DeFriday #1: May Market Meltdown Madness

DeFi just saw its first huge market crash. How'd it hold up?

May 21, 2021

Welcome to the first edition of DeFriday! This is a weekly newsletter I'm experimenting with focused on news & updates from the world of Decentralized Finance.

If you’re new to DeFi, definitely check out my first two articles on the subject on creating a crypto savings account and automating your asset allocation.

And if you have any tips or questions you'd like to see covered next week, be sure to tweet at me: @nateliason.

Market Crash

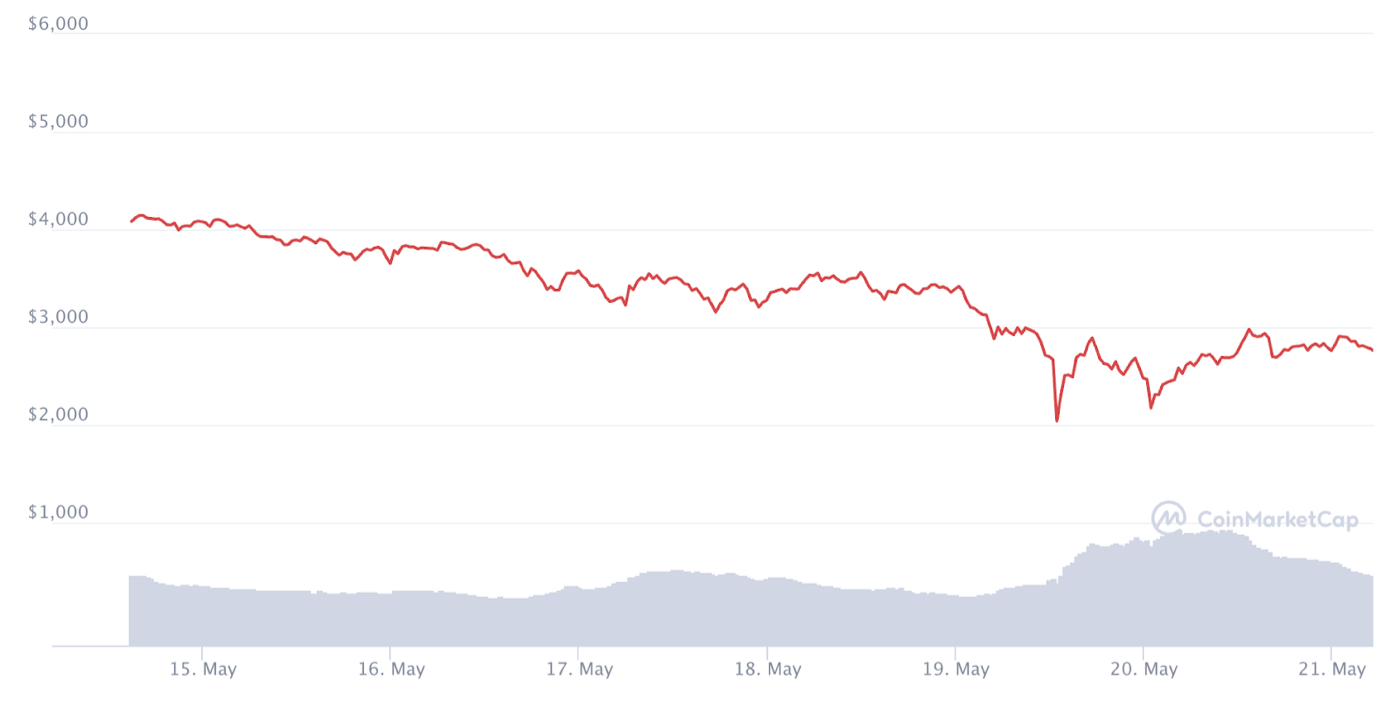

This is definitely an exciting week to start this newsletter. On Wednesday, Bitcoin dropped from its Tuesday high of ~$45,000 to a low of about $32,000. Ethereum fell from a high of $3,500 to a low of $2,100.

Overall the market dropped about 30% in a day, and while there's been some rebound (Bitcoin is currently at $40,000, Ethereum at $2,800), the market is certainly quite a bit lower than it was last week.

It is helpful to keep things in perspective though. This is the 1 week Ethereum chart:

But here's the 1 year chart:

Still not a fun drop, but even after falling to ~$2,500 Ethereum is up 1,200% from last year.

I'm not particularly interested in prices, though. It's impossible to predict how crypto market prices are going to move, and typically folly to try to time the market.

What I'm interested in from this week is how the many decentralized finance protocols, or "money legos" that have been built over the last couple years held up. DeFi didn’t exist during the last big market crash, so it wasn’t clear what would happen during a day like Wednesday.

It's no exaggeration to say this was the biggest stress test DeFi has ever had to endure. The crypto market lost around 1 trillion dollars in market cap in one morning, and until Wednesday, we didn't know how this new technology would handle such a massive correction.

For comparison, Black Monday is one of the biggest stock market crashes in global financial history. The market tanked 20-40% depending on the country, for a global loss of $1.71 Trillion (in 1987 dollars). We didn't quite hit those numbers... but we came close!

So how did DeFi hold up?

Liquidity Protocols

The first question I had was: how did the big liquidity protocols like Compound and AAVE hold up? These protocols provide lending and borrowing services similar to a bank in the TradFi world, and in the event of a massive market crash, would be at significant risk of becoming illiquid.

When Black Monday happened, government Central Banks had to step in and provide liquidity to the market to prevent financial institutions from defaulting. There is no central bank in DeFi, so these new financial institutions were on their own.

How'd they hold up? Perfectly. They automatically liquidated anyone who became overleveraged during the drop, and kept operating as usual. The total value locked in the major Ethereum Lending protocols dropped from $18b to $15b, but that was it. They all held up fine.

That’s not to say traders held up perfectly well, though. Along with the significant drop in prices, over $8 billion of leveraged collateral was liquidated from more than 775,000 traders by decentralized and centralized lenders. That’s rough, but to be fair, if you’re taking out leverage on volatile assets… these things happen.

I can't overstate how impressive the reiliency the system showed is, though. Despite there being billions of dollars at play, and hundreds of thousands of people taking out risky amounts of leverage, these brand new financial institutions' software weathered a mini Black Monday level event with no issues.

And they did it all automatically. No bankers, no managers, no sales people, just some very well programmed money robots.

DeFi Level 2 Protocols

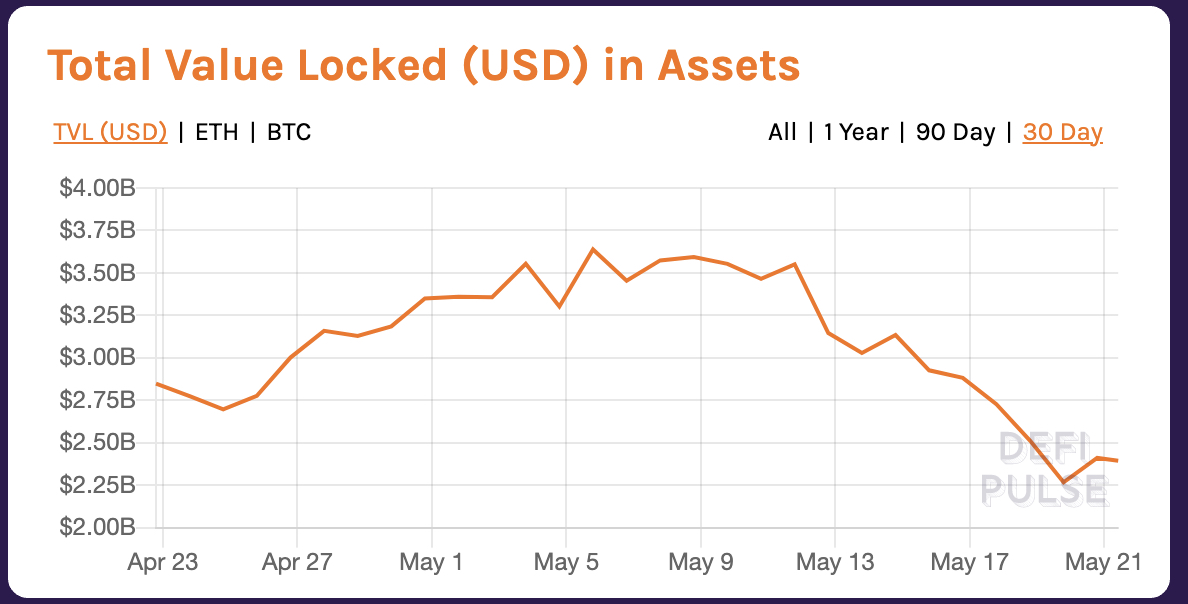

What about the "level 2" protocols like Yearn which I discussed in my automatic asset allocation post? These are the protocols that build an optimization layer on top of the base layer lending platforms.

These platforms definitely saw a larger decrease in their Total Value Locked (you can think of this as assets under management), dropping from ~3.5b last week to 2.26b at the bottom:

But, they kept chugging along, and interest rates on Yearn are still in the 12-15% range for stable coins.

Stable Coins

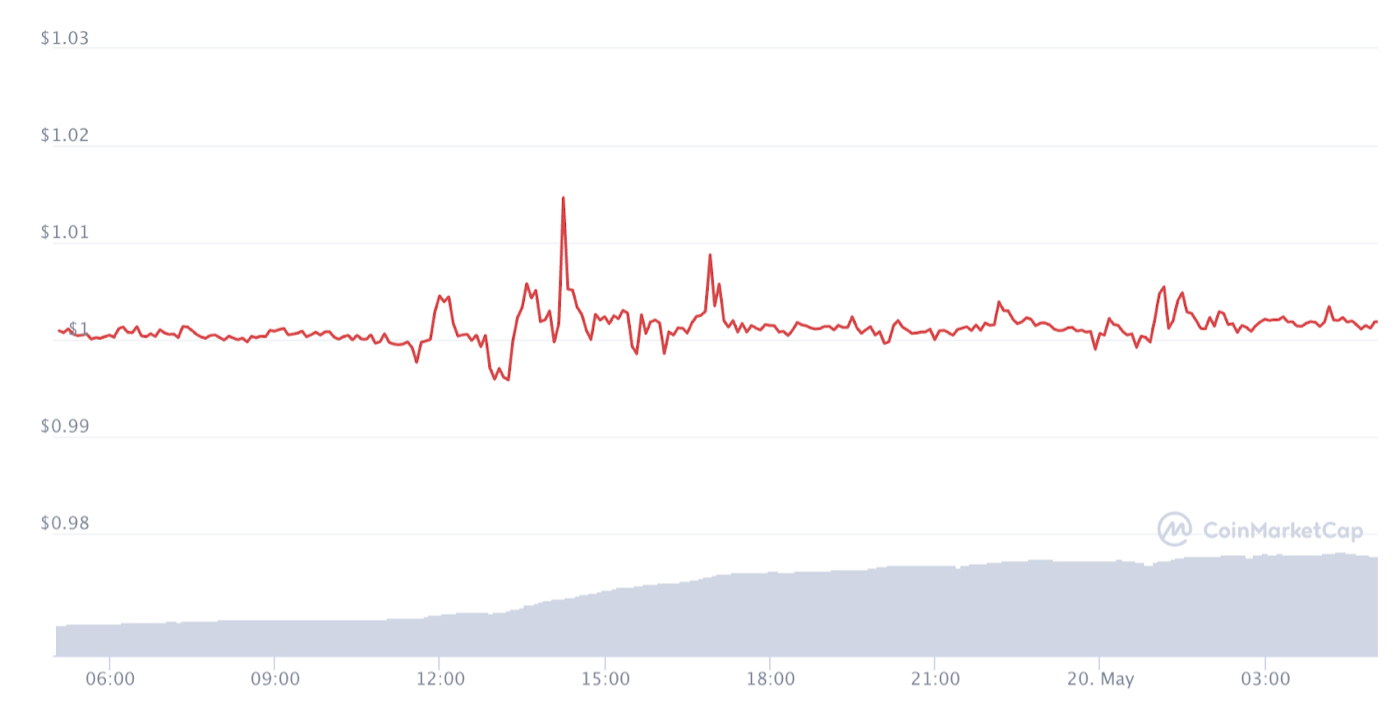

Another big question before Wednesday was how well stable coins would be able to maintain their peg in the event of a massive sell-off. The supply of stable coins needs to be carefully managed to ensure they don't deviate too far from $1.00, and we didn’t know what would happen if huge numbers of people tried to sell or buy stable coins at once. Would they maintain their peg? Or would they break down, start to fluctuate, and cause unexpected liquidations?

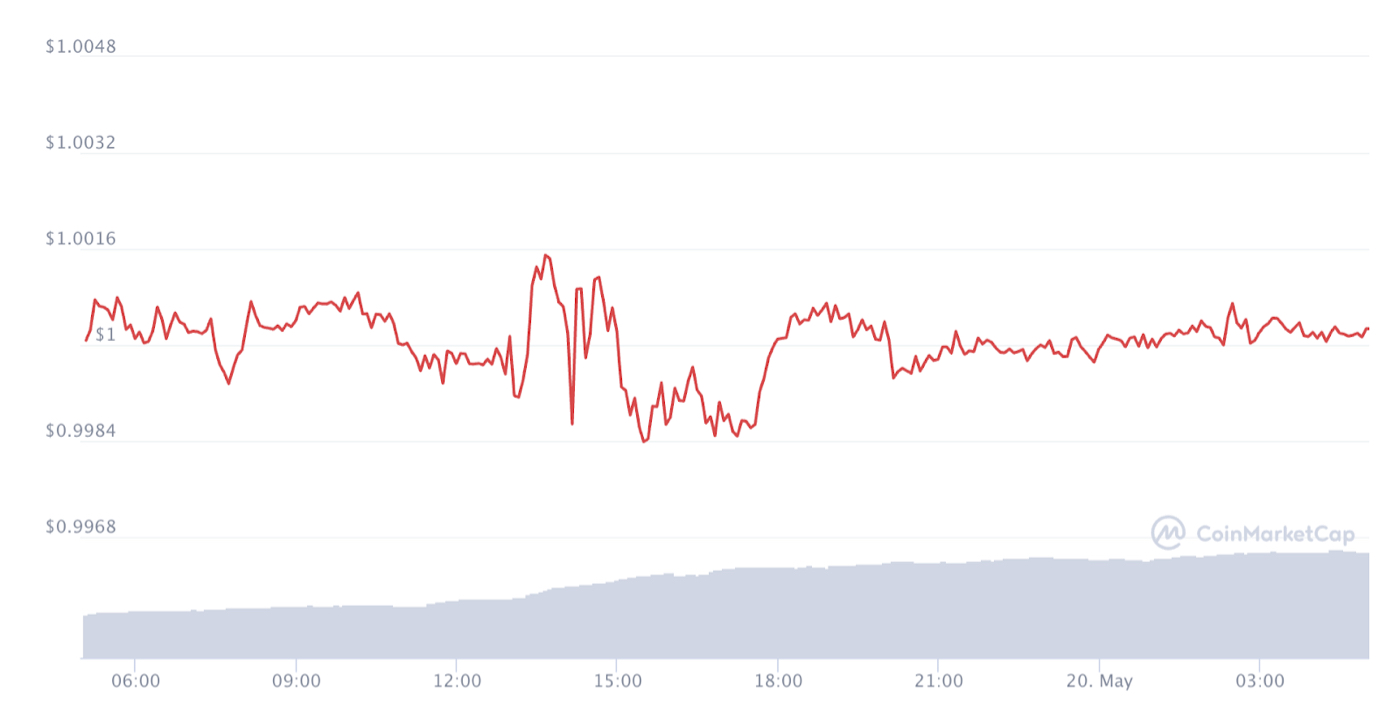

So let's look at the big 3: DAI, Tether, and USDC, to see how they held up.

For decentralization skeptics, DAI had the most risk going into the crash since its value is maintained by the MakerDAO community. Despite no bank or fiat reserves backing it, DAI's value stayed remarkably stable through the crash, only dropping to $0.9958 at the lowest, and rising to $1.0146 at the highest.

USDC, the coin backed by the Centre Consortium with fiat reserves, did slightly better, only hitting a peak of $1.0015 and dropping to $0.9985:

And Tether, which recently had some questions come up around its backing but is dominant nonetheless, dropped to $0.9986 and rose to $1.0019:

Despite maintaining their pegs through different strategies, all three of the big stable coins held up beautifully, giving them more credibility as a backbone for the future of DeFi.

What About Decentralized Exchanges?

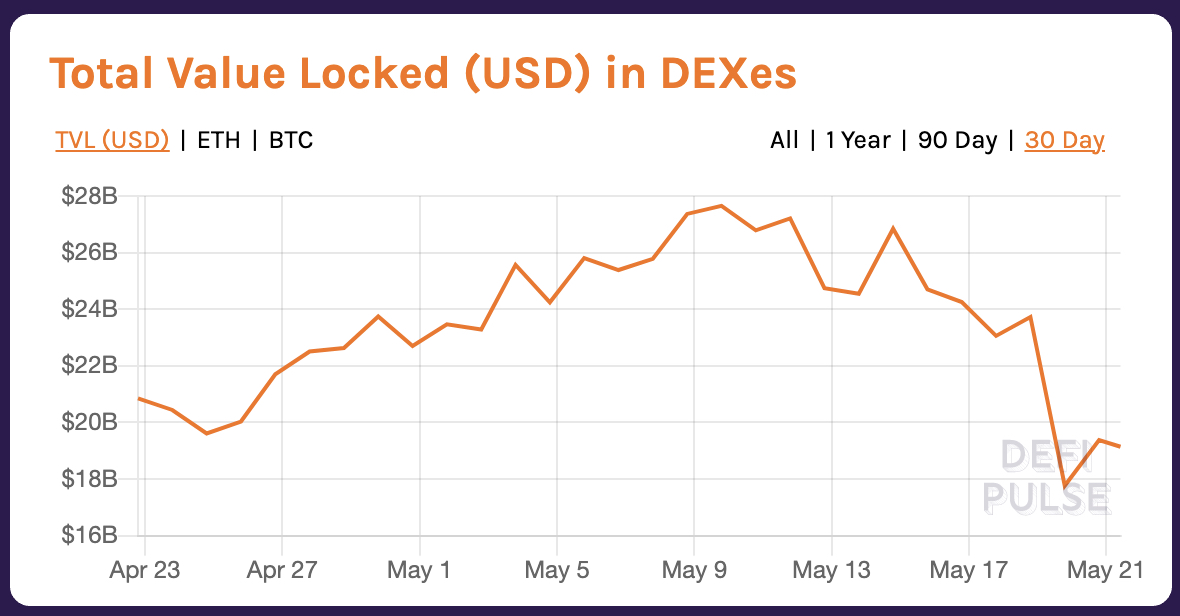

The big decentralized exchanges like Curve, Uniswap, SushiSwap, Balancer, and Bancor, all held up completely fine as well. Despite all liquidity being provided by other members of the crypto ecosystem, these decentralized exchanges kept chugging along and helped people exit any positions they wanted to get out of. Total value locked decreased as with the other categories, but the protocols operated completely fine:

And the Centralized Platforms?

Here's where things get kinda funny: the centralized platforms definitely had the hardest time.

Coinbase was crashing and lagging throughout the day:

BlockFi crashed:

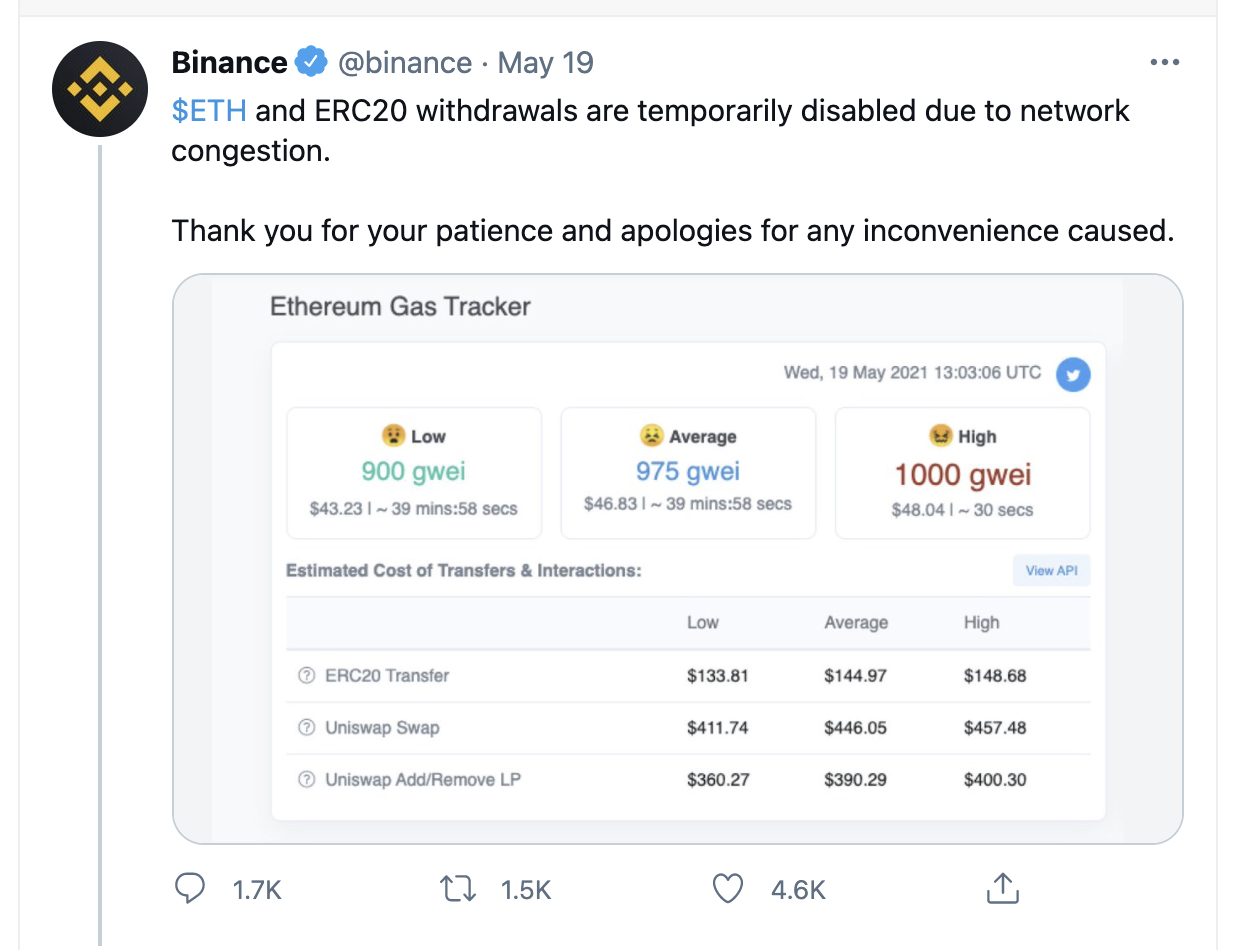

Binance had to suspend withdrawals for a period:

Gemini ran into similar challenges:

To be fair, this is definitely in part because these exchanges are how most people would exit crypto back into fiat. But it was definitely interesting to see how much they struggled compared to the decentralized ones.

One Big DeFi Struggle: Gas Fees

The biggest challenge DeFi ran into through this crash were the gas fees. As the market was tanking, Ethereum network congestion reached a record peak, with the max gwei price of the day hitting 2,000 or about $1000 for a Uniswap transaction.

In this regard, the more centralized exchanges definitely won. Coinbase Pro might have been crashing, but it at least still only cost .5% to do a transaction.

Hopefully as the layer 2 solutions like Optimistic and ZK Rollups launch throughout this year, Ethereum gas fees will come down considerably, preventing this kind of insane price jumping in the future.

That's all for this week, happy Friday, and have a great weekend!

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!