord with me and the other members of the bundle to talk all things Crypto, Finance, Productivity, Business, and more.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!

The Compound link is from last year?

@marc Whoops good catch, thanks!