The Mind-Bending Magic of Self-Paying Loans - DeFriday #4

How Alchemix changes the wealth building game

Imagine a world where loans don’t have interest.

One where instead of having assets that are appreciating, and debt that’s also growing, the appreciation on your assets is automatically paying down your debt.

So your stock portfolio growth automatically pays off your mortgage. Or your high yield savings account covers your car payments. Or your real estate portfolio pays off your credit card. All without you having to sell your assets.

Crazy? Kinda. But we’re closer to this world than you think. Enter Alchemix: a new kind of DeFi protocol that allows anyone to borrow against the future yield of their assets.

In other words, self-repaying loans. A platform where you can deposit crypto assets, borrow against them, and then have the future yield on those assets automatically pay off your debt. A loan whose value only goes down, and where your collateral can never get liquidated.

Alchemix is one of the more mind-bending DeFi protocols I’ve discussed yet, so strap in. It might change how you think about money forever.

What is Alchemix?

Alchemix is a fundamentally new financial tool. It blends aspects of a savings account with aspects of a lender, allowing you to earn interest on your deposits as well as borrow against them. Your earned interest automatically pays down your loan amount, meaning your loan never increases, and since you’re borrowing the same asset you’re using as collateral, you can never get liquidated.

To use it, you first need to deposit funds into Alchemix in the form of DAI, one of the most popular stablecoins pegged to the US Dollar on Ethereum. That DAI goes into the “Vault,” and immediately starts earning interest.

As soon as your funds are deposited, you can immediately borrow up to 50% of the value of those deposits as “alUSD,” another stablecoin pegged to the US Dollar that’s created by Alchemix. Then you can take that alUSD and do whatever you want with it. You could cash it back out to fiat dollars, you could buy Bitcoin or Ethereum, it’s all yours.

So now you have X dollars deposited in Alchemix, and X/2 dollars borrowed from Alchemix. What makes Alchemix special is your loan amount does not go up. It only goes down. Because instead of the interest on your deposits going on top of your deposits, it goes directly to paying down your debt.

Why is this better? Well, let’s take an example. Say you have $10,000, and all interest rates are fixed at 10%. We’re going to assume repayment is flexible and that no other money enters the system.

In Alchemix, you deposit your $10,000 and then borrow $5,000 against it. You earn 10% interest on the $10,000, or $1,000. The interest you earn on the deposit goes directly to paying off the loan which isn’t accumulating any interest. So after a year you still have $10,000 in assets, and only $4,000 in debt—for a total of $6,000.

In a TradFi institution, you could also deposit $10,000 and borrow $5,000 against it. After a year, you have $11,000 in assets, and $5,500 in debt, for a total of $5,500. That’s 9% less than in the Alchemix example.

What just happened? Alchemix is taking advantage of the larger base return on your assets in order to pay down your smaller liabilities. It’s similar to how reducing costs is often a better way to increase a business’s net margin than increasing revenue. You’ve doubled your effective interest rate by putting your earned interest straight towards paying down your debt.

The whole thing gets even crazier when you consider that TradFi interest rates on assets are basically 0 (or, say, 7% if you want average S&P returns), but Alchemix historically offers 10-20% interest on DAI. I’ll come back to why their interest rate is so high later.

Let’s explore some ways this fundamentally changes your relationship with money. For all of these, I’ll assume the Alchemix interest rate is at 10%.

The Alchemix Mortgage

Say you’re buying a $300,000 house as your primary residence. You qualify for the best Fannie & Freddie loans at 2.5% interest and 3.5% down, so you only need to put down $10,500. You actually have $25,000 in cash though, and you debate putting all of it down, but instead you put it all in Alchemix first.

You borrow $12,500 from Alchemix and supply that as a down payment. Now you’ve covered the down payment, but you still have that $25,000 in Alchemix earning interest you can borrow against. Every month you’ll be able to borrow another $208 from your debt being automatically repaid, which you could put towards paying the monthly mortgage cost.

Or, assuming the mortgage on that house would cost $1,685 per month (that’s what Nerdwallet tells me for Nashville as an example), if you got up to $202,200 in Alchemix the earned interest would completely cover your mortgage.

The Alchemix Car Loan

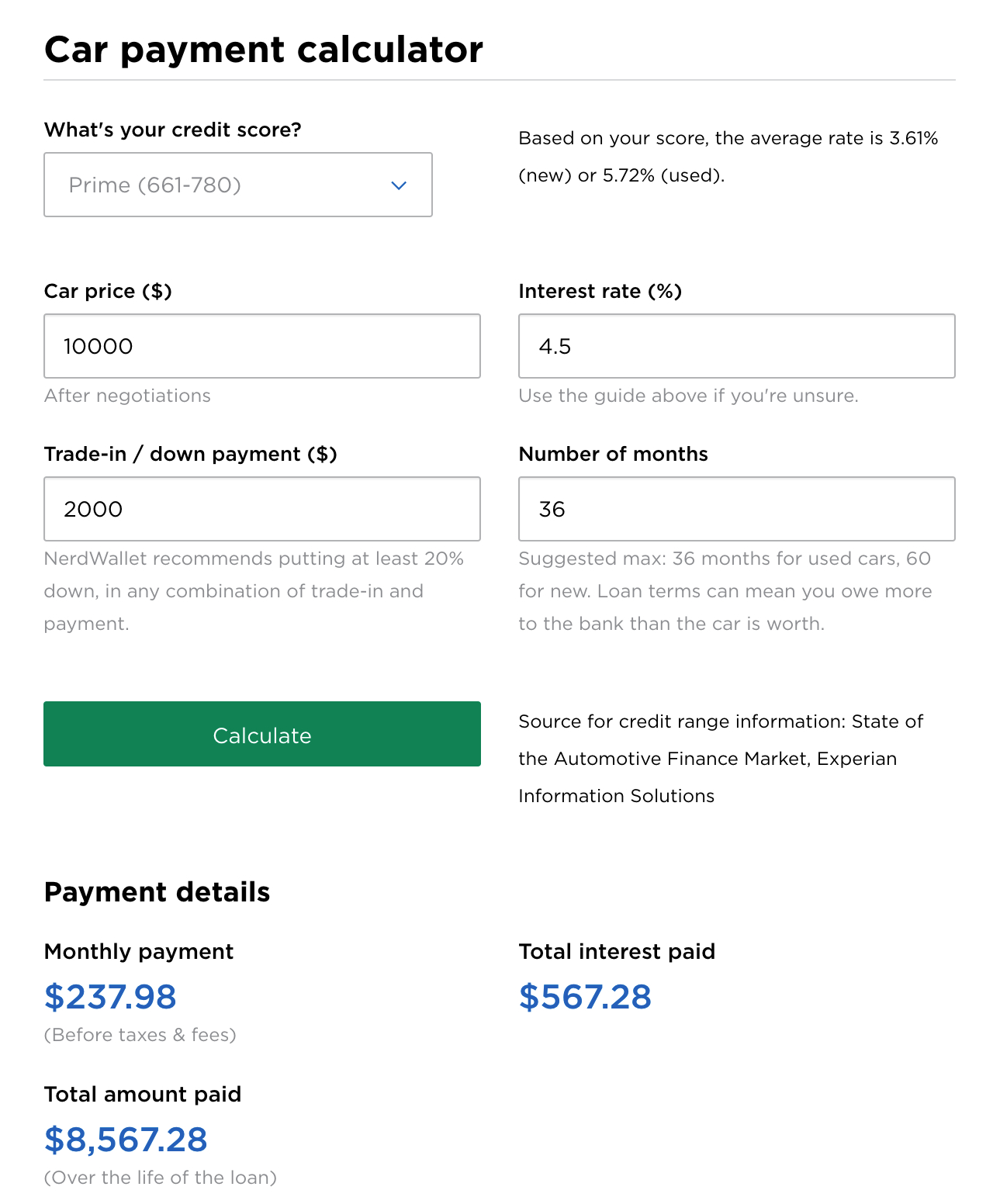

Next, it’s time to buy a car. You find a good used Toyota you can buy for $10,000 and you debate buying it all cash. But, instead, you put that into Alchemix first and get a car loan.

We’ll use these parameters from Nerdwallet:

So you put in $10,000, borrow $2000, and then you are earning $83 a month while having to pay $237 a month for a net cost each month of $154. Since you still have $3,000 left to borrow, you could do this for about 20 months before you’d have to start paying anything for the car out of pocket. And you’d still have your original $10,000 earning interest for you.

The Alchemix Nomad

After a years of hard work at a tech company, you’ve saved up $150,000 and you want to go do the digital nomad life for a year without working. So you put your $150,000 into Alchemix.

You peruse NomadList and discover you can live comfortably in Chiang Mai, Thailand for $1,046 a month, less than the $1,250 you can safely withdraw, so now your savings are completely covering your new highly Instagrammable life.

As you keep adding to your top line on Alchemix, your monthly withdrawal allowance steadily goes up, and you can move to higher and higher cost of living places. Or, you could stay in Chiang Mai, and keep building up your lifestyle support fund.

Alchemix Financial Independence

You go deep down the Mr. Money Mustache rabbithole and decide you want to pursue “FIRE” Financial Independence, Retire Early.

You’re making $100,000, so you radically cut your expenses to invest $50,000 a year. After 7 years, you’ve saved $506,000 (with compounding interest), enough to withdraw the $50,000 per year you’re used to living on and have the principal automatically earn back the difference. You can now retire early! Or you keep working and adding more on top, steadily increasing how much of a lifestyle can be passively funded by DeFi.

Alchemix Stacking

Here’s where things start to get a little strange. Let’s say you’re the Nomad, and you only have $100,000. That’s not enough to live on at $1,500 a month since you can only withdraw $833 a month, right?

Well… Another option would be to withdraw the max debt, $50,000, and put it back on top of your 100k. Now you have 150k paying down 50k of debt, and you can take out another $25k. So you take that out and put it on top, and now you have 175k. Then you do it one more time, and now you have $187,500 with $87,500 of debt but you’re earning $18,750 a year or $1,562.5 per month. What?? The big downside is that if you have a sudden expense come up you no longer have that debt reserve, but your $100k is now earning 37.5% and you can go live off it in Chang Mai. Anything you don’t spend goes towards paying down that debt, and eventually you could have that $187,500 debt free.

You could do this in the Early Retirement example too. You don’t actually need the whole $500,000 saved up, you can do it with about $260,000. Just stack it a few times, and as long as you don’t need the buffer for an unexpected expense, you’ll have enough to support your lifestyle.

How Alchemix Works

This all seems a little crazy and too good to be true, so let’s look at the mechanics of Alchemix and try to figure out what’s going on.

First, how is your debt getting repaid? Well, when you deposit your DAI into Alchemix, they stake it in a DAI Yearn vault like I wrote about in my article on automatic asset allocation. The interest rate you earn on Alchemix for DAI is higher than the interest rate for DAI on Yearn though, so where’s the extra interest coming from?

Well Alchemix gets a slightly better rate because of their volume, but they also have a bonus treasury of DAI in the “Transmuter” which is also earning interest on Yearn, and that interest goes to Alchemix users as a bonus. The Transmuter was originally used to convert alUSD back to DAI, but as Alchemix has gotten more popular the Curve pool for alUSD has gotten more popular and currently has over 250,000,000 alUSD in it, providing so much liquidity for trades that Alchemix users can skip the Transmuter entirely. The Transmuter still provides an essential service by making sure alUSD maintains its $1 peg, but it’s able to do so extremely effectively while also earning interest on the approximately 159,000,000 DAI currently stored in it. When the market crashed a few weeks ago, alUSD was one of the most stable stablecoins in the market, providing a great stress test for the Transmuter’s ability to maintain peg while earning interest.

A good comparison here would be how companies and financial institutions are able to earn interest on float: money that you can claim, but don’t need at that moment, and which they can invest in the meantime. Starbucks, for example, has about $1.4 billion from customers’ prepaid cards. That balance is redeemable for lattes and pastries, but Starbucks already has the money, and they’re probably not just letting it sit around in a bank account. Like Alchemix, they can put that money to work. But when Starbucks puts your money to work, Starbucks gets all the upside. When Alchemix does it, you get most of the upside.

How does Alchemix get paid? Well they’re getting a slightly better interest rate than they’re paying to you, and they’re collecting some of that difference. 10% of the profit Alchemix earns for its users is stored in the Alchemix treasury, which is used for anything from paying the team to awarding bug bounties. This aligns Alchemix’s incentives nicely with its customers. They only get paid if they make a good return for their users, so they’re incentivized to find the best balance of high return and low risk.

Compared to other DeFi projects I’ve covered, Alchemix is deceptively simple. You put in DAI, you borrow alUSD, and your debt gets repaid by interest from Yearn. But it’s a great example of how the composability of different applications in DeFi allow for interesting new projects to be created by building on each other. Alchemix is built on Yearn, which is built on Compound, AAVE, and many other apps, which are all built on Ethereum.

Alchemix Risks

Alchemix’s strength is how it leverages other DeFi protocols to build a new kind of lending protocol where your debt is automatically repaid and you can’t be liquidated.

The potential weakness is that since it’s built on top of those other DeFi protocols, failures further down the stack could cascade and harm Alchemix through no fault of its own. They’ve built in security systems to help prevent this and to protect user funds in the event of an emergency, and it didn’t run into any issues when the market crashed a few weeks ago, but you still never know.

That said, Alchemix has been audited, and they’re also implementing a “continuous auditing” system for their V2 launch later this year. They’re clearly prioritizing security and covering their bases as much as possible, but as always with DeFi, it’s a new and experimental world and anything could happen.

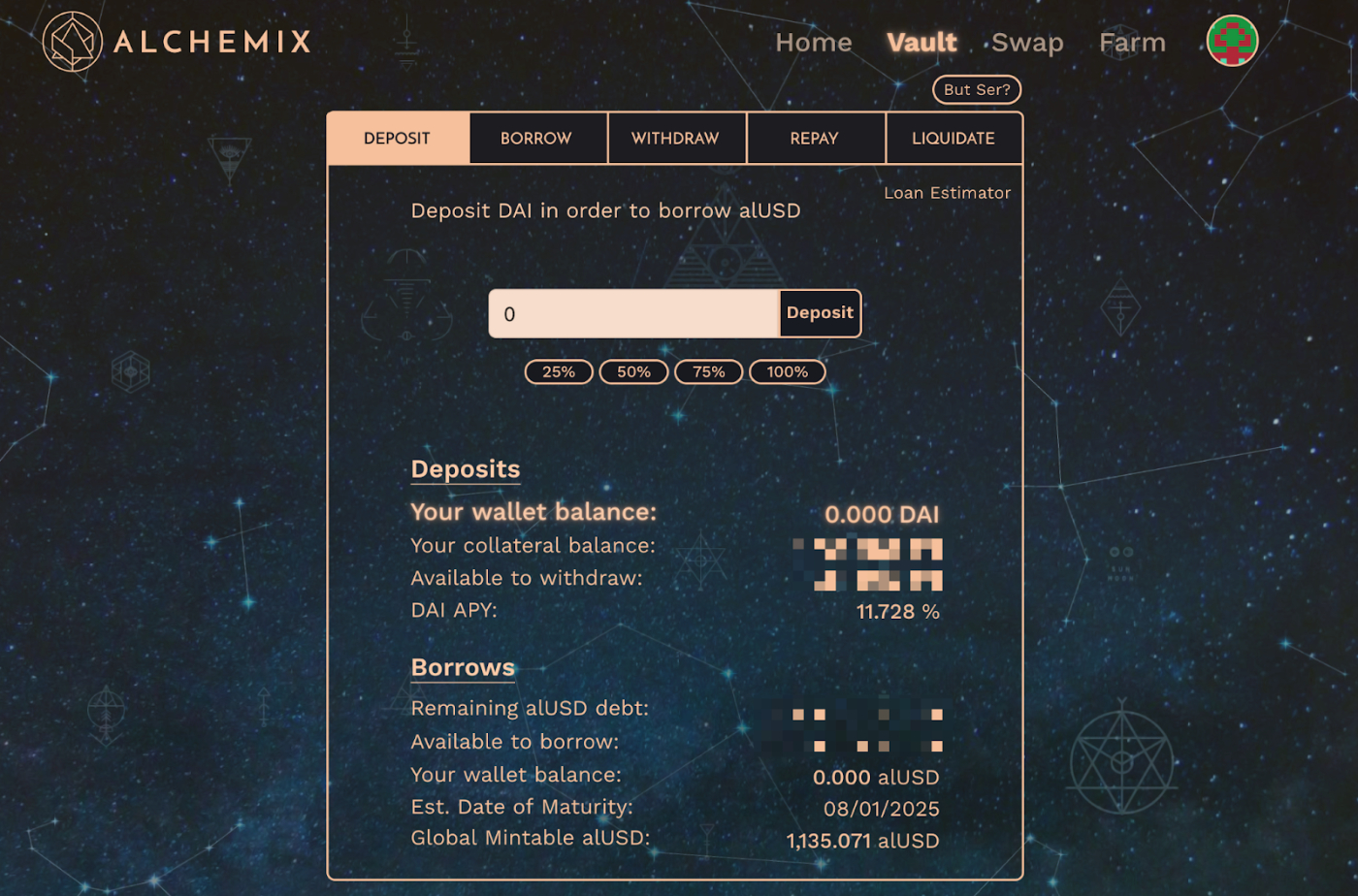

Using Alchemix

Using Alchemix is simple enough. If you buy some DAI on Coinbase or another exchange, you can transfer it into your MetaMask wallet, then deposit that DAI into Alchemix on the Vault page. As soon as it’s deposited, you’ll start earning interest, and be able to borrow against it.

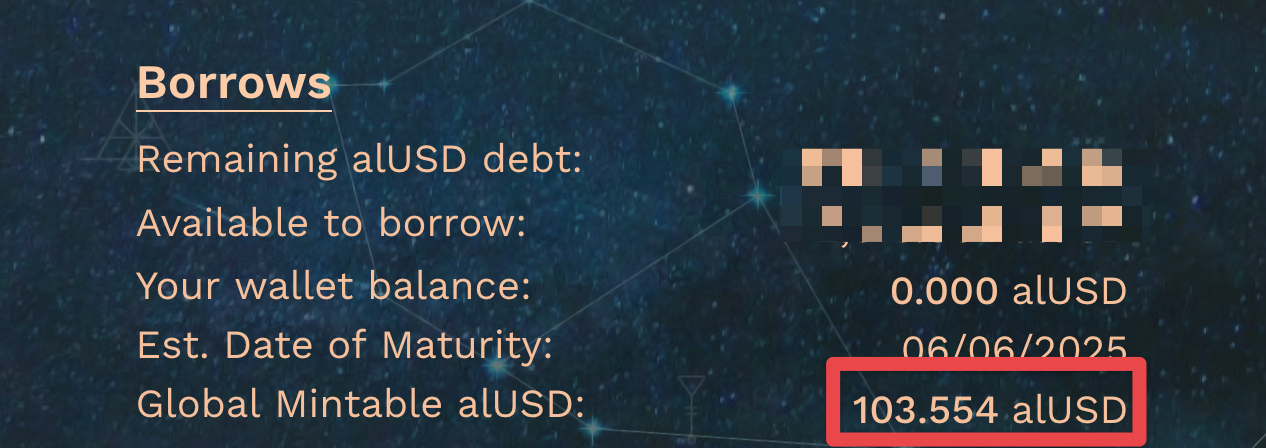

One caveat is that in order to make sure alUSD maintains its peg, Alchemix has to limit how much alUSD is created. So depending on the demand for alUSD, you may have to wait until the mintable amount goes up before you can borrow against your collateral.

Other News in the World of DeFi

El Salvador

El Salvador passed a bill to make Bitcoin legal tender in their country, the first country to do so. The text of the bill is remarkable and a massive move forward for Bitcoin legal adoption, since it includes provision like:

- Taxes can be paid in bitcoin

- Bitcoin exchanges will not be subject to capital gains tax

- Every “economic agent” must accept bitcoin as payment

- The government will create a bitcoin treasury for making transactions simple

Also remarkable is that while US politicians were complaining about the environmental impact of Bitcoin, El Salvador dug a well into a volcano to build a 100% renewable energy powered Bitcoin mining operation. It’s also possible that with this new bill, the US tax code will have to adapt since Bitcoin will be a foreign currency.

Curve V2

Curve is working on launching V2 of their token exchange protocol, and their new white paper is a doozy to try to get through. Curve is also experimenting with its first swap pool for more volatile crypto assets, with a three-way pool combining Ethereum, Bitcoin, and Tether.

Zapper

The popular DeFi management tool Zapper has launched a rewards program where you earn experience and level up in the application, and can claim special NFTs at certain levels. Since Zapper doesn’t have a token of their own, it’s possible this is an early way for them to start rewarding users and build a list of addresses for a future token airdrop similar to what Uniswap did.

Wrap Up

That's all for this week, be sure to subscribe to get future editions!

If you sign up for the paid membership, you'll also get access to a private Discord with me and the other members of the bundle to talk about all things Crypto, Finance, Productivity, Business, and more.

Aside from there if you have any questions or want to say hi, you can reach me on Twitter.

Find Out What

Comes Next in Tech.

Start your free trial.

New ideas to help you build the future—in your inbox, every day. Trusted by over 75,000 readers.

SubscribeAlready have an account? Sign in

What's included?

-

Unlimited access to our daily essays by Dan Shipper, Evan Armstrong, and a roster of the best tech writers on the internet

-

Full access to an archive of hundreds of in-depth articles

-

-

Priority access and subscriber-only discounts to courses, events, and more

-

Ad-free experience

-

Access to our Discord community

Comments

Don't have an account? Sign up!

Hi there,

I followed the setup of Alchemix as described here and successfully deposited DAI into my vault about one month ago. According to this article, that is all that needs to be done to start earning interest. However, I do not see my DAI balance increase in my vault. When do the payouts happen, or is there anything else that I need to do?

Thanks, Manfred